Synopsys (SNPS) Expands Its AI-based Multi-Die Portfolio

Synopsys SNPS shares have gained 15.7% in the year-to-date period compared with the Zacks Computer - Software industry’s growth of 15%.

Synopsys’ entrance into the artificial intelligence (AI) space through partnerships with AI chip companies is driving its top line. Throughout the past year, SNPS has been focusing on improving its AI portfolio for which it has partnered with industry giants, including Intel INTC, Advanced Micro Devices AMD and Microsoft MSFT.

SNPS benefits from its deeper presence in the electronic design automation (EDA) market, driven by Synopsys.ai's EDA suite and intellectual property (IP) chips.

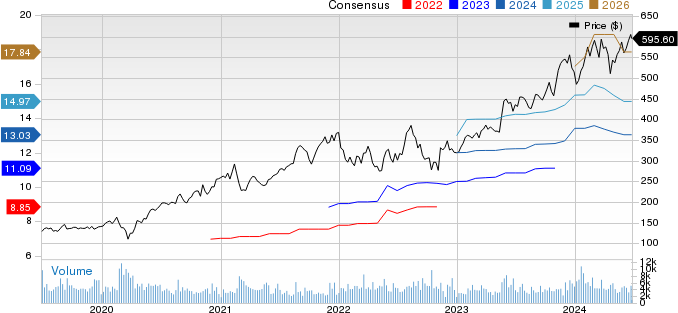

Synopsys, Inc. Price and Consensus

Synopsys, Inc. price-consensus-chart | Synopsys, Inc. Quote

SNPS recently expanded its portfolio by launching a production-ready multi-die reference flow supported by its Synopsys.ai EDA suite, IP and the 3DIC Compiler with the integration of Synopsys 3DSO.ai in the compiler.

The newly launched reference flow reduces the fabrication time of multi-die designs from silicon to the final product. The integration of the 3DIC Compiler in the design flow also improves signal, power, thermal integrity and system performance.

This new design flow will be integrated into Intel Foundry's embedded multi-die interconnect bridge packaging platform. SNPS is also producing IPs, particularly for Intel Foundry, so INTC can minimize integration risk and time-to-market.

The launch of this multi-die reference flow is expected to strengthen Synopsys’ position in the chip manufacturing space and bolster its bond with INTC. The adoption of this new design flow by Intel will drive up the sales of SNPS’ AI-based products, including Synopsys 3DSO.ai and Synopsys.ai EDA suite.

Synopsys Gains From Expanding AI Portfolio

Per a Statista report, the market size of AI is projected to witness a CAGR of 28.46% from 2024 to 2030. Synopsys is persistently increasing its product offerings to capitalize on this growing AI space.

So far in 2024, SNPS has launched hardware, including Synopsys ZeBu EP2, HAPS-100 12 system and Complete PCIe 7.0 IP solution, to support AI architecture. In the software and application space, SNPS has launched an AI-based application security assistant, Polaris Assist.

In late 2023, Synopsys launched Synopsys.ai Copilot in collaboration with Microsoft. The EDA giant integrated MSFT’s Azure OpenAI Service into its Synopsys.ai Copilot to bring in AI capabilities. SNPS also enhanced its Synopsys.ai EDA suite by integrating generative AI features. The EDA suite received AMD and Intel as its early adopters.

Stiff Competition Hurts SNPS’ Prospects

Although SNPS is persistently improving its offerings in the AI space, the company faces stiff competition that might hurt its growth prospects.

Moreover, tightening the corporate budget amid the ongoing macroeconomic challenges has added to Synopsys’ woes. A significant portion of SNPS’ revenues are derived from overseas that exposes it to currency fluctuation amid the ongoing global geopolitical volatility.

SNPS also faces concentration risk due to its reliance on a small number of clients that contribute large portions of its revenues.

All these factors might affect the performance of this Zacks Rank #3 (Hold) company in the upcoming quarters. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Synopsys’ third-quarter 2024 earnings is pegged at $3.26 per share, unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance