Third Avenue Value Fund Boosts Portfolio with Strategic Additions in Q2 2024

Harbour Energy PLC Emerges as a Prominent New Holding with a 2.8% Stake

Founded by the legendary Martin J. Whitman in 1990, the Third Avenue Value Fund (Trades, Portfolio) is renowned for its value-oriented investment strategy. The fund focuses on global, all-cap equities and opportunistic investments in credit securities, aiming for long-term capital appreciation. Investments are meticulously chosen based on financial strength, potential to compound NAV, and significant discounts to the fund's conservative NAV estimates. This approach has consistently aimed to uncover contrarian and special-situation opportunities across diverse sectors and geographies.

Summary of New Buys

During the second quarter of 2024, Third Avenue Value Fund (Trades, Portfolio) expanded its portfolio by adding three new stocks. Notably:

Harbour Energy PLC (LSE:HBR) was the largest new addition with 5,506,445 shares, representing 2.8% of the portfolio and valued at 19.68 million.

Close Brothers Group PLC (LSE:CBG) followed, comprising 2,184,235 shares or approximately 1.77% of the portfolio, with a total value of 12.43 million.

The third addition was Paltac Corp (TSE:8283), holding 226,500 shares, accounting for 0.97% of the portfolio and valued at 6.86 million.

Key Position Increases

The fund also strategically increased its stakes in four stocks, with significant adjustments in:

Genting Singapore Ltd (SGX:G13), which saw an addition of 6,104,800 shares, bringing the total to 23,698,500 shares. This adjustment increased the share count by 34.7%, impacting the portfolio by 0.58% and valued at S$15.82 million.

CK Hutchison Holdings Ltd (HKSE:00001) also saw an increase of 575,175 shares, bringing the total to 4,135,655 shares, a 16.15% increase in share count, valued at HK$20.09 million.

Key Position Reductions

Conversely, the fund reduced its positions in three stocks, with significant reductions in:

Ultrapar Participacoes SA (BSP:UGPA3) by 2,231,725 shares, resulting in a 43.45% decrease in shares and a 2.05% impact on the portfolio. The stock traded at an average price of R$28.42 during the quarter and has seen a return of -20.61% over the past three months and -15.58% year-to-date.

Tidewater Inc (NYSE:TDW) was reduced by 70,999 shares, a 15.89% reduction, impacting the portfolio by 0.77%. The stock traded at an average price of $83.31 during the quarter and has returned 1.10% over the past three months and 28.69% year-to-date.

Portfolio Overview

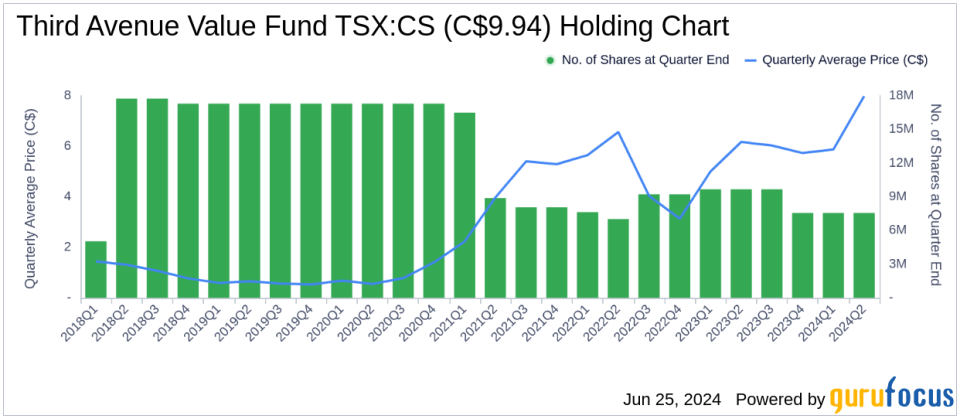

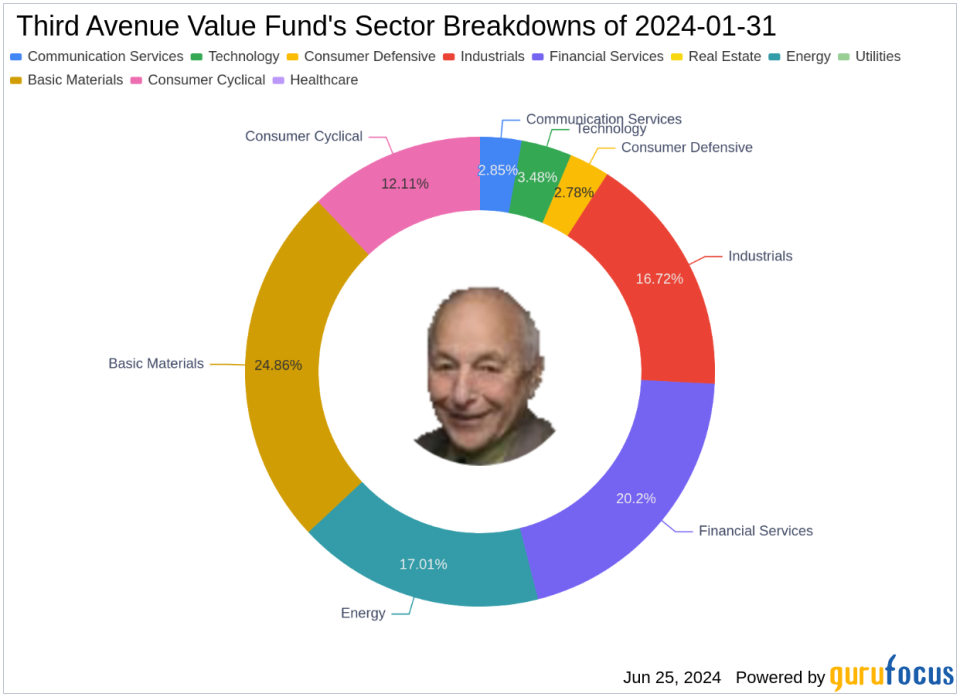

As of the second quarter of 2024, Third Avenue Value Fund (Trades, Portfolio)'s portfolio included 32 stocks. The top holdings were 7.44% in Capstone Copper Corp (TSX:CS), 6.47% in Warrior Met Coal Inc (NYSE:HCC), 4.99% in Deutsche Bank AG (XTER:DBK), 4.91% in Tidewater Inc (NYSE:TDW), and 4.57% in Bayerische Motoren Werke AG (XTER:BMW). The holdings are predominantly concentrated in eight industries: Basic Materials, Financial Services, Energy, Industrials, Consumer Cyclical, Technology, Consumer Defensive, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance