This stock is in the last chance saloon – it needs to start delivering now

This column broke a few of its own rules when it identified Smith & Nephew, the medical devices company, as a potential post-lockdown turnaround candidate in March 2021 and has only had cause to regret it since.

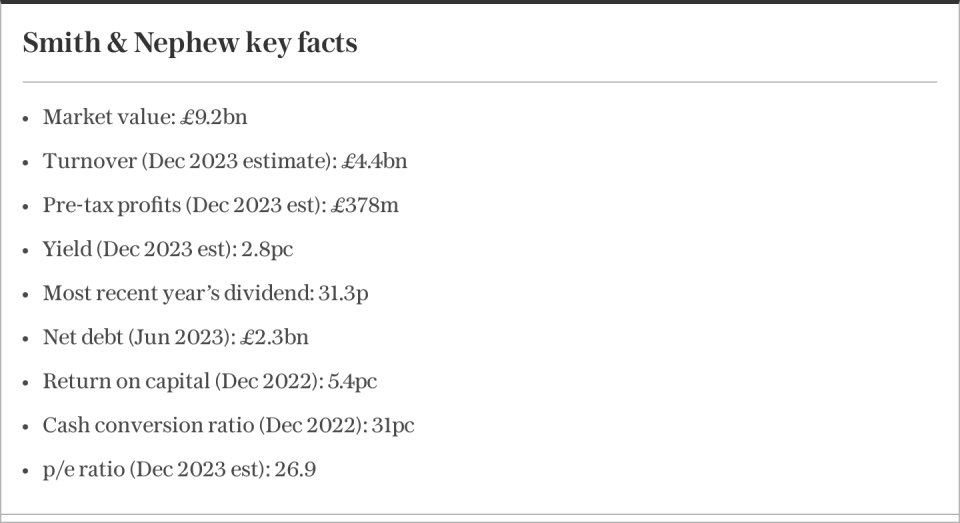

A book loss of almost 25pc since then is only partially covered by just over 58p a share in dividends, with 14.4p more to come on Nov 1, assuming we tough it out to the ex-dividend date of Oct 5, and we are now reaching a point where the chief executive, Deepak Nath, and his team need to start delivering on the 12-point plan outlined a year ago.

If all goes well, the shares are cheap. If not, they are dead money at best, so we are very much on a state of alert.

The first-half results for 2023, released a month ago, did at least feature an upgrade to sales guidance for the whole year from the group, an orthopaedics, medical devices, wound care and sports medicines specialist.

Smith & Nephew now expects underlying revenue growth for the year of between 6pc and 7pc, up from 5pc to 6pc previously. Management is also sticking to its target for underlying operating margins for 2023 of 17.5pc, compared with 17.3pc in 2022.

However, that goal does rely on a marked improvement in the second half from the first six months of the year, when the FTSE 100 company generated an underlying return on sales of 15.3pc, some 1.6 percentage points below where it had been in the equivalent period in 2022.

One year into the 12-point plan and we are nearing crunch time, with the target for an underlying trading margin of 20pc in 2025 looking a fair way away right now, even if the company is currently on track to meet its goal of revenue growth consistently in excess of 5pc per year.

If the planned cost savings and productivity gains come through as planned in the second half of the year, all will be well and good, as Smith & Nephew reaches the half-way point of its turnaround plan. Earnings momentum will confound a sceptical market and the shares will have the potential to look cheap, especially relative to American and global rivals.

If not, S&N will look like a company with a low return on capital employed, a spotty near-term cash conversion record and an apparent inability to turn a strong position in a market that should grow nicely thanks to long-term demographic trends into a decent return for shareholders. Increased volumes of elective surgical procedures in a post-lockdown world should at least provide some assistance and hopefully snarled supply chains are starting to loosen up too.

We will stick with Smith & Nephew – for now. Hold.

Questor says: hold

Ticker: SN

Share price at close: £10.55

Update: I3 Energy

Smith & Nephew failed to work out from the start but I3 Energy did, at least for a while. First analysed at 11.5p in September 2021, the shares swiftly gushed to a high of 32p last summer, only to recede as oil and gas prices fell, wildfires in Canada curtailed output and management responded by (prudently) cutting the dividend.

The good news is that production is still growing, the yield is still plump, the oil price is firming, and a continuation of the last-named trend should serve patient shareholders well.

Founded in 2014 and first quoted on Aim in 2017, I3 Energy acquires and develops mature oil and gas fields that are expected to have a long remaining life.

It currently has a working interest in around 850 sites across Canada and the North Sea that require limited investment and are producing nearly 21,000 barrels of oil equivalent, according to last week’s interim results. That is below 2022’s overall run rate (and peak output of more than 24,000 barrels), thanks largely to the Canadian wildfires, but increased output is the plan, especially as I3 Energy has a base of undeveloped reserves.

Increased production is therefore one potential catalyst for the stock, while higher commodity prices would be another. Natural gas prices remain depressed, but oil is rising.

America’s efforts to pressure Saudi Arabia and Opec into producing more oil are coming to nought, while the Biden administration is doing all it can to prevent the development of new shale fields even as its efforts to depress the oil price by running down its strategic reserves prove unsuccessful.

Common sense, and the need for energy security, would suggest that the US will need to top up those reserves at some stage and that could give crude prices a further boost, to the benefit of producers such as I3 Energy.

I3E’s shares could yet catch light once more. Hold

Questor says: hold

Ticker: I3E

Share price at close: 13.56p

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance