Steer Clear Of SD Biosensor And Explore One Better Dividend Option On The KRX

Investors often gravitate towards dividend stocks for their potential to generate a reliable income stream. In the South Korean market, where the average dividend yield is around 2.2%, some offerings may tempt with significantly higher yields. However, it's crucial to assess whether these high-yield dividends are sustainable, as they could indicate underlying financial challenges rather than opportunities for robust returns.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.46% | ★★★★★★ |

LOTTE Fine Chemical (KOSE:A004000) | 4.31% | ★★★★★☆ |

NH Investment & Securities (KOSE:A005940) | 6.15% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.00% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 6.91% | ★★★★★☆ |

KT (KOSE:A030200) | 5.47% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.56% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.93% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.12% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 5.98% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results and one of the companies to potentially avoid.

Top Pick

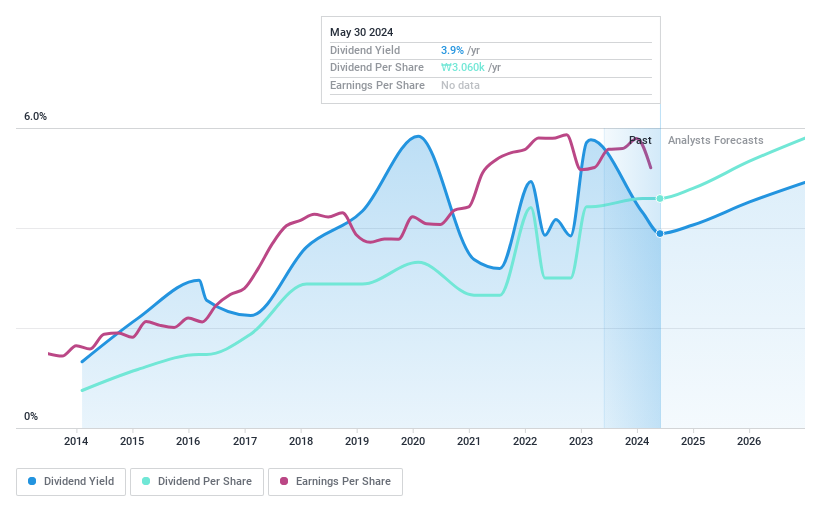

KB Financial Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KB Financial Group Inc. operates globally, offering diverse banking and financial services in regions including South Korea, the U.S., New Zealand, China, Cambodia, the UK, and Indonesia, with a market cap of approximately ₩32.67 billion.

Operations: KB Financial Group's revenue is primarily generated from its Banking Sector - Corporate Finance (₩4.39 billion) and Banking Sector - Household Finance (₩4.23 billion), followed by the Non-Life Insurance Sector (₩1.19 billion), Securities (₩1.59 billion), and Credit Card Sector (₩1.10 billion).

Dividend Yield: 3.6%

KB Financial Group's recent dividend distribution of KRW 510 on June 27, 2024, aligns with a broader strategy of shareholder returns, evidenced by significant share buybacks totaling KRW 300.00 billion for 5.58 million shares over recent months. Despite a dip in Q1 net income to KRW 1.05 billion from last year’s KRW 1.51 billion, the company maintains robust dividend coverage with a low payout ratio forecast at 24.9% in three years, supporting sustainability against potential high-yield traps seen elsewhere in the market.

Get an in-depth perspective on KB Financial Group's performance by reading our dividend report here.

Dividend Trap

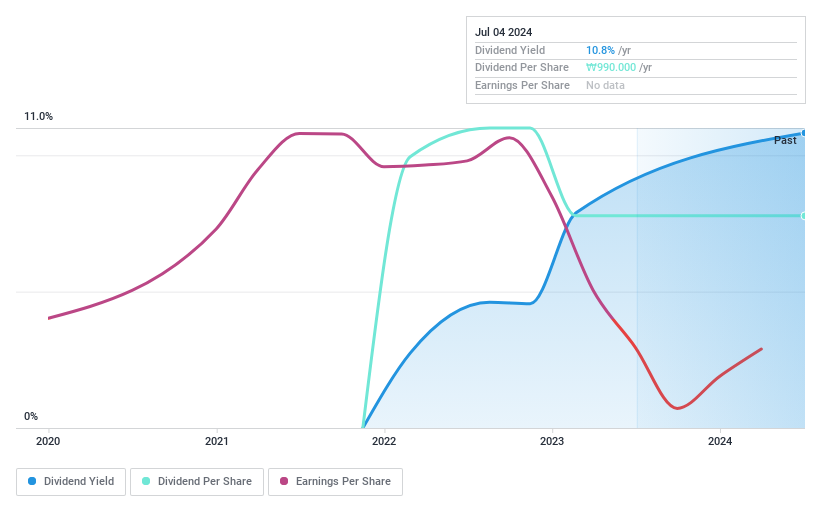

SD Biosensor

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: SD Biosensor, Inc., a company based in South Korea, specializes in in-vitro diagnostics and offers point-of-care diagnostic solutions globally, with a market capitalization of approximately ₩1.12 trillion.

Operations: The company's revenue from diagnostic kits and equipment amounts to approximately ₩649.67 million.

Dividend Yield: 10.8%

SD Biosensor has demonstrated unstable dividend payments with a significant annual decrease over 20%, reflecting its short two-year history of dividends. Despite a high current yield of 10.66%, the lack of free cash flows and insufficient data on payout sustainability raise concerns about the reliability and future prospects of these payments. Additionally, earnings have declined by 38.1% annually over the past five years, further challenging the sustainability of its dividends amidst shareholder dilution within the last year.

Summing It All Up

Click this link to deep-dive into the 72 companies within our Top KRX Dividend Stocks screener.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A105560KOSE:A137310 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance