Tenet (THC) Q4 Earnings Beat on Ambulatory Care Strength

Tenet Healthcare THC reported fourth-quarter 2022 adjusted earnings of $1.96 per share, which surpassed the Zacks Consensus Estimate by 54.3%. However, the bottom line dropped 27.4% year over year.

Net operating revenues improved 2.6% year over year to $4,990 million in the quarter under review. The top line beat the consensus mark of $4,905 by 1.7%.

The better-than-expected fourth quarter results were supported by strong performance of the Ambulatory Care business and contractual rate increases in the Conifer unit. The positives were partially offset by higher operating costs, and increased premium pay and decreased grant incomein Hospital Operations.

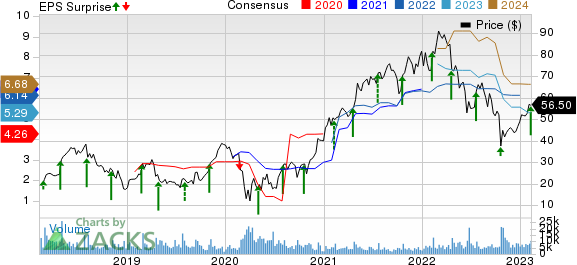

Tenet Healthcare Corporation Price, Consensus and EPS Surprise

Tenet Healthcare Corporation price-consensus-eps-surprise-chart | Tenet Healthcare Corporation Quote

Q4 Performance

Adjusted net income from continuing operations of Tenet Healthcare of $213 million slid 27.5% year over year. Adjusted EBITDA dipped 11.8% year over year to $897 million. While Adjusted EBITDA was in line with the company’s expectation, adjusted net income outperformed the same.

Operating expenses of $4,560 million escalated 5.1% year over year, mainly due to increased salaries, supplies and other expenses.

Segmental Details

Hospital Operations and Other - Net operating revenues in the segment totaled $3,840 million in the fourth quarter, which declined 1.8% year over year. Yet, the reported figure beat the Zacks Consensus Estimate of $3,774 million by 1.74%. The results reflected lower volume related to covid, which was partially offset by improved admissions and pricing yields.

On a same-hospital basis, net patient service revenues declined 1.66% year over year to $3,486 million due to lower covid volumes and acuity, which were partially offset by better pricing yield.

Adjusted EBITDA of $400 million fell 27.5% year over year in the quarter under review but surpassed the consensus mark of $354 million by 13.5%. Increased premium pay as a result of the pandemic, coupled with elevated contract labor costs and decreased grant income, dampened the metric’s prospects.

Ambulatory Care - The segment reported net operating revenues of $933 million, which climbed 25.7% year over year on the back of growing service lines, better pricing yield and additional revenues linked with the SurgCenter Development acquisition. The figure surpassed the consensus mark of $903 million by 3.31%.

Adjusted EBITDA rose 9.7% year over year to $407 million in the fourth quarter and outpaced the consensus mark of $334 million by a whopping 21.8%.

Conifer - Net operating revenues improved 0.6% year over year to $326 million, thanks to contractual rate increases and new business growth. However, the figure lagged the Zacks Consensus Estimate of $340 million by 4.2%.

Adjusted EBITDA of $90 million dropped 4.25% year over year due to an increase in other operating expenses. However, the metric beat the consensus mark of $82 million by 10.16%.

Financial Position (as of Dec 31, 2022)

Tenet Healthcare exited 2022 with cash and cash equivalents of $858 million, which plunged from $2,364 million at 2021-end. Total assets of $27,156 million fell from $27,579 million at 2021-end.

Long-term debt, net of the current portion, amounted to $14,934 million, down from $15,511 as of Dec 31, 2021. Short-term debt totaled $145 million at 2022-end.

THC had no outstanding borrowings under its $1.5-billion line of credit as of 2022-end.

Total shareholders’ equity of $1,142 million increased from $1,028 at 2021-end mainly due to narrowing accumulated deficit and other comprehensive losses.

Net cash from operating activities increased 18% year over year to $421 million in December 2022.Free cash flows were recorded at $131 million, up 147% year over year due to an increase in net cash from operating activities and reduced expenditure on the purchase of plants and equipment.

Share Repurchase Update

THC bought back 5.9 million shares of management approved $1-billion share buyback program for $250 million.It had $750 million authorization remaining, to be completed by 2024-end.

2023 Q1 Outlook

Net operating revenues are estimated to be between $4,700 million and $4,900 million.

Adjusted EBITDA is projected within $750-$800 million.

Adjusted net income from continuing operations is forecasted to be between $110 million and $135 million.

Adjusted earnings per share (EPS) is currently estimated within $1.00-$1.23.

2023 Outlook

Net operating revenues are estimated to be between $19,700 million and $20,100 million, compared to $19,174 million in 2022. Adjusted EBITDA is projected within $3,160-$3,360 million. This estimate is less than $3,469 million of Adjusted EBITDA in 2022. Adjusted EBITDA margin is anticipated in the band of 16-16.7% for 2023. This figure is a 7.3% drop from the 2022 margin of 18.9%.

Adjusted EPS is currently projected within $4.68-$5.85. This figure is much lower than $6.80 EPS witnessed in 2022. Net cash provided by operating activities is estimated to be between $1,700 million and $2,000 million. Free cash flow is expected from $1,075-$1,325 million. Capital expenditures are projected to be between $625 million and $675 million.

Zacks Rank

Tenet Healthcare currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported fourth-quarter results so far, the bottom-line results of Humana Inc. HUM, Molina Healthcare Inc. MOH beat their respective Zacks Consensus Estimate, while Centene Corporation’s CNC bottom line missed the same.

Humana reported fourth-quarter 2022 adjusted EPS of $1.62, beating the Zacks Consensus Estimate by 11%. The bottom line soared 30.6% year over year. HUM’s revenues improved 6.6% year over year to $22,439 million but fell short of the consensus mark by a whisker. Total premiums of Humana amounted to $21,275 million, which grew 7.3% year over year in the quarter under review.

Molina Healthcare reported fourth-quarter 2022 adjusted earnings of $4.10 per share, which beat the Zacks Consensus Estimate by a whisker. The bottom line soared 42.4% year over year. MOH’s total revenues amounted to $8,223 million, which rose 11% year over year in the quarter under review and beat the consensus mark by 4.6%. Premium revenues improved 10.5% year over year to $7,917 million in the fourth quarter.

Centene Corporation reported fourth-quarter 2022 adjusted earnings per share of 86 cents, which missed the Zacks Consensus Estimate by 1.2% and fell 14.9% year over year. CNC’s revenues of $35,561 million improved 9% year over year in the quarter under review but lagged the consensus mark by a whisker. Premiums of $31,884 million rose 10.4% year over year in the quarter under review, while service revenues climbed 3.7% year over year to $1,669 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance