Swedish Growth Companies With High Insider Ownership To Watch In June 2024

As global markets exhibit mixed signals with some regions showing economic resilience and others grappling with challenges, Sweden's market remains a focal point for investors looking for growth opportunities. Particularly, Swedish growth companies with high insider ownership are garnering attention as they often signal strong confidence from those closest to the company’s operations and future. In current market conditions, where discernment in investment choices becomes paramount, companies with substantial insider ownership can be compelling. These entities typically benefit from aligned interests between shareholders and management, potentially leading to more prudent risk management and innovative strategies that leverage deep industry insights.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.9% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Biovica International (OM:BIOVIC B) | 12.7% | 73.8% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 43.4% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Here we highlight a subset of our preferred stocks from the screener.

Betsson

Simply Wall St Growth Rating: ★★★★☆☆

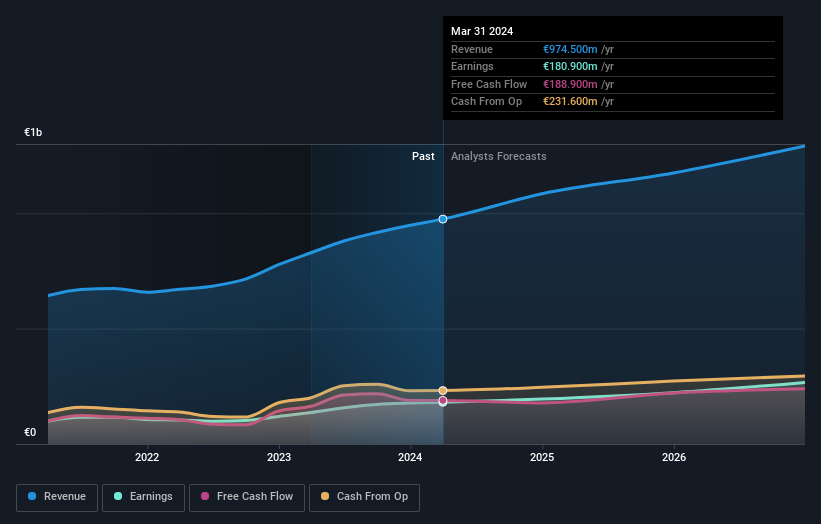

Overview: Betsson AB operates an online gaming business across various regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, and Central Asia, with a market capitalization of approximately SEK 16.36 billion.

Operations: Betsson's revenue from its Casinos & Resorts segment amounts to approximately €0.97 billion.

Insider Ownership: 10.9%

Betsson, a growth-oriented company with significant insider buying recently, reported a solid earnings increase of 32.9% over the past year. With an expected revenue growth outpacing the Swedish market at 9.9% annually and earnings projected to grow by 14% per year, Betsson is trading at a good value relative to its peers. However, its dividend track record remains unstable despite recent increases totaling EUR 0.645 per share in redemption procedures for 2024. The company's return on equity is also anticipated to be high at 23.5% in three years' time.

NIBE Industrier

Simply Wall St Growth Rating: ★★★★☆☆

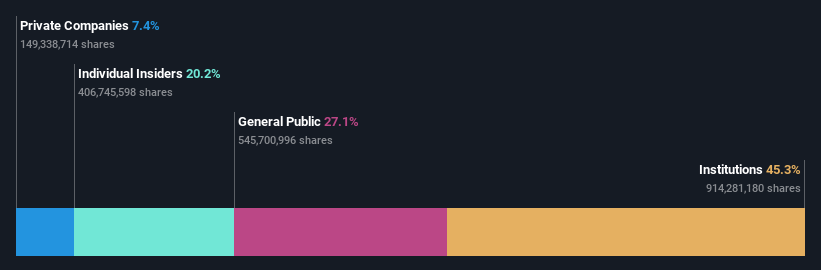

Overview: NIBE Industrier AB specializes in developing, manufacturing, marketing, and selling energy-efficient solutions for indoor climate comfort and intelligent heating and control across the Nordic countries, Europe, North America, and globally. The company has a market capitalization of approximately SEK 98.26 billion.

Operations: NIBE Industrier's revenue is primarily derived from three segments: Climate Solutions at SEK 36.83 billion, Element at SEK 13.62 billion, and Stoves at SEK 5.62 billion.

Insider Ownership: 20.2%

NIBE Industrier, a Swedish growth company with high insider ownership, is navigating challenges despite robust earnings forecasts. With expected annual earnings growth of 27.6%, it outpaces the local market's 13.9%. However, its profit margins have dipped from 11.5% to 6% over the past year, and debt coverage by operating cash flow is weak. Recent strategic appointments and expansion efforts signal a focus on strengthening its competitive position in climate solutions, although recent financial results showed a significant downturn with a net loss reported in Q1 2024.

Vimian Group

Simply Wall St Growth Rating: ★★★★☆☆

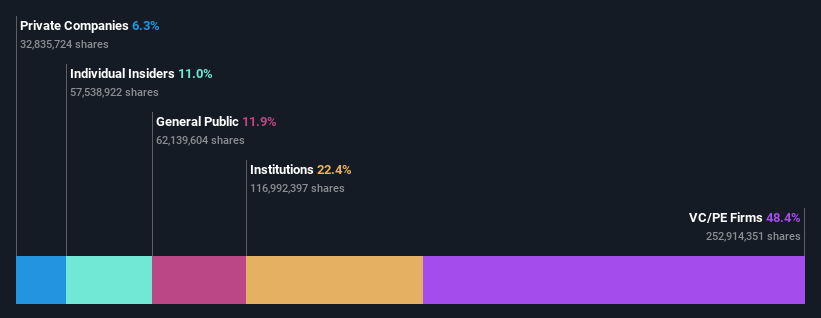

Overview: Vimian Group AB operates globally in the animal health sector and has a market capitalization of approximately SEK 18.15 billion.

Operations: The company generates revenue from several segments: Medtech (€109.03 million), Diagnostics (€21.14 million), Specialty Pharma (€153.26 million), and Veterinary Services (€51.63 million).

Insider Ownership: 11%

Vimian Group, reflecting a mix of challenges and growth potential, reported a slight increase in Q1 2024 sales to €91.3 million but saw a decrease in net income to €3.5 million. With high insider buying activity over the past three months and no substantial insider selling, the company demonstrates confidence from its leadership, exemplified by the recent board appointment of Magnus Welander as chairman. Despite this optimism, shareholder dilution occurred last year and interest coverage remains weak. However, Vimian's revenue is expected to grow faster than the Swedish market average at 12.2% per year with significant earnings growth anticipated.

Taking Advantage

Delve into our full catalog of 84 Fast Growing Swedish Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BETS BOM:NIBE BOM:VIMIAN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance