State pension age: look up when you will retire

Teenagers and those in their twenties can expect to work to age 70 as the state pension age rises to cope with an ageing population and longer lifespans.

There are already a number of age increases planned, but that process is beginning to accelerate.

The Government has just announced that a planned increase to 68, due to happen between 2044 and 2046, will now take place between 2037 and 2039.

This occurred in response to a report, by John Cridland, which outlined ways in which future pensioners might be able to delay taking their state pension in exchange for cash.

It means around six million people, in their 40s, will need to wait or work longer than anticipated to receive their state pension.

Bringing forward the state pension age increase was one of John Cridland's main suggestions.

He also said that the state pension age should not increase more than one year in any ten year period, assuming that there are no exceptional changes to the data used.

This would give those generations affected by changes adequate time to save and plan.

Another recent report, by the Government Actuary's Department, outlined in more detail how ages would rise depending on increases in lifespans.

Current plans

The state pension age is currently 65 for men and 64 for women. The latter will keep steadily rising every few months and equalise at 65 for men and women in 2018.

The state pension age will then increase every few months, reaching 66 by 2020.

Then it climbs up to 67 through a series of gradual increases, with those born in 1961 and beyond being the first to collect their state pension at 67.

The re-scheduled increase to 68 occurs for those born after 1970 - so aged around 47 today - when again phased rises take it to the point where everyone born on or after April 6, 1970, collects it from age 68.

Future changes on the cards

The recently announced acceleration of the plans to increase the state pension age may well not be the last.

State pension ages hinge on a basic equation - which determines how much of our (increasing) lives we should be spending in receipt of a state pension.

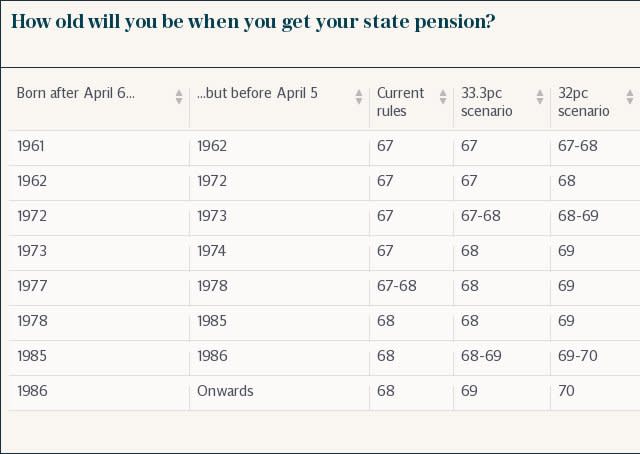

There are two options: make no changes to a formula which triggers state pension age increases when an average person could be expected to spend a third (33.3pc) of their adult life in retirement.

Or, slightly reduce the "trigger point" in the formula from 33.3pc to 32pc.

The argument for the reduction is based on increasing life expectancy, with the suggestion being that more of adult life should thus be spent in work.

Tom Selby, an analyst at Sipp provider AJ Bell, said: "The Government has stated its aim is for people to spend 32pc of their adult life in receipt of the state pension, so if life expectancy goes up the implication is the state pension age will follow suit."

For a personalised estimate on the current plans, use the Government website gov.uk/calculate-state-pension or call The Pensions Service on 0800 731 7898.

Yahoo Finance

Yahoo Finance