Super Micro Computer And Two More Stocks Estimated To Trade Below Fair Value

As global markets navigate through varying degrees of volatility, with technology stocks showing robust performance amid shifting economic indicators, investors are keenly watching for opportunities. In this context, identifying stocks that trade below their fair value can be particularly compelling, offering potential for appreciation in a market ripe with both challenges and opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Plus Alpha ConsultingLtd (TSE:4071) | ¥1788.00 | ¥3567.37 | 49.9% |

Vente-Unique.com (ENXTPA:ALVU) | €14.70 | €29.25 | 49.7% |

Smart Parking (ASX:SPZ) | A$0.48 | A$0.96 | 49.9% |

DYPNFLtd (KOSDAQ:A104460) | ₩19960.00 | ₩39799.17 | 49.8% |

Kier Group (LSE:KIE) | £1.362 | £2.71 | 49.7% |

CTK (KOSDAQ:A260930) | ₩8620.00 | ₩17180.62 | 49.8% |

Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49571.57 | 49.8% |

CapMan Oyj (HLSE:CAPMAN) | €1.894 | €3.78 | 49.9% |

CMC Markets (LSE:CMCX) | £2.575 | £5.15 | 50% |

Nexxen International (AIM:NEXN) | £2.465 | £4.90 | 49.7% |

Let's explore several standout options from the results in the screener

Super Micro Computer

Overview: Super Micro Computer, Inc. specializes in developing and manufacturing high-performance server and storage solutions with a modular and open architecture across the United States, Europe, Asia, and internationally, boasting a market capitalization of $49.45 billion.

Operations: The company's revenue from high-performance server solutions totals $11.82 billion.

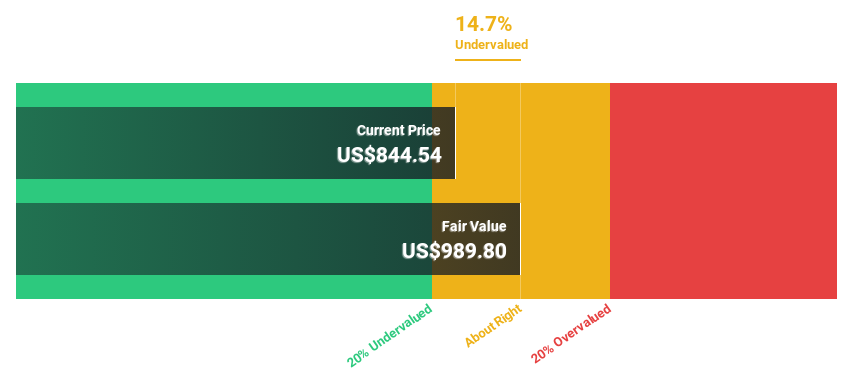

Estimated Discount To Fair Value: 14.7%

Super Micro Computer is currently trading at US$844.54, below the estimated fair value of US$989.8, suggesting a modest undervaluation based on discounted cash flows. Despite this, the company's earnings have grown by 78.6% over the past year and are expected to continue growing at 40.25% annually, outpacing the US market significantly. However, shareholder dilution occurred last year and share price volatility has been high recently. Revenue forecasts also exceed market expectations significantly, indicating potential for sustained growth amid operational expansions like their recent AMD EPYC 4004 CPU servers launch aimed at enhancing computing density and efficiency in cloud-native workloads.

Uber Technologies

Overview: Uber Technologies, Inc. is a global technology company that develops and operates proprietary applications for ridesharing, food delivery, and freight across multiple regions including the United States, Canada, Latin America, Europe, the Middle East, and Africa; it has a market capitalization of approximately $146.39 billion.

Operations: Uber's revenue is generated from three key segments: Mobility with $21.14 billion, Delivery at $12.33 billion, and Freight contributing $5.13 billion.

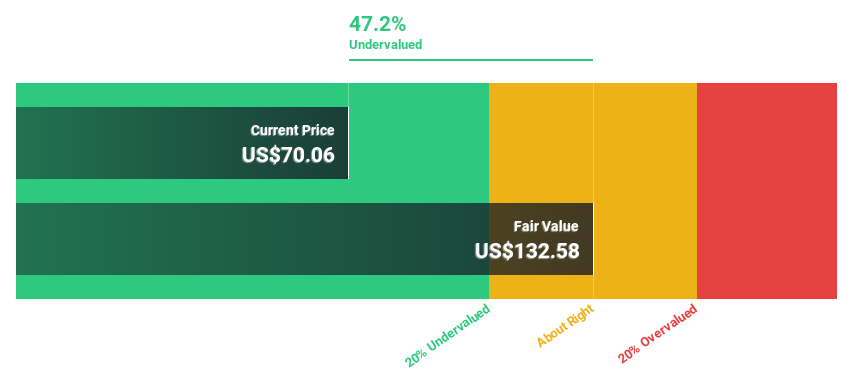

Estimated Discount To Fair Value: 47.2%

Uber Technologies, priced at US$70.06, is currently valued at 47.2% below its fair value of US$132.58, indicating a significant undervaluation based on cash flows. Analysts predict a robust annual earnings growth of 34.5% and revenue growth of 12.8%, both surpassing market averages significantly, which could signal future financial health improvement despite recent shareholder dilution and substantial insider selling over the past quarter. Additionally, Uber's strategic partnerships in business sectors are enhancing its service delivery capabilities, although it faces legal challenges regarding accessibility services.

Our growth report here indicates Uber Technologies may be poised for an improving outlook.

Take a closer look at Uber Technologies' balance sheet health here in our report.

BYD

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$743.85 billion.

Operations: The company's revenue is generated from its automobile and battery sectors across various regions including China, Hong Kong, Macau, and Taiwan.

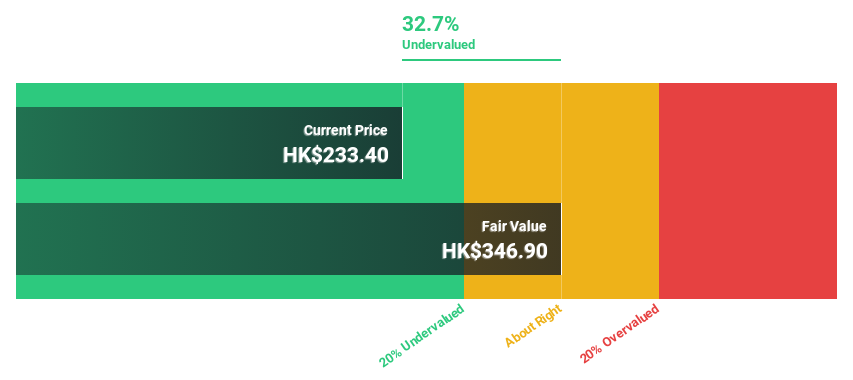

Estimated Discount To Fair Value: 32.7%

BYD, trading at HK$233.4, is identified as undervalued based on DCF with a fair value of HK$346.9, marking a 32.7% undervaluation. Forecasted earnings growth is 14.9% annually, surpassing the Hong Kong market's 11.7%. Revenue growth projections also exceed market expectations at 14.2% per year against the market's 7.8%. Recent dividend increase and robust sales figures underscore financial health, though it's noted that revenue growth isn't exceptionally high compared to some industry peers.

Insights from our recent growth report point to a promising forecast for BYD's business outlook.

Delve into the full analysis health report here for a deeper understanding of BYD.

Key Takeaways

Delve into our full catalog of 951 Undervalued Stocks Based On Cash Flows here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:SMCI NYSE:UBER and SEHK:1211.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance