Three Top UK Dividend Stocks Yielding Up To 8.5%

Amidst a backdrop of muted trading in the FTSE 100 and cautious optimism in global markets, investors are closely monitoring economic indicators and central bank movements. In such an environment, dividend stocks can offer a compelling option for those seeking potential stability and regular income.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 7.76% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.55% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.09% | ★★★★★☆ |

DCC (LSE:DCC) | 3.44% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.85% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.06% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.58% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.55% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.11% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.34% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

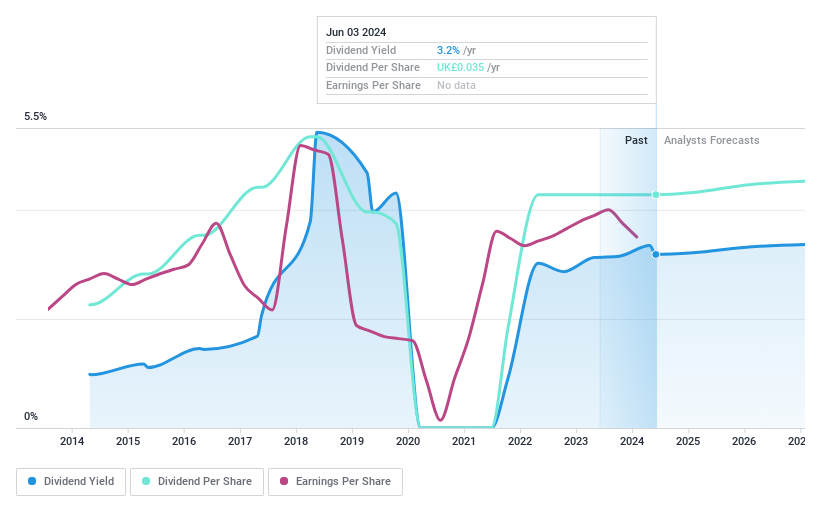

Sanderson Design Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanderson Design Group plc operates globally, designing, manufacturing, marketing, and distributing interior furnishings, fabrics, and wallpapers with a market capitalization of £78.88 million.

Operations: Sanderson Design Group plc generates revenue primarily through three segments: Brands (excluding Licensing) at £78.77 million, Manufacturing at £35.01 million, and Licensing at £10.92 million.

Dividend Yield: 3.2%

Sanderson Design Group's dividend sustainability is moderately secure with a payout ratio of 30.5% and a cash payout ratio of 43%, indicating coverage by both earnings and cash flows. However, the company's dividend history is marked by volatility over the past decade, reflecting inconsistency in payments. Recently, the firm committed to a progressive dividend policy with an upcoming payment proposed at 3.50 pence per share if approved at their AGM in July 2024.

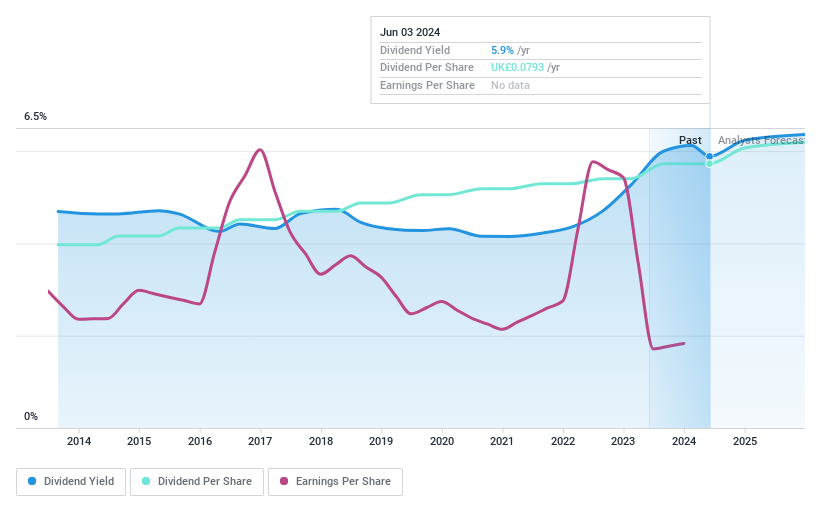

BBGI Global Infrastructure

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BBGI Global Infrastructure S.A. is an investment firm that focuses on infrastructure investments in operational or near operational assets, with a market capitalization of approximately £0.96 billion.

Operations: BBGI Global Infrastructure S.A. generates its revenue primarily from the financial services sector related to closed-end funds, amounting to £48.10 million.

Dividend Yield: 5.9%

BBGI Global Infrastructure reported a significant drop in revenue and net income for 2023, with earnings of £40.29 million on revenues of £49.52 million, down from £119.04 million and £159.63 million respectively in the previous year. Despite this decline, BBGI has committed to an aggressive share repurchase program authorized to buy back up to 14.99% of its issued capital at prices potentially reaching 105% above market average quotes preceding purchase days. However, the sustainability of its dividend is questionable as it's not well-covered by either earnings or cash flows, with a high payout ratio of 140.6%.

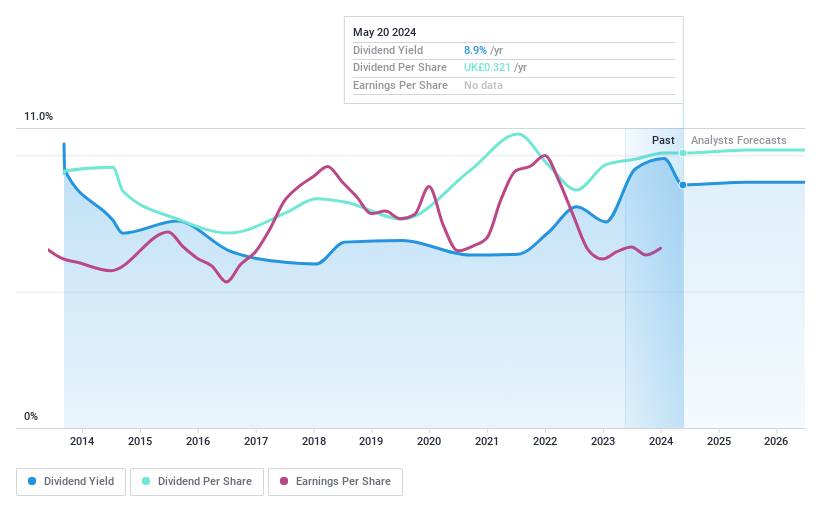

City of London Investment Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market capitalization of approximately £181.87 million.

Operations: City of London Investment Group PLC generates its revenue primarily from asset management, contributing $73.72 million.

Dividend Yield: 8.6%

City of London Investment Group offers a high dividend yield at 8.56%, ranking in the top 25% of UK dividend payers, but its sustainability is questionable due to coverage issues. The company's dividends have shown volatility and unreliability over the past decade with a payout ratio exceeding earnings at 112.5%. Despite trading below fair value by 21.2%, concerns are compounded by recent auditor changes, suggesting potential governance shifts that could impact future financial stability.

Seize The Opportunity

Gain an insight into the universe of 57 Top Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:SDG LSE:BBGI and LSE:CLIG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance