Steering Clear Of Procrea Holdings With One Strong Dividend Stock Option

In the pursuit of steady dividends from Japanese stocks, investors should be vigilant about the financial health behind these payouts. Companies with high payout ratios, such as Procrea Holdings, may present a cautionary tale; their generous dividends could be a red flag for potential financial troubles rather than an opportunity for reliable income. This article will explore both an attractive dividend stock option and one that might warrant avoidance due to concerns like these.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.68% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.59% | ★★★★★★ |

Globeride (TSE:7990) | 3.86% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.15% | ★★★★★★ |

Japan Pulp and Paper (TSE:8032) | 4.08% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.47% | ★★★★★★ |

Innotech (TSE:9880) | 3.93% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.38% | ★★★★★☆ |

Click here to see the full list of 375 stocks from our Top Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

Open Up Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Open Up Group Inc., with a market cap of ¥187.16 billion, operates in engineer dispatching, subcontracting, outsourcing, and recruiting within the construction management, manufacturing, machinery, electronics, and IT software sectors globally.

Operations: The company generates revenue through engineering dispatch, subcontracting, outsourcing, and recruitment services across various sectors including construction management, manufacturing, machinery, electronics, and IT software on a global scale.

Dividend Yield: 3%

Open Up Group has demonstrated a solid financial foundation for dividend sustainability, with earnings covering dividends at 28.9% and cash flows at 30%. Despite this robust coverage, the company's dividend track record shows volatility; dividends have increased over the past decade but have also been unstable year-to-year. Recently, Open Up Group raised its quarterly dividend to JPY 20 per share from JPY 17 and adjusted its annual forecast to JPY 45 per share, signaling potential future stability.

Take a closer look at Open Up Group's credentials here in our dividend report.

Our valuation report here indicates Open Up Group may be overvalued.

One To Reconsider

Procrea Holdings

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Procrea Holdings, Inc. serves as a holding company for The Aomori Bank, Ltd., with a market capitalization of approximately ¥54.51 billion.

Operations: The primary revenue stream for the entity comes from its operations involving The Aomori Bank, Ltd.

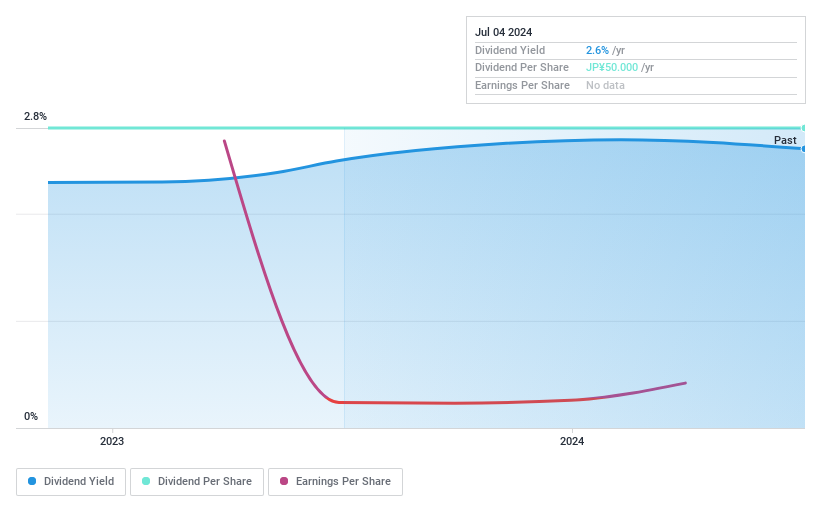

Dividend Yield: 2.6%

Procrea Holdings exhibits several red flags for dividend investors: its current dividend yield of 2.61% trails behind the market's top quartile at 3.39%, and there's no history of payment increases since initiation two years ago. The company also faces profitability issues, with a sharp decline in profit margins from last year and ongoing revenue decreases. Furthermore, the dividend is not adequately covered by earnings, indicating potential sustainability issues ahead without significant financial improvement.

Taking Advantage

Click through to start exploring the rest of the 373 Top Dividend Stocks now.

Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2154TSE:7384 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance