Thoma Bravo Nears Deal for NextGen Healthcare

(Bloomberg) -- Thoma Bravo is in advanced talks to buy health records software company NextGen Healthcare Inc., according to people familiar with the matter.

Most Read from Bloomberg

Apple’s 2-Day Slide Nears $200 Billion on China IPhone Curbs

Trudeau Says There’s No Room for Political Rapprochement With China

Soaring US Dollar Raises Alarm as China, Japan Escalate FX Pushback

Traders Shun Risk Amid Apple’s $190 Billion Rout: Markets Wrap

The private equity firm could announce a deal as soon as this week for NextGen, said the people, who asked to not be identified because the matter isn’t public. No final decision has been made and discussions could still fall through, the people added. NextGen had drawn interest from several other buyout firms before talks accelerated with Thoma Bravo, according to the people.

Representatives for Thoma Bravo and NextGen didn’t immediately respond to requests for comment.

NextGen rose 6.2% to close at $19.33 in New York trading Friday, giving it a market value of about $1.3 billion.

Originally based in Atlanta, Georgia, NextGen provides cloud-based technology services that health-care providers use to manage patients’ electronic health records, among other services, according to its annual report. Its larger competitor Cerner Corp. sold itself to Oracle Corp. in a $28 billion deal in 2022.

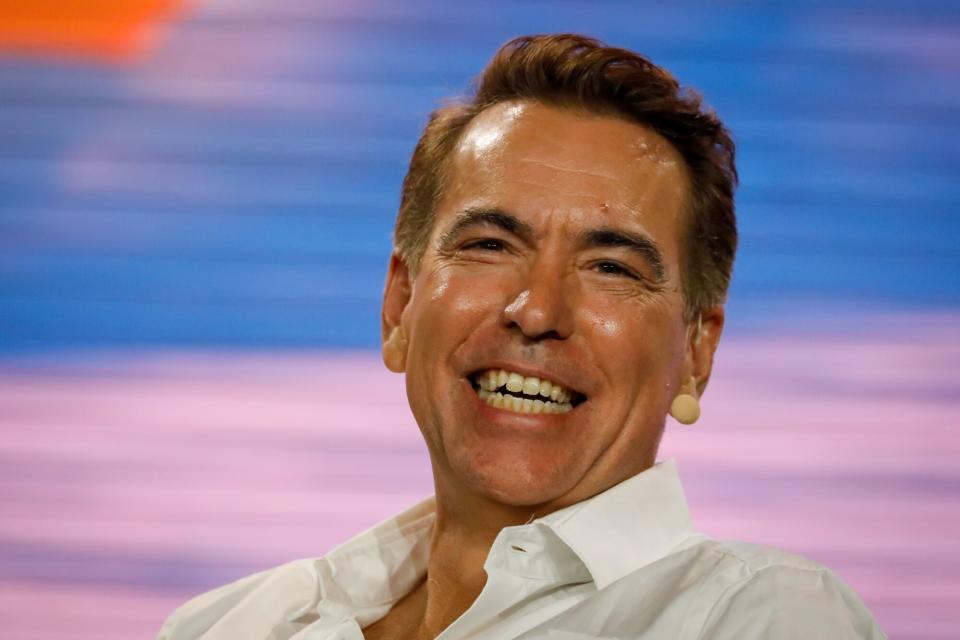

Led by Managing Partner Orlando Bravo, Thoma Bravo is one of the most active technology investors among private equity firms. It agreed in June to sell financial software maker Adenza to Nasdaq Inc. for $10.5 billion. In July, Thoma Bravo inked a $3.6 billion deal to sell Imperva, another software maker, to Thales SA.

Reuters reported last month that NextGen was exploring a sale.

(Adds more details from second paragraph.)

Most Read from Bloomberg Businessweek

Huawei’s Surprise Phone Gives Ammo to Biden Doubters on China

Lyme Disease Has Exploded, and a New Vaccine Is (Almost) Here

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance