Three Growth Stocks With Insider Ownership Exceeding 22%

As global markets exhibit varied performance with the S&P 500 reaching new highs and modest gains across major indices, investors are keenly observing market trends and economic indicators. In this context, examining growth stocks with substantial insider ownership might offer valuable insights, as high insider stakes often signal confidence in the company's future prospects amidst current market dynamics.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Gaming Innovation Group (OB:GIG) | 20.2% | 36.2% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Here's a peek at a few of the choices from the screener.

GPS Participações e Empreendimentos

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GPS Participações e Empreendimentos S.A. operates in Brazil, offering a range of services including facilities management, security, logistics, and engineering, with a market capitalization of R$11.80 billion.

Operations: The company generates revenue through services in facilities management, security, logistics, utility engineering, industrial service, catering, and infrastructure.

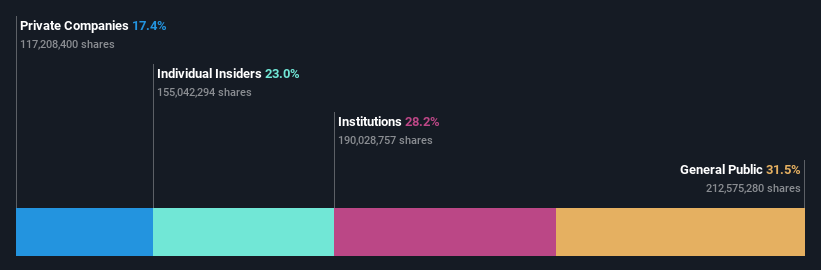

Insider Ownership: 23%

GPS Participações e Empreendimentos S.A. demonstrated a solid financial performance with its net income rising from BRL 120.86 million to BRL 137.67 million in the first quarter of 2024, reflecting an earnings growth of 21.1% over the past year. The company's revenue and earnings are expected to outpace the Brazilian market, with forecasts suggesting a revenue increase of 19.7% annually and earnings growth at 17.7% per year, compared to market averages of 7.2% and 14.2%, respectively. Despite these optimistic projections, GPS3's anticipated annual profit growth does not reach the high threshold often sought by investors looking for rapid expansion.

Dohome

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dohome Public Company Limited operates in Thailand, focusing on the retail and wholesale of construction materials, office equipment, and household products, with a market capitalization of approximately THB 33.26 billion.

Operations: The company generates approximately THB 30.73 billion from the retail and wholesale of construction materials, along with office and household appliances.

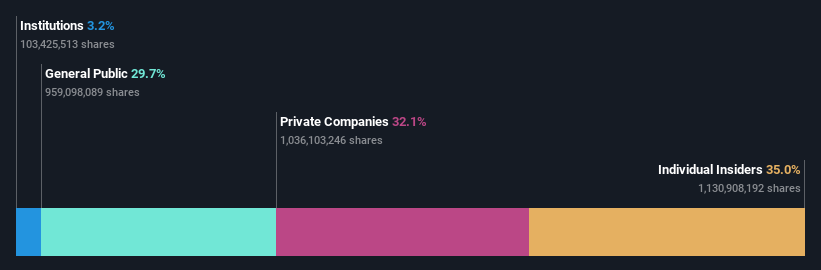

Insider Ownership: 35%

Dohome's recent financial performance shows a slight decline in quarterly revenue and net income, with sales dropping from THB 8,375.16 million to THB 7,876.66 million year-over-year and net income decreasing to THB 244.33 million. Despite this downturn, the company's earnings are expected to grow significantly at an annual rate of 33.5%, outpacing the Thai market's average growth rate of 14.7%. However, concerns arise as its interest payments are not well covered by earnings and its Return on Equity is forecasted to be low at 9.5% in three years' time.

Unlock comprehensive insights into our analysis of Dohome stock in this growth report.

Our expertly prepared valuation report Dohome implies its share price may be too high.

Beijing Wantai Biological Pharmacy Enterprise

Simply Wall St Growth Rating: ★★★★★★

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. is a biopharmaceutical company focusing on the development, manufacturing, and sale of diagnostic reagents and vaccines, with a market capitalization of CN¥82.94 billion.

Operations: The company generates its revenue from the development, manufacturing, and sale of diagnostic reagents and vaccines.

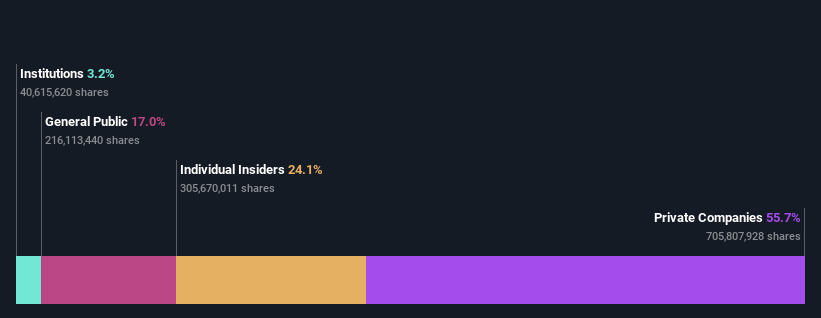

Insider Ownership: 24.1%

Beijing Wantai Biological Pharmacy Enterprise has experienced a sharp decline in quarterly and annual revenue and net income, with recent figures showing significant drops from previous years. Despite this downturn, the company's earnings are expected to grow by 62.98% annually over the next three years, outpacing the average growth rate in China. However, profit margins have decreased notably, and there is no substantial insider trading activity reported in the past three months to indicate strong insider confidence.

Make It Happen

Investigate our full lineup of 1457 Fast Growing Companies With High Insider Ownership right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BOVESPA:GGPS3 SET:DOHOME and SHSE:603392.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance