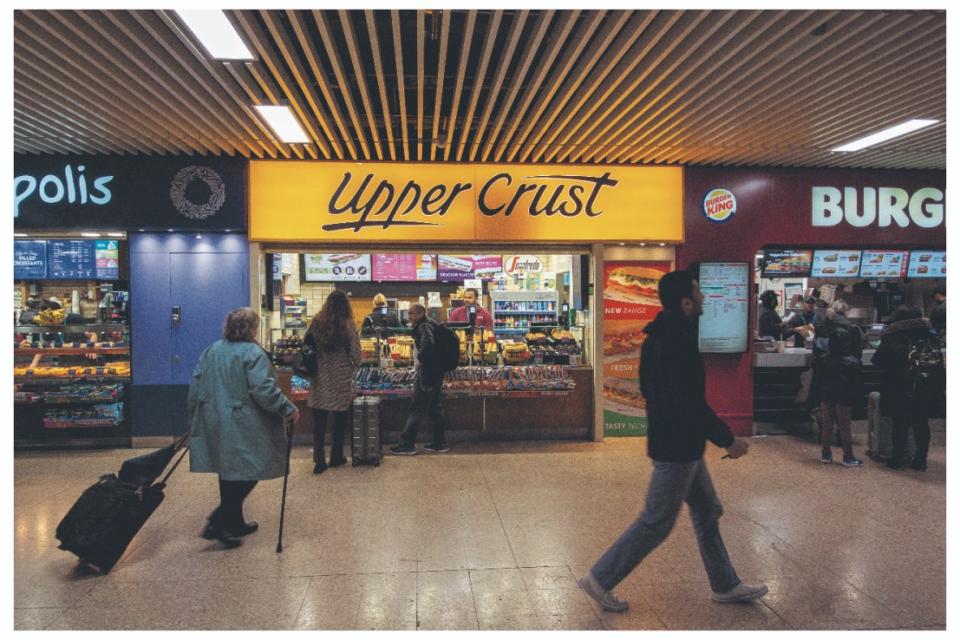

SSP Group: Upper Crust owner’s shares soar on back of impressive sales

Shares in the travel food specialist behind Upper Crust SSP Group jumped over ten per cent this morning on the back of impressive sales numbers driven by the continued rebound demand for leisure travel.

The FTSE 250 constituent, which earlier this week opened its “busiest” Starbucks at Heathrow airport, maintained its guidance off the back of a strong sales performance across all regions, with North America and the Asian Pacific particularly strong.

Overall, sales at the firm grew by 15 per cent between March and June 30 compared to the same period last year, while sales in the US and Canada – boosted by three acquisitions – were up 25 per cent.

In Continental Europe, the firm said sales growth of seven per cent represented a “solid performance”. And in the UK, earnings were up 12 per cent, which was largely down to good passenger air numbers.

Shares in the London-listed firm were up 12 per cent as of 8 45am BST.

The group, which operates franchises of well-known cafes and sandwich shops like Upper Crust, Starbucks and M&S in transport hubs, also stated its willingness to work with the rail watchdog on recommendations contained in a report on its retail landscape.

Last month, the Office of Rail and Road found there to have been a lack of competition between retail providers, allowing outlets in retail settings to push up prices. But the ORR stopped short of referring them to the Competition and Markets authority.

The firm added that its its outlook looked solid confirming that it was “well-positioned” for the peak summer period, and to deliver results in line with its planning assumptions.

Its full year results are expected in the Autumn.

Yahoo Finance

Yahoo Finance