Synchronoss Technologies' (SNCR) spatialSUITE Gains Traction

Synchronoss Technologies SNCR recently announced that it will be showcasing its spatialSUITE platform at SCTE Cable-Tec Expo in Philadelphia. The company will exhibit automated end-to-end network design and asset management platforms to its audience.

Synchronoss’ spatialSUITE enables automatic network planning and designing, seamless sharing of network information between the field and office, optimizing network performance with system setup and monitoring framework and many more.

These features of spatialSUITE have been driving strong demand for broadband buildout and fiber investment. Currently, spatialSUITE supports 80 million connected customers and more than 400,000 miles of fiber.

Personal Cloud Solutions Aids Synchronoss Prospects

Synchronoss has been expanding into new markets and new verticals. Last month, it rolled out two new premium personal cloud solutions with Telkomsel, opening the door to an additional 170 million potential customers in Indonesia.

The company also signed a letter of intent with Street Cred Capital to bundle its Cloud solution with the latter’s mobile device financing offerings. This will allow subscribers to finance their purchase of mobile apps such as Synchronoss Cloud, along with other products and accessories.

Synchronoss’ cloud service continues to drive growth as cloud revenues, which represent two-thirds of the company’s total revenues, grew 12% year over year in the second quarter of 2022.

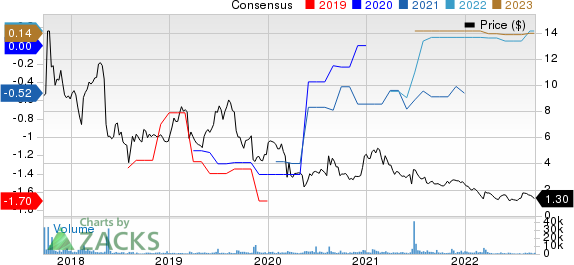

Synchronoss Technologies, Inc. Price and Consensus

Synchronoss Technologies, Inc. price-consensus-chart | Synchronoss Technologies, Inc. Quote

The company recently announced strategic partnerships with Alibaba BABA and Alphabet’s GOOGL Google Cloud. It will be offering personal cloud and email suite services to Alibaba and Google Cloud, respectively.

Alibaba provides SNCR with additional avenues to drive global adoption of the cloud while ensuring security, accessibility and reliability to subscribers.

The e-mail solution on Alphabet’s Google Cloud platform allows customers to deploy and scale the Synchronoss e-mail suite globally. It also creates opportunities to expand Synchronoss’ email and Advanced Messaging solutions.

Synchronoss Personal Cloud and Synchronoss Email Suite, which support more than 250 million subscribers and store more than 142 petabytes of data, will get to expand through Asia and beyond with certifications from Alibaba and Google Cloud.

The company has previously been certified by companies like Amazon AMZN to provide mobile operators with Amazon consumer services globally.

What Lies Ahead for Synchronoss?

Synchronoss currently sports a Zacks Rank #1 (Strong Buy). It eyes long-term growth with its 5G expansion, fixed wireless expansion and bundled services offerings. You can see the complete list of today’s Zacks #1 Rank stocks here.

However, the company’s shares have declined 46.7% year to date compared with the Zacks Computer and Technology sector’s fall of 31.8%.

SNCR expects its third-quarter revenues to decrease slightly, owing to the $2 million in revenues recognized prior to the divestiture of the DXP and Activation assets and the recognition of approximately $4 million in deferred non-cash revenues from the cloud business in the second quarter, which won’t be repeated in the current quarter.

Despite this, the company anticipates a healthy sales pipeline and strong subscriber growth. It has narrowed the full-year 2022 expectations for adjusted EBITDA to $48-$55 million compared with the previous range of $45-$55 million.

The strong tailwinds and operating momentum in the cloud business will be keeping Synchronoss well positioned for growth and profitability in 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Synchronoss Technologies, Inc. (SNCR) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance