Three Swiss Dividend Stocks Offering Up To 5.4% Yield

The Switzerland market recently demonstrated resilience, gaining strength amid optimism for potential interest rate cuts by major central banks. The benchmark SMI index notably climbed, reflecting a robust appetite for Swiss equities. In such a buoyant market environment, dividend stocks can be particularly appealing, offering investors steady income streams alongside the potential for capital appreciation.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.43% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.14% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.32% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.41% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.80% | ★★★★★☆ |

EFG International (SWX:EFGN) | 4.20% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.12% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.13% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

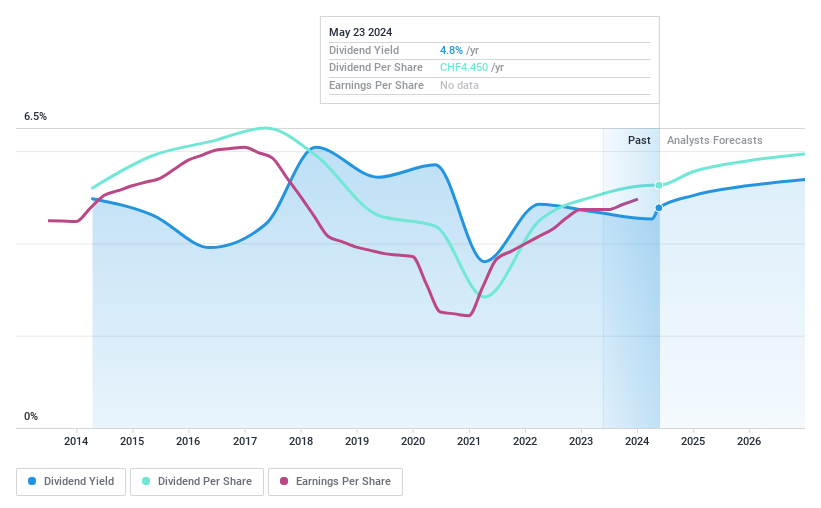

Burkhalter Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burkhalter Holding AG specializes in providing electrical engineering services to the construction industry across Switzerland, with a market capitalization of CHF 985.06 million.

Operations: Burkhalter Holding AG generates CHF 1.16 billion in revenue primarily from its electrical engineering services tailored for the construction sector.

Dividend Yield: 4.8%

Burkhalter Holding AG's recent financial performance shows a significant revenue increase to CHF 1.13 billion and net income rise to CHF 51.87 million in 2023, with earnings per share at CHF 4.95. Despite a high payout ratio of 89.9%, both earnings and cash flows adequately cover the dividend payments, which are set at CHF 2.225 for regular and special distributions each, slated for May-16-2024 distribution. However, the company's dividend history over the past decade reveals instability and unreliability in its growth trajectory, reflecting volatility that might concern conservative dividend investors seeking steady returns.

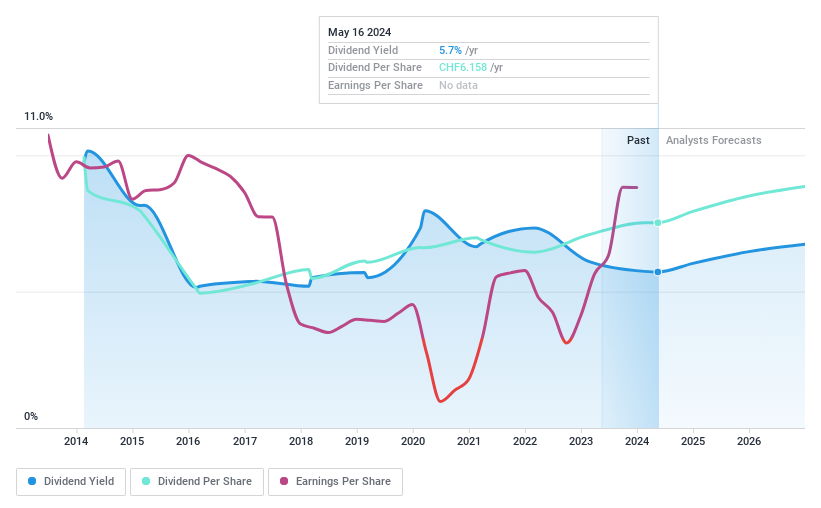

St. Galler Kantonalbank

Simply Wall St Dividend Rating: ★★★★★★

Overview: St. Galler Kantonalbank AG operates as a cantonal bank offering banking products and services primarily to residents and small to mid-sized businesses in the Canton of St. Gallen, with a market capitalization of CHF 2.63 billion.

Operations: St. Galler Kantonalbank AG generates its revenue by providing banking services tailored to the needs of residents and small to mid-sized enterprises in the Canton of St. Gallen.

Dividend Yield: 4.3%

St. Galler Kantonalbank (SGKN) offers a compelling 4.32% dividend yield, ranking in the top 25% of Swiss dividend payers. Over the last decade, SGKN has consistently increased its dividends, supported by a stable payout ratio of 54.9%. Dividends are projected to remain well-covered by earnings with a future payout ratio forecast at 49.2%. Additionally, SGKN maintains a low allowance for bad loans at 55%, enhancing its financial stability and supporting sustained dividend payments. Trading at 23.8% below estimated fair value also suggests potential upside for value investors.

Swiss Re

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG operates globally, offering wholesale reinsurance, insurance, and various insurance-based risk transfer services with a market capitalization of CHF 32.66 billion.

Operations: Swiss Re AG generates revenue through its Corporate Solutions, Life & Health Reinsurance, and Property & Casualty Reinsurance segments, with earnings of $6.06 billion, $18.09 billion, and $23.74 billion respectively.

Dividend Yield: 5.4%

Swiss Re reported a Q1 2024 net income of US$1.09 billion, reflecting robust financial health. Despite a volatile dividend history over the past decade, current dividends are supported by a sustainable payout ratio of 53.9% and cash flows with a cash payout ratio of 48.3%. Recent strategic enhancements, including the launch of Connected Underwriting Life Workbench in collaboration with Appian, aim to streamline operations and may bolster future profitability despite historical dividend inconsistencies.

Delve into the full analysis dividend report here for a deeper understanding of Swiss Re.

Our expertly prepared valuation report Swiss Re implies its share price may be lower than expected.

Where To Now?

Click this link to deep-dive into the 28 companies within our Top Dividend Stocks screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BRKN SWX:SGKN and SWX:SREN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance