How tax-free income and the personal allowance work

Having worked hard to earn money, it’s important not to find yourself paying more tax than is absolutely necessary.

With this in mind, it’s worth familiarising yourself with the allowances available, as some income is tax-free. Make it your mission to take advantage where you can.

Here, Telegraph Money reveals the tax-free allowances you need to know about.

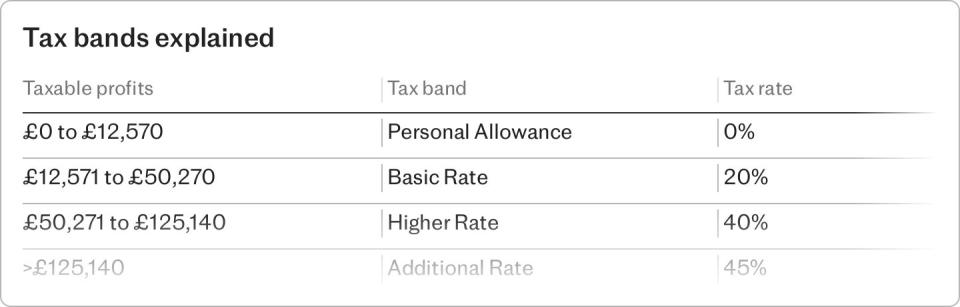

Income tax rates and personal allowances

When it comes to income tax, the amount you have to pay is determined by how much of your income falls within each tax band – and how much is above your “personal allowance”.

This is the amount you can earn before having to pay income tax. It is currently set at £12,570.

The basic rate of tax is 20pc for people earning between £12,571 and £50,270. The higher rate of 40pc is for those earning between £50,271 and £125,140.

Additional-rate taxpayers pay a rate of 45pc on anything over £125,140.

Note that the personal allowance will start to reduce if you earn more than £100,000.

For every £2 over this threshold, you’ll lose £1 of the tax-free allowance, meaning that by the time you earn £125,140 all of your income will be taxable.

What about fiscal drag?

At present, there is a lot of attention on the income tax thresholds, as not only have they been frozen since 2021, they are also set to stay at current levels until 2028.

Due to what is known as “fiscal drag”, many more people are now paying income tax for the first time – in other words, breaching the £12,570 personal allowance.

Fiscal drag is where thresholds remain frozen, while people’s inflationary wage rises mean they pay an increasing amount of tax, and may even find themselves going into higher tax bands.

According to figures from the Office for Budget Responsibility (OBR), a further four million people on relatively low incomes are being captured by the tax system for the first time.

Many more have also found themselves in the 40pc tax bracket.

The OBR says it could be an extra three million over the next five years and another 400,000 will be pushed into paying the 45pc top rate of tax.

National Insurance personal allowance

In addition to paying income tax, most people under state pension age will also have to pay National Insurance (NI) on their earnings or profits over £12,570.

Workers currently pay Class 1 contributions of 8pc on income between £12,570 and £50,270, and 2pc on income over this.

Self-employed people pay Class 4 contributions of 6pc on profits between £12,570 and £50,270, and 2pc on profits over the threshold. Those with profits of less than £6,725 can make voluntary contributions to bolster their NI record.

Under changes announced in the Budget, the main rate for Class 1 NI changed from 10pc to 8pc on April 6, 2024.

But while a 2pc cut should be something to smile about, the reality is, workers won’t necessarily feel much benefit.

Tom Selby, director of public policy at AJ Bell, said: “If thresholds remain frozen until 2028, millions of Brits will be pulled into paying more income tax through ‘fiscal drag.’

“This works in exactly the opposite direction to the NI reductions announced by the Government, not to mention the hints at further NI cuts to come.

“This is effectively a case of giving with one hand by lowering NI and taking away with the other.”

Had the personal allowance been inflation-linked since 2021 to 2022 when the freeze was implemented, it would be forecast to rise to £15,989 by 2028, according to Mr Selby.

This is nearly £3,500 higher than if the deep freeze remains.

Pension annual allowance

Topping up your pension is a great way to reduce the amount of tax you pay, but you need to be aware of the annual allowance.

This refers to the maximum you can pay into pensions in a single tax year and still get tax relief.

At present, this stands at £60,000 – or 100pc of your salary, whichever is lower.

Alice Haine, personal finance analyst at Bestinvest, said: “Note that this limit encompasses all contributions across all pension arrangements, tax relief and employer contributions.”

Dividend allowance

The tax-free dividend allowance was cut to £500 at the start of the latest tax year on April 6, 2024. It had reduced from £2,000 to £1,000 in 2023.

Dividends received above this level are taxable if not held in an Isa. Protecting your investments using pensions and Isas is essential.

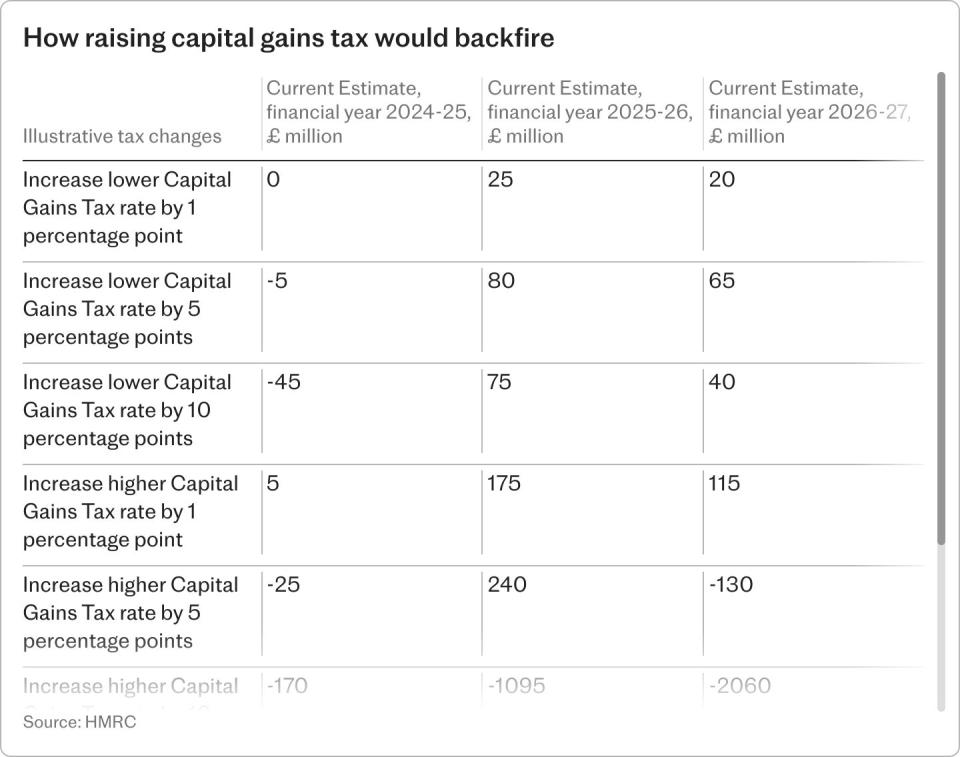

Capital gains tax personal allowance

This is the profit or “gain” someone can make after the sale of shares, valuable assets or properties that aren’t their main residence before becoming liable for capital gains tax (CGT).

As of April 2024, the tax-free allowance for CGT was chopped from £6,000 to £3,000, having already been more than halved from £12,300 to £6,000 in April 2023.

As gains above £3,000 on investments not held in an Isa are now potentially liable to tax, this has dragged more people into paying the tax, filing a tax return, and seeing tax eat into their returns.

According to AJ Bell, it means that a higher-rate taxpayer will now be paying up to £1,860 on their investments compared to a year ago, assuming they were to realise gains up to the previous £12,300 limit. A basic-rate taxpayer will now be hit with up to £930 more on their tax bill.

This makes it more important than ever to put your investments inside a tax wrapper such as an Isa or pension at the earliest opportunity, so that the tax protection kicks in.

Marriage allowance

The marriage allowance is designed to help couples by allowing one partner to transfer a portion of their personal allowance to the other, if they earn less and the recipient is a basic-rate taxpayer.

Alex Davies, founder of Wealth Club, said: “This can reduce an individual’s tax bill by allowing you to transfer £1,260 of your personal allowance to your spouse or civil partner if they earn more.”

This could reduce your tax bill by up to £252.

Ms Davies added: “To qualify, you just need to complete and return this within your annual self-assessment tax return, but if you don’t, you won’t receive it.”

Many do not claim the allowance – and end up missing out. The easiest way to get the money you are entitled to is via the online calculator at Gov.uk.

Also check out the option of being able to backdate your claim for the previous four years.

If you do not claim marriage allowance and you or your partner were born before April 1935, you may be able to claim ‘married couple’s allowance’.

To find out more about the different eligibility rules, head here.

Other HMRC personal allowances to be aware of

Make it a priority to get up to speed on all the tax allowances from HM Revenue & Customs (HMRC) and tax reliefs that apply to your finances.

Ms Haine said: “This is a good way to claw back some cash. After all, there is no point saying ‘no’ to free money – and paying tax on things you don’t need to.”

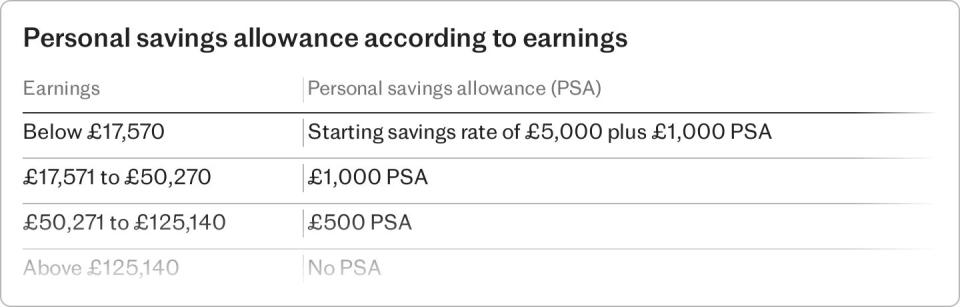

Savings interest allowance

The personal savings allowance allows basic-rate taxpayers to earn £1,000 a year in savings before they potentially have to start paying income tax on their interest.

For higher-rate taxpayers, this amount drops to £500. Additional-rate taxpayers do not get an allowance.

When the allowance was introduced back in 2016, it resulted in many savers no longer having to pay tax on their savings, but right now, it’s a very different story.

Anna Bowes from Savings Champion, said: “As interest rates have risen significantly over the last few years, more and more people are breaching their personal savings allowance with far smaller amounts of savings.”

Isas are totally tax-free – so make use of these to protect your savings from the taxman.

Note there’s extra help for those on lower incomes, too.

The savings starting rate can offer an additional £5,000 to protect savings interest – you’ll get this full amount if you earn less than the £12,570 personal allowance.

It will then reduce by £1 for each £1 you earn over it.

Blind Person’s Allowance

This offers an additional personal tax allowance of £3,070 – plus the usual £12,570 – if you or your spouse or civil partner are blind or have severely impaired sight.

In other words, you get this amount in addition to the personal allowance.

As with the marriage allowance, any unused blind person’s allowance can be transferred to a spouse or civil partner.

Note that you do not receive it automatically; you need to claim it by contacting HMRC.

Maintenance Payment Relief

If you pay maintenance to a former spouse or civil partner, it’s worth being aware of this relief as it reduces your income tax.

It is worth 10pc of the maintenance you pay to your ex, up to a maximum of £428 a year.

Find out more here.

Property Allowance

This allowance is a tax exemption of up to £1,000 a year for those who get income from land or property.

With this relief, if your annual gross property income is £1,000 or less, you do not need to tell HMRC about the income.

If it’s above this level, you do have to declare it.

Rent-a-room scheme

If you let out a room to a lodger in the home you live in, you can benefit from the £7,500 “rent-a-room” scheme meaning you don’t have to pay tax on this amount.

This exemption is automatic if you earn less than £7,500, making this a simple way to reduce your tax burden.

Trading allowance

This is a tax exemption of up to £1,000 a year for individuals with income from either self-employment, or casual services (such as babysitting or gardening) – or hiring personal equipment (such as power tools).

Once again, if you earn less than £1,000, there’s no requirement to tell HMRC.

FAQ

What are my allowances if I am paid a pension?

If you receive a pension, you have the same personal tax allowance as everyone else, set at £12,570.

While there’s no longer a lifetime allowance on your total pension savings, there are three new pension allowances you should know about.

These includes the lump sum allowance, lump sum and death benefit allowance and overseas transfer allowance.

What about the state pension?

While state pension income is taxable, you only have to pay once your total income is above the personal allowance (currently £12,570).

With the full-flat rate state pension currently at just over £11,500 a year and the personal allowance frozen at £12,570, the state pension will take up the lion’s share of that tax-free allowance.

What is the meaning of personal allowances?

A personal allowance is the amount of money you’re allowed to earn each tax year in the UK before you start paying income tax.

It is income which is tax-free, and applies to your individual income.

For the 2024-25 tax year, this allowance stands at £12,570. Earn less than this, and you usually won’t be required to pay any tax.

How do I qualify for personal allowance in the UK?

The allowance is available to most people who are resident in the UK.

It is also available to some who are not resident in the UK – but conditions will apply.

If your income is more than £100,000, your personal allowance will reduce by £1 for every £2 you earn over this threshold.

Can you use “unused” personal allowance?

You can when it comes to your pension allowance.

If you have already maximised the current year’s pension allowance you can mop up any unutilised allowances for the previous three tax years.

But you need to tread carefully, as there are some rules you need to abide by when carrying forward.

Read more here.

Gary Smith, director of financial planning at wealth manager Evelyn Partners, said: “The ability to carry forward can be extremely useful for those looking to catch up on pension contributions because they want to give their pot a late boost before retirement.”

Can my husband use my personal allowance?

Those who are married or in civil partnerships can give part of their personal allowance to their partner by using the marriage allowance.

The lower earner, who must earn less than the personal allowance, must apply to HMRC to ask that any unused personal allowance can be transferred to their spouse, who must be a basic-rate taxpayer.

The maximum that can be transferred in the 2024 to 2025 tax year is £1,260.

Yahoo Finance

Yahoo Finance