Tactics and Analysis, June 28, 2017 – Pound Proves Stable & Strong

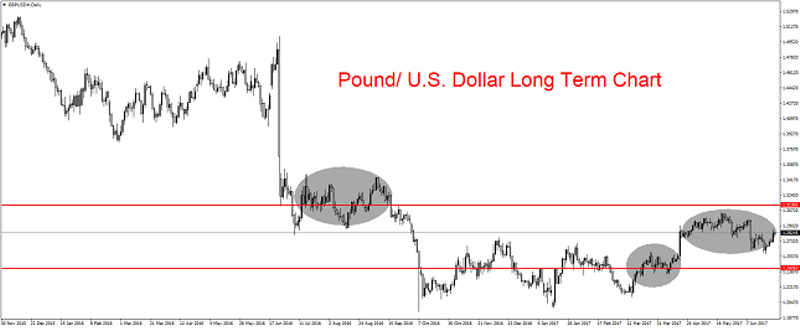

The Pound has gained early this week and finds itself near important mid-term resistance against the U.S Dollar. The British currency has recovered well since the surprise results of the U.K general election and its stability has attracted speculative buying in the short-term.

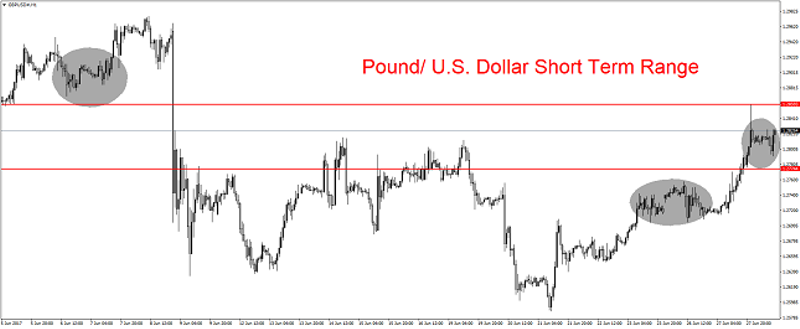

Pound’s Short-Term Recovery

The Pound has provided traders a solid price recovery early this week as it has proven stable and strong once again.

The short-term has been difficult for British currency traders as they have dealt with politics, elections and the continued bantering surrounding the Brexit mechanics. Early in June the Pound was doing very well based on the expectation Prime Minister Theresa May would win the U.K general election in a convincing manner.

However, the surprise result which weakened Theresa May sent a shiver into the forex markets and the Pound quickly lost value against the U.S Dollar. Since the election outcome, the British currency has seen a rather continuous test of its value, but it has shown the ability to stabilize and in the past two days it has seen additional buying speculation.

Mid-Term Questions for Pound

The Pound is trading near the 1.28 level as of this morning. This is an accomplishment taking into consideration the downward movement the currency faced in the immediate aftermath of the U.K election, when it was unclear if Theresa May would be able to hold onto her leadership position.

The weakened Prime Minister’s status put the Brexit talks under a cloud as the U.K’s bargaining position was questioned too. But in the past week, the Tory government has been able to mold a coalition government and it has made clear it intentions to move forward regarding its policies and negotiations with the European Union. The future result is unknown, but the Pound has recovered since the June 9th election and now finds itself within the upper realms of its mid-term range.

Mark Carney Ready for the Future

Trading in the Pound has been volatile and this will likely continue in the interim. However, economic conditions in the U.K have shown the ability to improve incrementally and this has helped bolster sentiment.

From afar the U.S Federal Reserve’s monetary policy stance is essentially known, investors are expecting one more interest rate hike from the U.S central bank this year. And after initially losing ground following the Fed’s most recent hike, the Pound has gained against the U.S Dollar.

Bank of England Governor Mark Carney made it clear yesterday that he is prepared for all scenarios regarding Brexit ramifications – the good and the bad. His straight forward approach may have also helped the Pound put in additional gains recently.

In the short term, we believe the Pound may be positive. In the mid-term and long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance