Swedish Growth Companies With High Insider Ownership In May 2024

As global markets experience varied performance with technology sectors showing resilience, Sweden's market presents unique opportunities, particularly in growth companies with high insider ownership. These firms often benefit from aligned interests between shareholders and management, potentially leading to more stable and committed leadership amidst the broader market's fluctuations.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

BioArctic (OM:BIOA B) | 35.1% | 50.5% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.4% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

InCoax Networks (OM:INCOAX) | 18.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 42.5% |

SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

Underneath we present a selection of stocks filtered out by our screen.

CTT Systems

Simply Wall St Growth Rating: ★★★★★★

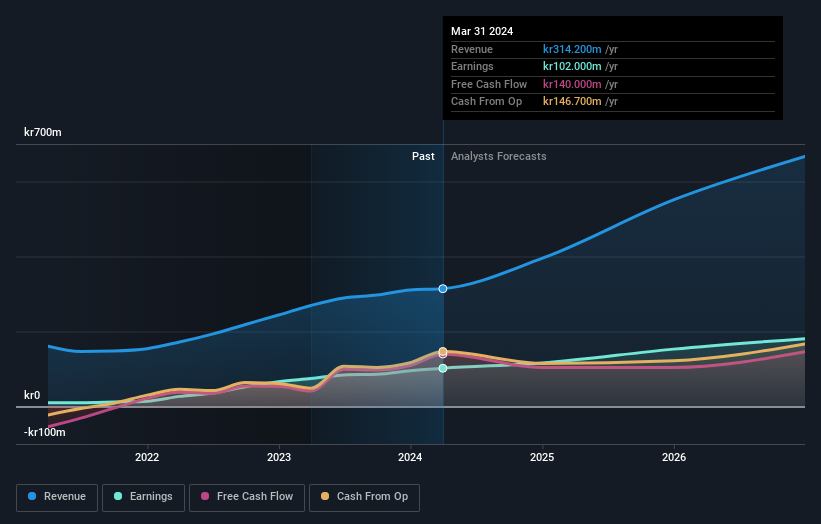

Overview: CTT Systems AB, based in Sweden, specializes in designing, manufacturing, and selling humidity control systems for aircraft globally, with a market capitalization of approximately SEK 4.44 billion.

Operations: The company generates its revenue primarily from the Aerospace & Defense segment, which accounted for SEK 314.20 million.

Insider Ownership: 16.9%

Return On Equity Forecast: 44% (2027 estimate)

CTT Systems, a Swedish company with high insider ownership, shows promising growth prospects. Recently, the firm announced an increase in dividends and forecasted significant sales growth for Q2 2024, indicating robust financial health. Despite an unstable dividend track record, CTT is trading below its estimated fair value and expects revenue to grow faster than the market at 20.3% per year. Moreover, earnings are projected to expand significantly over the next three years with a very high forecasted Return on Equity of 44.2%.

Click here and access our complete growth analysis report to understand the dynamics of CTT Systems.

The valuation report we've compiled suggests that CTT Systems' current price could be inflated.

Sectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) specializes in medical IT and cybersecurity solutions across Sweden, the UK, the Netherlands, and other European countries, with a market capitalization of approximately SEK 46.63 billion.

Operations: The company's revenue is primarily generated from its Imaging IT Solutions and Secure Communications segments, which respectively brought in SEK 2.45 billion and SEK 301.16 million.

Insider Ownership: 30.3%

Return On Equity Forecast: 30% (2027 estimate)

Sectra, a Swedish company with substantial insider ownership, recently secured significant contracts enhancing its growth trajectory. Notably, the NATO Communications and Information Agency extended a crucial contract and ordered additional Sectra Tiger units, underscoring trust in Sectra's secure communication solutions. Additionally, recent FDA clearance for its digital pathology solution marks a pivotal advancement in medical diagnostics. Despite these positives, Sectra's revenue growth forecast of 13.9% per year slightly trails behind more aggressive market benchmarks.

Truecaller

Simply Wall St Growth Rating: ★★★★☆☆

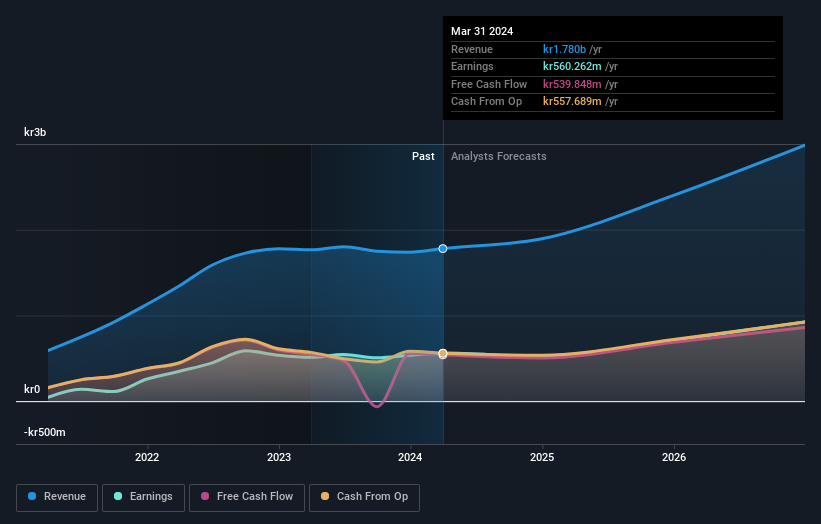

Overview: Truecaller AB operates globally, developing mobile caller ID applications for both individual and business use in regions including India, the Middle East, and Africa, with a market capitalization of SEK 12.32 billion.

Operations: The company's revenue from communications software totaled SEK 1.78 billion.

Insider Ownership: 14.9%

Return On Equity Forecast: 45% (2027 estimate)

Truecaller, a Swedish growth company with high insider ownership, has recently demonstrated robust financial and strategic progress. The firm reported a 10.8% increase in Q1 sales year-over-year, reaching SEK 429.94 million, with net income rising to SEK 133.05 million from SEK 109.12 million previously. Strategic alliances like the one with Microsoft to integrate Azure AI Speech technology into Truecaller's AI Assistant highlight innovation driving user engagement and market expansion. Despite these strengths, insider transactions have been minimal over the past three months, indicating a potential area for investor caution.

Make It Happen

Dive into all 86 of the Fast Growing Swedish Companies With High Insider Ownership we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:CTT OM:SECT BOM:TRUE B and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance