Streaming Profit Report: A Year Spent Chasing Netflix

Several years into Hollywood giants’ streaming pushes, they still find themselves confronted with that famous Jerry Maguire line from Wall Street: “Show me the money!” In the case of streaming, “the money” means profits.

With Netflix having been crowned by some observers as the king of streaming, Hollywood CEOs have focused on making their streaming business units profitable after an initial focus on subscriber growth.

More from The Hollywood Reporter

The full year of 2023 provided some positives for sector watchers. One entertainment titan ended up eking out a small profit for its streaming unit, while two others narrowed their losses in their divisions with their core streaming businesses, with one of those promising to start turning black ink this year. And another sector biggie made clear that 2023 marked its year of peak losses in streaming.

But Hollywood conglomerates’ streaming results still make for a sharp contrast with Netflix’s continued growth in its annual bottom line. And entertainment biggies remain in the stage of proving that they can make money in streaming and, importantly, get to sustainable profitability.

That is particularly important for investors as Hollywood has seen the bottom line of its cable TV networks businesses, once the key growth drivers and profit centers of entertainment conglomerates, hit by cord-cutting and the growth of streaming. Research firm Ampere Analytics recently forecast that streaming revenue would overtake pay TV subscription revenue in the U.S. for the first time in the third quarter of 2024, helped by the addition of ad tiers by various streamers. “Streaming will continue to race ahead as traditional pay TV declines – with the value of pay TV in 2028 expected to fall to half the value it saw at its peak in 2017,” its report predicted.

But which companies can follow up revenue growth with streaming profits and who can get them to scale? This kind of streaming promised land has not been reached by Hollywood powerhouses, the Street agrees.

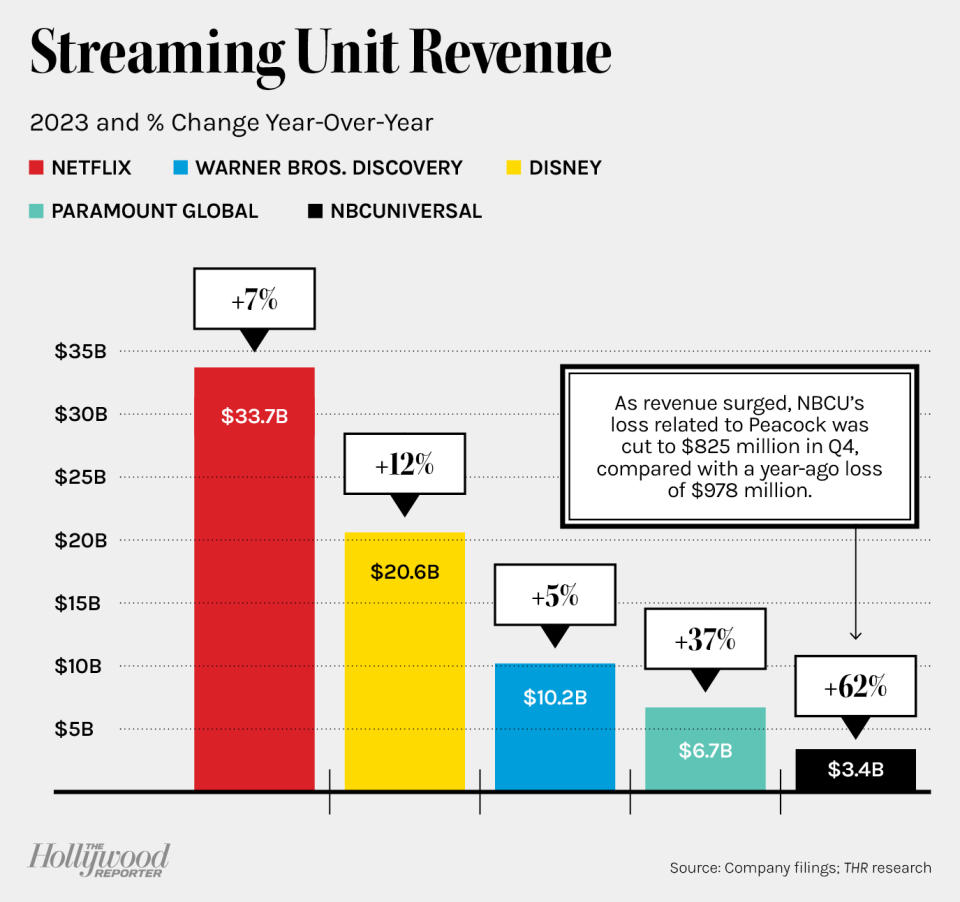

No surprise that Hollywood CEOs have been looking to tout their streaming progress and successes. An analysis must keep in mind that the divisions that contain Hollywood companies’ streaming businesses are not directly comparable. After all, some of them don’t include all streaming services of a company or include additional operations. Warner Bros. Discovery’s “Direct-to-Consumer,” or DTC, unit, for example, consists of its streaming and premium pay-TV services, meaning HBO is part of it. Meanwhile, the Walt Disney Co.’s “Direct-to-Consumer” division does not include ESPN+. And Comcast’s NBUniversal breaks out revenue and profit for its streamer Peacock, which is part of its broader Media unit.

Meanwhile, Netflix has long been a streaming-focused company that last year ended its DVD rental offering. But it has also started pushing into businesses beyond streaming, such as gaming and merchandise.

So while a direct comparison of all these businesses is not an apples-to-apples affair, it is educative and allows to see longer-term trends beyond quarterly updates. Keep in mind that Disney’s fiscal year runs through the fall, while The Hollywood Reporter calculated DTC results for the calendar year 2023 to focus on a comparable period.

With all that out of the way, here is a closer look at Hollywood giants’ streaming business units in 2023.

*****

Netflix

The only way has been up for the global streaming giant as of late. It kept growing its full-year revenue, “primarily due to the 8 percent growth in average paying memberships, partially offset by a 1 percent decrease in average monthly revenue per paying membership.”

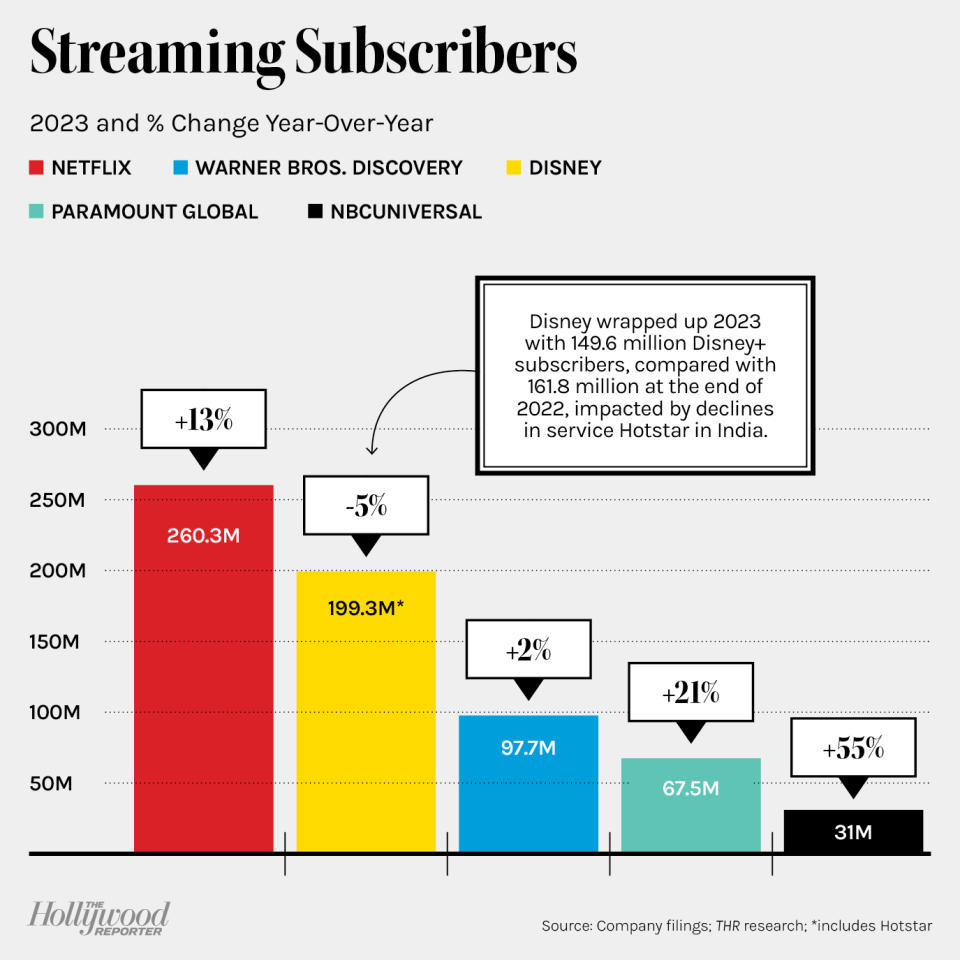

Indeed, Netflix added 29.5 million members in 2023, up from 8.9 million in 2022, boosted by its password-sharing crackdown and the late 2022 launch of a cheaper advertising-supported subscriber tier, ending 2023 with around 260 million worldwide users. “Revenues earned from sources other than monthly membership fees were not material,” the streamer highlighted. But “in 2024, we see big opportunities,” it noted. Those include the chance to “tap into a significant new long-term revenue and profit pool by scaling our ads business.”

With its full-year operating expenses only rising 3 percent in 2023, compared with a 7 percent revenue increase, Netflix’s operating margin climbed from 18 percent to 21 percent, and its profit jumped 25 percent.

“If we continue to execute well and drive continuous improvement — with a better slate, easier discovery and more fandom — while establishing ourselves in new areas like advertising and games, we believe we have a lot more room to grow,” the streamer touted in its fourth-quarter letter to shareholders.

Netflix’s first-ever “What We Watched” report, covering the first half of 2023, touted The Night Agent as its top show with more than 812 million hours of total watch time, followed by season 2 of comedy-drama Ginny & Georgia (665 million hours of view time), and Korean drama The Glory (622 million hours). Action-thriller The Mother, starring Jennifer Lopez, came out on top of the film list with more than 249 million hours.

NBCUniversal

NBCUniversal says it has now passed peak losses in streaming. Its parent Comcast followed Netflix’s latest financial update, reporting that it grew its subscribers to streamer Peacock by more than 50 percent to 31 million as of the end of 2023. While that percentage growth came in above peers, it also came off a smaller user base.

Peacock posted the biggest full-year loss among entertainment giants’ streaming businesses, but started its turn toward profitability. After previously vowing that 2023 would mark the year of “peak losses” in streaming, it posted a $2.7 billion loss related to Peacock for the year, up from a $2.5 billion loss in 2022, but slightly better than previously targeted. Peacock revenue jumped by two-thirds in the latest year, and its losses narrowed to $565 million in the third quarter from a year-ago loss of $614 million, marking a turning point after a time of growing quarterly losses. The fourth-quarter loss again showed progress, narrowing from $978 million in 2022 to $825 million in the final period of 2023. “For 2024, we expect to show meaningful improvement in losses versus 2023,” Comcast president Michael Cavanagh told a recent earnings conference call. Universal’s Five Nights at Freddy’s was “the highest-grossing horror film of 2023 and also set a record on Peacock as the most watched title of all time in the first five days of its release,” he also was happy to tout.

Management’s take on its streaming progress is bullish. “Only three years in, we’re achieving a level of scale with paying subs that’s about 60 percent of the level of the streamers that have been out there for many years domestically, ex-Netflix. And we’re holding a very strong average revenue per user (ARPU) at $10 per sub,” Cavanagh said. “Leveling off a little bit of the growth rate of programming spend as we get to this level is clearly part of the improvement in Peacock losses standalone that will be a factor as we see continued strong growth on the revenue side, given the higher level of subs” and expected further growth. But he also emphasized that Comcast’s strategy is “to manage Peacock and our linear TV businesses as one.” That is different from other players’ focus on making streaming units as profitable as possible. “I’m less focused on what standalone Peacock losses are doing than I am on doing what’s right for the long term for the totality of the media business, which is linear and streaming,” Cavanagh said. “I think we’ve navigated a very good path for us.”

Walt Disney

Disney CEO Bob Iger and his team are getting closer. For the final calendar quarter of 2023, Disney reported its latest narrowed streaming loss, excluding ESPN+, which is part of the company’s sports unit. The $138 million quarterly loss was a clear improved over the year-ago deficit of nearly $1 billion. And for the full calendar year 2023, the company cut its streaming losses by more than half.

The subscriber picture has been more mixed. It lost 1.3 million core Disney+ subscribers in the latest quarter amid a price hike to end the year with 111.3 million, up 7.0 million for all of 2023. Meanwhile, Disney+ Hotstar in India returned to growth, adding 700,000 users in the latest quarter to reach 38.3 million, but that was down from 57.5 million at the end of 2022.

In total, Disney wrapped up 2023 with 149.6 million Disney+ subscribers, compared with 161.8 million as of the end of 2022.

Hulu, of which Disney agreed to to take full ownership under a deal with Comcast unveiled in late 2023, also continued to expand its customer base. Its streaming-only subscriptions grew by 1.6 million to 45.1 million subscribers in 2023, while its live TV plus SVOD plan gained around 100,000 users to end the year with 4.6 million.

With this backdrop, on his most recent earnings conference call, Disney CEO Bob Iger reiterated his goal of making the streaming unit profitable by the fourth quarter of Disney’s current fiscal year, which is the third quarter of calendar year 2024. “In 2019, Disney+ launched with nearly 500 films and 7,500 episodes of television from across the worlds of Disney. Three years later, its meteoric rise is considered one of the most successful rollouts in the history of the media business,” Iger argued before vowing: “Now it’s time for another transformation… one that rationalizes our enviable streaming business and puts it on a path to sustained growth and profitability.”

Calling this his “number one priority,” Iger concluded: “We are focused on the success of our streaming business and the return it generates for our shareholders long into the future.”

Part of that is a strategic focus he has applied across the company, namely a focus on core brands and franchises, which, he has touted, “have consistently delivered higher returns,” better curation of general entertainment content, revisiting the balance between global and local content, potential pricing adjustments and a fine-tuning of “our advertising initiatives on all streaming platforms.”

Speaking of the recently launched Disney+ ad tier, it hasn’t made a huge financial splash yet, but management expects it to start providing a “meaningful financial impact” later this fiscal year.

Morgan Stanley analyst Benjamin Swinburne is bullish on Disney’s path to streaming profits. “By the end of fiscal year 2024, the two most impactful businesses to Disney shares should be inflecting – with streaming turning profitable and [theme] parks growth accelerating,” he wrote in a report, in which he boosted his stock price target by $25 to $135 while sticking to his “overweight” rating on Disney.

Warner Bros. Discovery

It wasn’t much, but it was a profit. Late in the latest earnings season, Warner Bros. Discovery touted the turnaround in its streaming unit, which includes HBO in addition to streamer Max.

Despite a slight loss in the fourth quarter, it became the first Hollywood conglomerate to turn a profit for the unit housing its streaming business for a full year – albeit a tiny one.

WBD’s 2023 profit of $103 million for its DTC division compared with a loss of nearly $2.1 billion in 2022, “driven by growth across all revenue streams, as well as more efficient marketing spend and lower content expense.”

Revenue growth was helped by subscriber price increases and gains in the Max U.S. ad-lite user tier, as well as higher content revenue thanks to a “higher volume of licensing deals” as WBD looked to monetize its content in various ways, including via deals with third parties.

Overall, the conglomerate ended 2023 with 97.7 million streaming subscribers, including the recent acquisition of Turkish streamer BluTV, a slight gain from the 96.1 million recorded at the end of 2022.

“We fought hard to get Max to be profitable last year,” Zaslav told Wall Street analysts on his latest earnings call. We are now committed to driving profitable {revenue] growth.”

Over the next two years, the company would use “a number of meaningful growth levers,” the CEO vowed, including the rollout of Max in key international markets, starting with the recent launch in Latin America, followed by territories in the Europe/Middle East/Africa and Asia-Pacific regions. After all, so far, “we are only available in less than half the addressable households and markets as compared to our larger peers,” Zaslav explained.

“We’re also driving better segmentation and monetization by launching the new ad-supported offering which is currently only available here in the U.S.” By the end of 2024, it should be available in more than 40 markets.

Also key to streaming growth ahead will be the “refreshing and reigniting” of WBD’s content pipeline at Max. “The strikes really slowed down production,” Zaslav lamented.

New market launches and relaunches elsewhere will mean that the streaming unit will end the first half of 2024 “modestly negative,” followed by profitability in the back half, said WBD CFO Gunnar Wiedenfels. “Net-net, we currently expect the DTC segment to be profitable for the year as we continue to pivot our focus to profitable top line growth.”

Management also said WBD was “on track” to hit its target of $1 billion in streaming earnings in 2025. “2024 will certainly lay important foundations for achieving this goal,” promised Wiedenfels.

But amid no track record of streaming profits at Hollywood giants and WBD’s need to pay down debt and manage costs, some wonder about the future of streaming profits. “The prospect for meaningful DTC segment profits remains unclear,” Swinburne argued in a post-earnings report.

Peter Supino, analyst at Wolfe Research, also said that the promising DTC trends at WBD could be outweighed by “intense” pressure at its cable networks unit. “With overall company revenue declining, the question becomes: can the revenue mix shift to studio and DTC combined with further cost cuts stabilize EBITDA?” he argued. “If not, 80 percent of profits still tied to linear and $44 billion of debt makes for a challenging investment case. Despite some recent improvement in core advertising, we see no internal nor external force that would stabilize networks. If that is correct, total EBITDA will continue to face a roughly $1 billion per year headwind which more durable studio and DTC segments may struggle to outrun.”

Paramount Global

Paramount Global is asking investors for patience and a bit more time when it comes to streaming profits. Led by CEO Bob Bakish, it has been the topic of much deal chatter as of late. But management emphasized its focus on making money, including from the company’s streaming business, touting that “streaming investment peaked ahead of plan.”

All in all, Paramount’s streaming loss for 2023 narrowed slightly, while its streaming revenue jumped more than 35 percent, led by a 46 percent subscription gain, helped by a price increase, and 17 percent ad growth.

The company lauded “strong growth in engagement and revenue, and improved operational efficiency.”

Streaming user growth also continued last year. Paramount+ ended 2023 with 67.5 million subscribers, a gain of 11.6 million over the 12-month period. Ad-funded streamer Pluto TV grew monthly active users in 2023, but the company didn’t disclose a latest user figure.

Bakish’s takeaway on the latest earnings conference call: “We hit peak streaming losses in 2022, a year ahead of schedule, with further significant improvement expected in 2024.” While Paramount’s domestic streaming business will only become profitable in 2025, Bakish called that “a significant and exciting milestone in the company’s transformation.”

While some analysts argue that management’s promise to cut back on original spending, including local programming in international markets, to focus on the biggest hits could affect streaming growth ahead, Paramount believes it can avoid that.

“We’ve learned that Paramount+ subscribers outside the United States spend nearly 90 percent of their time with our global Hollywood hits. Meaning we can keep them engaged while right-sizing our investment in content that does not travel around the world,” Paramount CFO Naveen Chopra told Wall Street analysts.

“Paramount+’s value proposition is strong: cornerstone original and library content and top-tier movies and sports in an integrated package,” he argued. “This proposition allows us to continue to grow subscribers and drive revenue by deepening engagement, improving retention, and increasing monetization. And we continue to believe that the key to deeper engagement and retention is savvy programming execution and a stable volume of original content. It’s about smartly combining acquisition drivers like the NFL, blockbuster films, and our slate of hit Paramount+ originals with lower-cost library and affinity programming.”

Many on Wall Street remain cautious on Paramount though. Swinburne in a recent note to investors addressed chatter about possible consolidation or asset sales. “This speculation has not and does not shift our view that the risk skews to the downside on Paramount shares at current levels,” he said. “There are no easy fixes to the secular trends the traditional TV business faces or to rapidly drive streaming profitability.”

Best of The Hollywood Reporter

Yahoo Finance

Yahoo Finance