We Think Exel Composites Oyj (HEL:EXL1V) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Exel Composites Oyj (HEL:EXL1V) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Exel Composites Oyj

What Is Exel Composites Oyj's Debt?

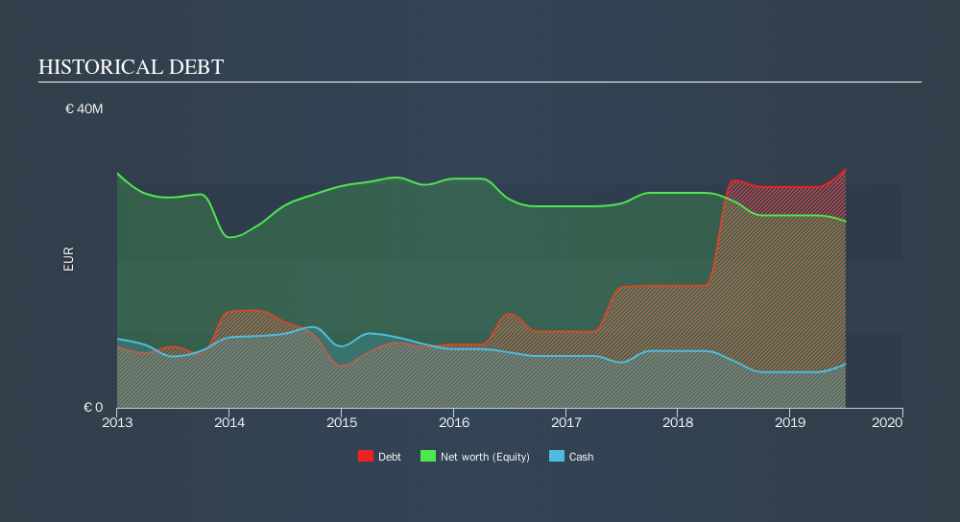

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Exel Composites Oyj had €32.0m of debt, an increase on €30.5m, over one year. However, it also had €5.88m in cash, and so its net debt is €26.1m.

A Look At Exel Composites Oyj's Liabilities

Zooming in on the latest balance sheet data, we can see that Exel Composites Oyj had liabilities of €43.9m due within 12 months and liabilities of €14.2m due beyond that. Offsetting this, it had €5.88m in cash and €21.7m in receivables that were due within 12 months. So it has liabilities totalling €30.5m more than its cash and near-term receivables, combined.

Exel Composites Oyj has a market capitalization of €53.3m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Exel Composites Oyj has a debt to EBITDA ratio of 3.6 and its EBIT covered its interest expense 4.9 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Importantly, Exel Composites Oyj's EBIT fell a jaw-dropping 42% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Exel Composites Oyj can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Exel Composites Oyj created free cash flow amounting to 6.2% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Mulling over Exel Composites Oyj's attempt at (not) growing its EBIT, we're certainly not enthusiastic. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. Overall, it seems to us that Exel Composites Oyj's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. While Exel Composites Oyj didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance