State Street (STT) Gains on Q1 Earnings Beat, Y/Y Revenue Rise

State Street’s STT first-quarter 2024 adjusted earnings of $1.69 per share surpassed the Zacks Consensus Estimate of $1.48. The bottom line increased 11.2% from the prior-year quarter.

STT shares jumped 3.5% in the pre-market trading on a better-than-expected quarterly performance. However, a full day’s trading session will depict a clearer picture.

Results were primarily aided by growth in fee revenues and lower provisions. Also, the company witnessed improvements in the total assets under custody and assets under management (AUM) balances. However, lower net interest revenues (NIR) and higher expenses were major headwinds.

Net income available to common shareholders (after considering the notable items) was $418 million, down 20.4% from the year-ago quarter. Our projection for the metric was $433.2 million.

Revenues Improve, Expenses Rise

Total revenues of $3.14 billion increased 1.2% year over year. Also, the top line beat the Zacks Consensus Estimate of $3.06 billion.

NIR was $716 million, down 6.5% year over year. The decline was due to lower average deposit balances and deposit mix shift, partially offset by the impacts of higher interest rates, client lending growth, and investment portfolio positions. Our estimate for the metric was $658.9 million. The net interest margin declined 18 basis points year over year to 1.13%.

Total fee revenues increased 3.7% year over year to $2.42 billion. We estimated the metric to be $2.38 billion.

Non-interest expenses were $2.51 billion, up 6.1% from the prior-year quarter. The rise was due to an increase in almost all cost components, except for compensation and employee benefits costs. Our estimate for the metric was $2.40 billion.

Provision for credit losses was $27 million, down 38.6% from the prior-year quarter. Our prediction for the metric was $11.2 million.

The Common Equity Tier 1 ratio was 11.1% as of Mar 31, 2024, compared with 12.1% in the corresponding period of 2023. The return on common equity was 7.7% compared with 9.3% in the year-ago quarter.

Asset Balances Increase

As of Mar 31, 2024, total assets under custody and administration were $43.91 trillion, up 16.7% year over year. The rise was driven by higher quarter-end equity market levels, net new business and client flows. We had projected the metric to be $40.44 trillion.

AUM was $4.34 trillion, up 19.8% year over year, primarily driven by higher quarter-end market levels and net inflows. Our estimate for the metric was $3.82 trillion.

Share Repurchase Update

In the reported quarter, State Street repurchased shares worth $100 million.

Our Take

Persistently rising expenses and a tough operating backdrop are major concerns. Yet, higher interest rates and solid business servicing wins are expected to keep supporting STT’s financials.

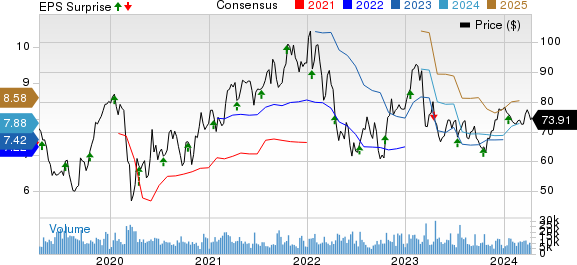

State Street Corporation Price, Consensus and EPS Surprise

State Street Corporation price-consensus-eps-surprise-chart | State Street Corporation Quote

State Street currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Expected Earnings Dates of Other Banks

Bank of America BAC is scheduled to release quarterly results on Apr 16. Over the past seven days, the Zacks Consensus Estimate for BAC’s quarterly earnings has been unchanged at 77 cents.

The Bank of New York Mellon Corporation BK is also scheduled to report earnings on Apr 16. Over the past seven days, the Zacks Consensus Estimate for BK’s quarterly earnings has been unchanged at $1.20.

Currently, both BAC and BK carry a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance