Swedish Growth Companies With High Insider Ownership To Watch In May 2024

As global markets exhibit mixed signals with technology sectors showing resilience amidst broader market challenges, Sweden's market remains a focal point for investors seeking growth opportunities. In this context, companies with high insider ownership in Sweden present an interesting avenue as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

Dignitana (OM:DIGN) | 30.2% | 139% |

edyoutec (NGM:EDYOU) | 14.0% | 63.1% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 42.5% |

SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

Let's review some notable picks from our screened stocks.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

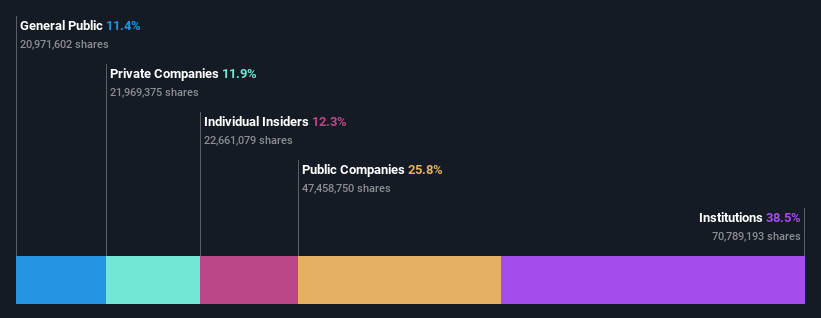

Overview: Pandox AB is a hotel property company that specializes in owning, operating, and leasing hotel properties, with a market capitalization of approximately SEK 33.09 billion.

Operations: The company generates its revenue primarily through two segments: Own operation, which brought in SEK 3.24 billion, and Rental Agreement, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Return On Equity Forecast: N/A (2027 estimate)

Pandox, a Swedish hotel operator, has seen more insider buying than selling recently, indicating some confidence from those closest to the company. Despite this, its revenue growth is modest at 2.2% per year, slightly above the market average but well below high-growth benchmarks. The company's earnings are expected to grow significantly at 46.3% annually over the next three years. However, financial challenges persist as earnings barely cover interest payments and dividends are poorly covered by earnings. Recent financial results show improvement with a net income of SEK 447 million compared to a loss in the previous year.

Truecaller

Simply Wall St Growth Rating: ★★★★☆☆

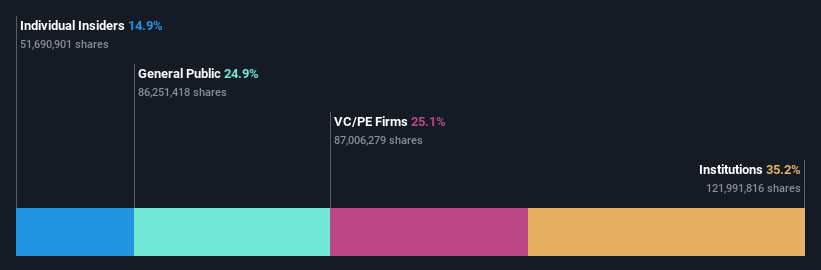

Overview: Truecaller AB (publ) specializes in developing and publishing mobile caller ID applications for both individuals and businesses across India, the Middle East, Africa, and globally, with a market capitalization of approximately SEK 12.85 billion.

Operations: Truecaller generates its revenue primarily from communications software, totaling SEK 1.78 billion.

Insider Ownership: 14.9%

Return On Equity Forecast: 45% (2027 estimate)

Truecaller, a Swedish tech firm, is actively innovating with features like the AI Call Scanner to combat AI-driven scams, reflecting its growth-oriented strategy despite not being top-tier in insider ownership. The company's recent share buyback and consistent dividend payouts suggest a balanced approach to shareholder value. However, while Truecaller shows robust projected earnings growth and substantial market penetration with initiatives like TrueTalks Community and enhanced Truecaller for Business plans, it remains under pressure to maintain its competitive edge in a rapidly evolving tech landscape.

Yubico

Simply Wall St Growth Rating: ★★★★★★

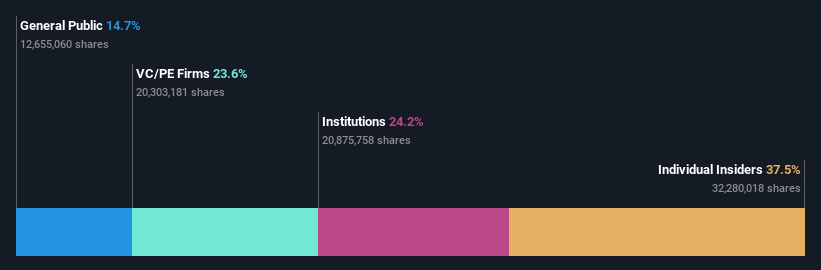

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 20.75 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Return On Equity Forecast: 27% (2027 estimate)

Yubico, a Swedish company specializing in secure authentication solutions, has shown notable growth with a 19.9% increase in revenue over the past year and is expected to continue this trend with projected annual earnings growth of 42.5%. Despite high insider selling recently, the company trades at 10.6% below its estimated fair value and has introduced significant product updates like the YubiKey 5.7 firmware, enhancing its competitive edge in cybersecurity. However, financial data availability is limited to under three years and shareholder dilution has occurred within the last year.

Taking Advantage

Investigate our full lineup of 86 Fast Growing Swedish Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:PNDX B OM:TRUE B and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance