Stock market fear will ultimately return to greed – and this stock is well placed to benefit

Change is a constant in the investment world. While the current era of restrictive monetary policy, above-target inflation and weak economic growth may feel as though it will last forever, ultimately it will be replaced by an environment that is more conducive to share price growth.

Indeed, just over two years ago, we added online automotive marketplace Auto Trader to our Wealth Preserver portfolio.

At the time, the economy had just grown by 6.5pc in the second quarter of 2021, interest rates stood at an all-time low of 0.1pc and inflation was in line with the Bank of England’s 2pc target.

Many investors pontificated back then that the stock market would produce uninterrupted gains amid a buoyant economic environment. Just as they have been proved wrong, today’s doom-mongers and naysayers are almost certain to be wholly incorrect in their downbeat assessment of the UK economy and stock market’s future.

In Questor’s view, the combination of a tough economic period and weak investor sentiment means that cyclical stocks have vast long-term appeal.

Auto Trader, for example, is likely to experience a significant improvement in its operating environment as economic conditions strengthen.

While consumers may currently be postponing a change of vehicle or trading down to cheaper options as they seek to cut back on non-essential spending, they are likely to return to previous habits as pressure on discretionary income gradually alleviates.

With the OECD forecasting that the UK economy will grow by 1pc next year, versus 0.3pc this year, and the Bank of England expecting inflation to plummet to 2.8pc within the next 13 months, the prospects for consumers are set to markedly improve.

In turn, investors are likely to anticipate a more sanguine economic outlook over the medium term by increasing demand for riskier assets. For investors who can look beyond short-term uncertainty, the rewards of owning cyclical stocks could therefore be extremely attractive.

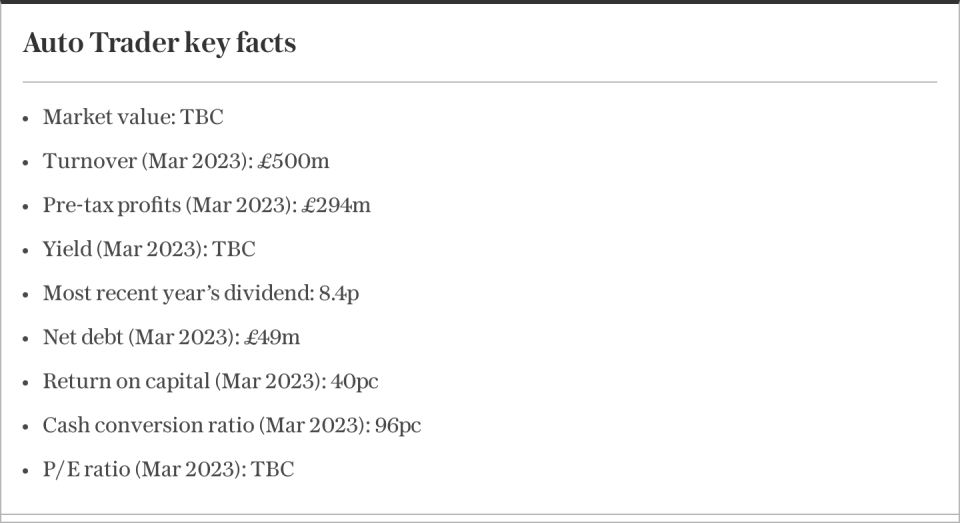

Although Auto Trader’s shares have risen by just 1pc since being added to our Wealth Preserver portfolio in July 2021, crucially the company has maintained its dominant market position.

In its financial year to March 31, the firm reported that over 75pc of all minutes spent on automotive classified sites were on its website. This equals the previous year’s figure and is seven times greater than that of its nearest competitor.

Further evidence of the company’s competitive advantage can be seen in its return on equity figure.

It stood at 47pc last year, and has averaged the same figure over the past three years. Given that it has a debt-to-equity ratio of just 13pc, an exceptionally high return on equity figure highlights the extent of dominance it enjoys over sector peers.

With the firm targeting a net cash position over the coming years, it is also financially well placed to overcome any further economic or industry-related challenges that may disproportionately affect smaller rivals.

In addition, the company has successfully maintained profit margins in its core marketplace business in spite of a tough economic climate. It expects to sustain last year’s operating profit margin of 70pc despite ongoing inflationary pressures.

This task is likely to be made easier by the fact that its customers lack realistic alternatives and thereby are seemingly very accepting of price increases.

This high degree of pricing power further strengthens the investment case for Auto Trader.

Although the company’s shares have produced anaemic growth over the past two years, they continue to trade on a relatively rich valuation.

Indeed, they have a price-to-earnings ratio of around 23 at a time when many UK-focused companies trade at extremely cheap prices due to investor pessimism regarding the economy’s near-term prospects.

In Questor’s view, though, Auto Trader continues to offer good value for money.

While its financial returns and share price performance have been lacklustre since it was added to our Wealth Preserver portfolio, the firm retains an extremely dominant market position that means it is well placed to benefit from an improving trading environment.

Furthermore, the UK’s economic outlook is likely to dramatically improve over the medium term. As a cyclical stock, it is set to be a major beneficiary as investors gradually pivot from a state of pessimism to a feeling of optimism.

Therefore, it continues to offer significant long-term investment appeal and fully merits its place in our portfolio.

Questor says: hold

Ticker: AUTO

Share price at close: 633p

Read the latest Questor column on telegraph.co.uk every Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance