Stratasys (SSYS) Q2 Earnings and Revenues Beat Estimates

Stratasys SSYS reported second-quarter 2022 non-GAAP earnings of 2 cents per share, which compared favorably with the Zacks Consensus Estimate of a loss of 3 cents per share. The bottom line improved significantly from the year-ago quarter’s loss of 2 cents per share.

The company’s revenues jumped 13.3% year over year to $166.7 million and surpassed the consensus mark of $166 million. This year-over-year top-line growth was driven by strength in the Systems performance.

Quarter in Detail

Segment-wise, Product revenues were up 15.4% from the year-ago quarter to $115.7 million. Within Product revenues, System revenues climbed 29.2%, while Consumables revenues jumped 3.9% year over year.

Revenues from Services increased 9% year on year to $50.9 million. Within Service revenues, customer support revenues advanced 9.1% year over year.

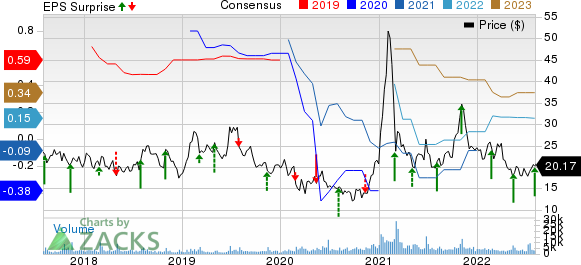

Stratasys, Ltd. Price, Consensus and EPS Surprise

Stratasys, Ltd. price-consensus-eps-surprise-chart | Stratasys, Ltd. Quote

Stratasys’ non-GAAP gross profit increased 9.4% from the year-ago period to $79.3 million. Consequently, non-GAAP gross margin expanded 10 basis points (bps) to 47.6%.

Non-GAAP operating expenses flared up 6.8% year on year to $77.4 million. As a percentage of revenues, it contracted 290 bps to 46.4%. Non-GAAP operating income came in at $1.9 million against the year-ago quarter’s loss of $2.6 million. The margin rose by 300 bps to 1.2%.

Adjusted EBITDA soared 111.4% to $7.4 million.

Balance Sheet & Other Details

Stratasys exited the second quarter with cash and short-term deposits of $438.3 million compared with the $475.6 million witnessed at the end of the previous quarter.

As of Jun 30, 2022, there was no long-term debt.

During the April-June quarter, the company utilized an operating cash flow of $22.8 million.

Updated Outlook

For 2022, Stratasys’ management now projects revenues between $675 million and $685 million, down from the earlier estimate of $685-$695 million. SSYS still anticipates non-GAAP earnings in the range of 14 cents to 19 cents per share in 2022.

Stratasys estimates 2022 operating expenses to increase by $18-$23 million from the 2021 level, primarily due to the ongoing investments in new products associated with higher revenues.

For 2022, Stratasys continues to expect the non-GAAP operating margin to be slightly above 2%. Adjusted EBITDA is still forecast in the band of $38 million to $41 million.

Zacks Rank & Key Picks

Stratasys currently carries a Zacks Rank #3 (Hold). Shares of SSYS have declined 7.8% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Taiwan Semiconductor TSM, Clearfield CLFD and Silicon Laboratories SLAB, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Taiwan Semiconductor's third-quarter 2022 earnings has been revised 10 cents northward to $1.70 per share over the past 30 days. For 2022, earnings estimates have moved 37 cents north to $6.30 per share in the past 30 days.

TSM's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 3.9%. Shares of the company have decreased 27.4% in the past year.

The Zacks Consensus Estimate for Clearfield's fourth-quarter fiscal 2022 earnings has been revised upward by 10 cents to 80 cents per share over the past seven days. For fiscal 2022, earnings estimates have moved 36 cents north to $3.13 per share in the past seven days.

Clearfield’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 33.9%. Shares of CLFD have soared 141.9% in the past year.

The Zacks Consensus Estimate for Silicon Laboratories’ third-quarter 2022 earnings has increased 22.9% to $1.02 per share over the past seven days. For 2022, earnings estimates have moved 14.2% up to $4.18 per share in the past seven days.

Silicon Laboratories’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 63.6%. Shares of SLAB have decreased 3.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stratasys, Ltd. (SSYS) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Silicon Laboratories, Inc. (SLAB) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance