Tesco sales rise with a boost from Booker

Tesco’s acquisition of Booker helped boost its overall sales at the start of the year, offsetting a slight slowdown in its UK supermarkets, which were affected by the snowy weather.

Group like-for-like sales at Tesco, which strip out new shops, rose 1.8pc in the 13 weeks to May 26, marking a 10th consecutive quarter of growth, and came despite falling sales in Asia and Europe.

Booker, the wholesaler and distributor it bought last year, reported growth of 14.3pc, partly on the back of new business wins.

Tesco’s core UK business suffered a minor slowdown in growth, however, due in part to the Beast from the East weather front that battered the country at the beginning of March. UK like-for-like sales growth was 2.1pc, down from 2.3pc in the previous quarter.

The supermarket has been busy overhauling its own-brand ranges and began cutting prices on fresh food towards the end of the quarter in a sign that the grocery market remains highly competitive.

Boss Dave Lewis declared himself “delighted” with the progress made integrating Booker, which it bought for £3.7bn.

The company has begun selling select Booker products in its stores and is now sending out Booker products from one of its distribution centres.

Mr Lewis said that inflation had eased, dropping from just over 3pc in the second half of last year to between 1.8pc and 2.4pc.

He described the number of retail failures this year as "unprecedented". Toys R Us and Maplin have collapsed while House of Fraser, Mothercare and New Look plan to close swathes of shops.

“Food has been resilient, and the closures that we have seen are in categories which are not food focused, but the pressures are there for all to see," he added.

Laith Khalaf of Hargreaves Lansdown said: "The recently acquired Booker business flaunted a sparking performance in the first few months of the year, and is already looking like a nice little growth engine for Tesco.

"Booker is now benefiting from the Tesco distribution network, a good example of how Dave Lewis intends to wring £200m of annual synergies out of combining the two businesses."

Analysts at Jefferies hailed the numbers as "an assured update across the board", with Tesco having made an "upbeat start" to the year.

Earlier this year the retailer announced the closure of Tesco Direct, its Amazon competitor that allows third parties to sell goods through Tesco online. The retailer said this would result in a “simpler online experience for customers”. The service will close on July 9.

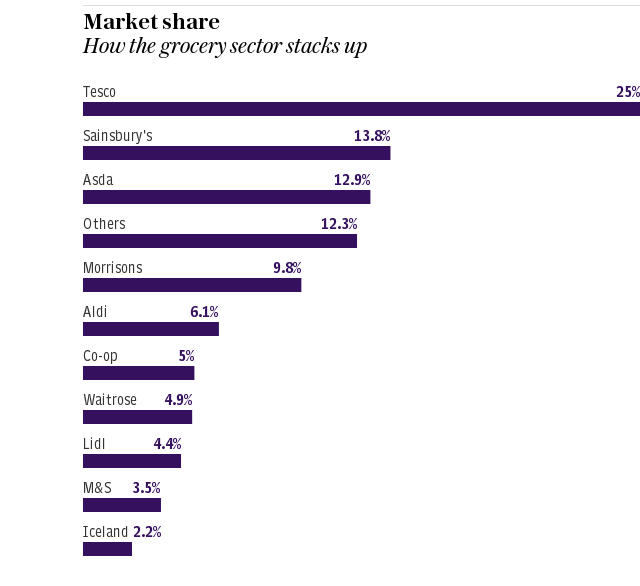

Since Tesco bought Booker, Sainsbury's and Asda have responded by announcing a mega-merger of their stores. The competition watchdog is to review the plan, which would create a grocer bigger than Tesco.

Tesco shares rose 2.1pc in lunchtime trade to 255p. It will hold its annual general meeting at 2pm today.

Yahoo Finance

Yahoo Finance