Three Japanese Exchange Growth Companies With High Insider Ownership And 15% Earnings Growth

Amidst a backdrop of mixed performance in global markets, Japan's stock markets have shown resilience with the Nikkei 225 Index eking out gains. This stability is particularly noteworthy as investors navigate through varying economic signals and central bank policies. In such a market environment, growth companies with high insider ownership in Japan present an interesting focus, as these firms often demonstrate alignment between management’s interests and those of shareholders, potentially leading to robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 80.9% |

We'll examine a selection from our screener results.

DIP

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DIP Corporation, a labor force solution company in Japan, offers personnel recruiting services with a market capitalization of approximately ¥141.38 billion.

Operations: The company specializes in providing personnel recruiting services across Japan.

Insider Ownership: 38.6%

Earnings Growth Forecast: 15% p.a.

DIP Corporation, a Japanese firm with substantial insider ownership, has recently intensified its shareholder value efforts through an aggressive share repurchase program. While trading at 59.7% below estimated fair value and exhibiting a 14.1% earnings growth over the past year, DIP's revenue growth projections of 11.3% per year are modest compared to some market leaders but still outpace the broader Japanese market's average of 4.1%. However, concerns linger over its unstable dividend track record despite recent dividend increases and ongoing executive board enhancements aimed at bolstering strategic initiatives like AI services expansion.

Dive into the specifics of DIP here with our thorough growth forecast report.

Our expertly prepared valuation report DIP implies its share price may be lower than expected.

PeptiDream

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥292.52 billion.

Operations: The company primarily generates revenue through its biopharmaceutical projects aimed at developing innovative therapeutic peptides and small molecule drugs.

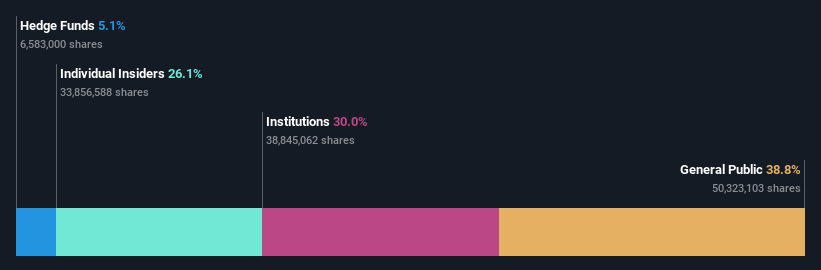

Insider Ownership: 26.1%

Earnings Growth Forecast: 22.3% p.a.

PeptiDream, a Japanese biotech firm, is advancing its growth trajectory with high insider ownership and strategic alliances, notably with Novartis for peptide discovery. Recent clinical studies target renal cell carcinoma diagnostics, enhancing its innovative edge. Despite a volatile share price and lower profit margins year-over-year, the company's earnings are expected to grow by 22.3% annually. PeptiDream's recent upward revision in earnings guidance underscores its potential amid operational challenges.

Click here to discover the nuances of PeptiDream with our detailed analytical future growth report.

Our valuation report unveils the possibility PeptiDream's shares may be trading at a premium.

CyberAgent

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CyberAgent, Inc. operates in media, internet advertising, gaming, and investment development primarily in Japan, with a market capitalization of approximately ¥493.27 billion.

Operations: The firm's operations span across media, internet advertising, and gaming sectors.

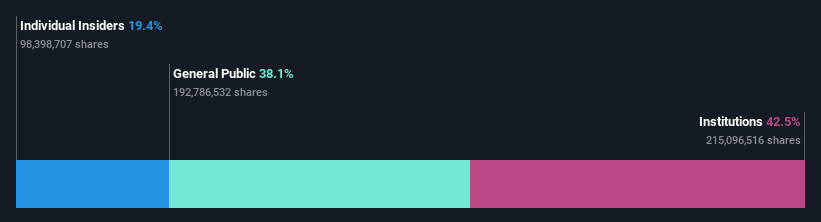

Insider Ownership: 19.4%

Earnings Growth Forecast: 21.3% p.a.

CyberAgent, a Japanese digital advertising firm, exhibits robust growth prospects with high insider ownership. Despite its highly volatile share price recently, the company's earnings have grown by 23.5% over the past year and are expected to continue expanding at 21.27% annually. This growth rate surpasses the Japanese market average significantly. However, concerns linger due to large one-off items affecting financial results and a forecast low Return on Equity of 14.2% in three years' time.

Click to explore a detailed breakdown of our findings in CyberAgent's earnings growth report.

The valuation report we've compiled suggests that CyberAgent's current price could be inflated.

Make It Happen

Get an in-depth perspective on all 100 Fast Growing Japanese Companies With High Insider Ownership by using our screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:2379 TSE:4587 and TSE:4751.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance