Those Who Purchased Medica Group (LON:MGP) Shares A Year Ago Have A 14% Loss To Show For It

Medica Group Plc (LON:MGP) shareholders should be happy to see the share price up 13% in the last quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 14% in the last year, significantly under-performing the market.

See our latest analysis for Medica Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Medica Group share price fell, it actually saw its earnings per share (EPS) improve by 8.4%. It's quite possible that growth expectations may have been unreasonable in the past. The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

Given the yield is quite low, at 1.7%, we doubt the dividend can shed much light on the share price. Medica Group managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

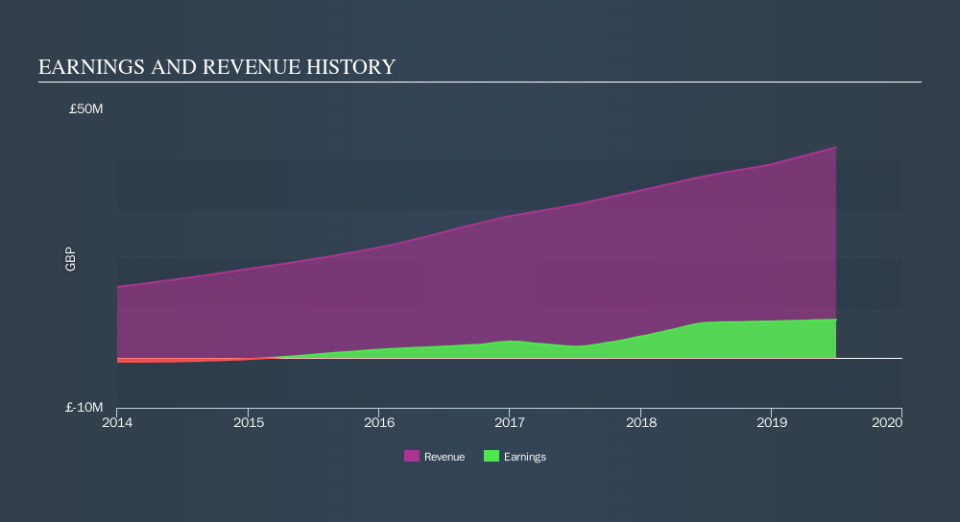

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Medica Group has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Given that the market gained 2.9% in the last year, Medica Group shareholders might be miffed that they lost 13% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 13%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. If you would like to research Medica Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Medica Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance