Texas Instruments (TXN) Q1 Earnings Beat, Revenues Fall Y/Y

Texas Instruments TXN reported first-quarter 2023 earnings of $1.85 per share, beating the Zacks Consensus Estimate by 5.1%. Also, the figure is near the higher end of the management’s guided range of $1.64-$1.90.

However, the bottom line declined 21% year over year and 13.1% from the previous quarter.

TXN reported revenues of $4.38 billion, which surpassed the Zacks Consensus Estimate of $4.36 billion. Further, the figure was within the management’s guided range of $4.17-$4.53 billion.

TXN decreased 11% from the year-ago quarter’s level and 6% sequentially. This was attributed to a weak demand environment. The company witnessed sluggishness in its Analog and Other segments.

On a sequential basis, Texas Instruments suffered from widespread weakness in the personal electronics, communication equipment and enterprise systems markets.

It experienced sequential growth in the automotive end market, which remains a positive.

Also, Embedded Processing segment delivered improved performance on a year-over-year basis, which was another positive.

We note that Texas Instruments’ efficient manufacturing strategies and consistent returns to shareholders are likely to instill investors’ optimism on the stock. Its substantial investments in growth avenues and competitive advantages are other positives.

Shares of Texas Instruments have gained 3.3% in the year-to-date period, underperforming the industry’s growth of 51.6%.

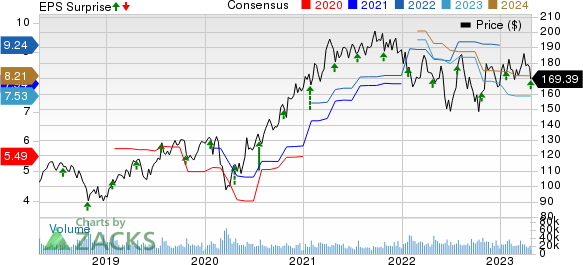

Texas Instruments Incorporated Price, Consensus and EPS Surprise

Texas Instruments Incorporated price-consensus-eps-surprise-chart | Texas Instruments Incorporated Quote

Segments in Detail

Analog: Revenues of $3.3 billion were generated from the segment (75.1% of total revenues), down 14% from the year-ago quarter’s level.

Embedded Processing: Revenues summed up to $832 million (19% of total revenues), up 6% year over year.

Other: Revenues totaled $258 million (5.9% of total revenues). The figure was down 16% from the prior-year quarter’s level.

Operating Details

Texas Instruments’ gross margin of 65.4% contracted 480 basis points (bps) from the year-ago quarter’s level.

As a percentage of revenues, selling, general and administrative expenses expanded 220 bps year over year to $474 million in the reported quarter.

Research and development expenses of $455 million expanded 250 bps from the year-ago quarter’s level as a percentage of revenues.

The operating margin was 44.2%, which contracted 800 bps from the prior-year quarter’s number.

Balance Sheet & Cash Flow

As of Mar 31, 2023, the cash and short-term investment balance was $9.5 billion compared with $9.1 billion as of Dec 31, 2022.

At the end of the reported quarter, TXN had a long-term debt of $9.6 billion compared with $8.2 billion in the prior quarter.

Current debt was $500 million at the end of first-quarter 2023, which remained flat compared with the previous quarter.

Texas Instruments generated $1.16 billion of cash from operations, down from $2.04 billion in the previous quarter.

Capex was $982 million in the reported quarter. Free cash flow stood at $178 million.

Texas Instruments paid out dividends worth $1.12 billion in the reported quarter. TXN repurchased shares worth $103 million.

Guidance

For second-quarter 2023, Texas Instruments expects revenues between $4.17 billion and $4.53 billion. The midpoint of this range is below the Zacks Consensus Estimate of $4.42 billion.

Texas Instruments expects earnings within $1.62-$1.88 per share. The Zacks Consensus Estimate for the same is pegged at $1.81 per share.

Zacks Rank and Stocks to Consider

Currently, Texas Instruments carries a Zacks Rank #4 (Sell).

Investors interested in the broader Zacks Computer & Technology sector may consider some better-ranked stocks like Salesforce CRM, Arista Networks ANET and Analog Devices ADI. While Salesforce sports a Zacks Rank #1 (Strong Buy), Arista Networks and Analog Devices carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Salesforce’s shares have risen 43.8% in the year-to-date period. CRM’s long-term earnings growth rate is currently anticipated to be 16.75%.

Arista Networks’ shares have risen 26.5% in the year-to-date period. ANET’s long-term earnings growth rate is currently projected to be 14.17%.

Analog Devices’ shares have gained 10.5% in the year-to-date period. ADI’s long-term earnings growth rate is currently expected to be 10.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance