Three UK Exchange Stocks Estimated To Be Trading Between 21.2% And 49% Below Intrinsic Value Estimates

Amidst a rebound in the FTSE 100 and rising British consumer confidence, the United Kingdom's financial markets show signs of resilience despite global economic uncertainties. In such an environment, identifying stocks that are trading below their estimated intrinsic value could offer potential opportunities for investors seeking value in a recovering market.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £24.95 | £48.90 | 49% |

Kier Group (LSE:KIE) | £1.394 | £2.72 | 48.8% |

Morgan Advanced Materials (LSE:MGAM) | £3.19 | £6.11 | 47.8% |

Mercia Asset Management (AIM:MERC) | £0.295 | £0.58 | 49.2% |

Loungers (AIM:LGRS) | £2.68 | £5.33 | 49.7% |

Deliveroo (LSE:ROO) | £1.296 | £2.51 | 48.3% |

Elementis (LSE:ELM) | £1.452 | £2.79 | 48% |

Nexxen International (AIM:NEXN) | £2.525 | £4.92 | 48.7% |

Aston Martin Lagonda Global Holdings (LSE:AML) | £1.524 | £2.95 | 48.3% |

eEnergy Group (AIM:EAAS) | £0.057 | £0.11 | 48.3% |

Here's a peek at a few of the choices from the screener

TBC Bank Group

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.35 billion.

Operations: The company generates its revenue through diverse financial services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

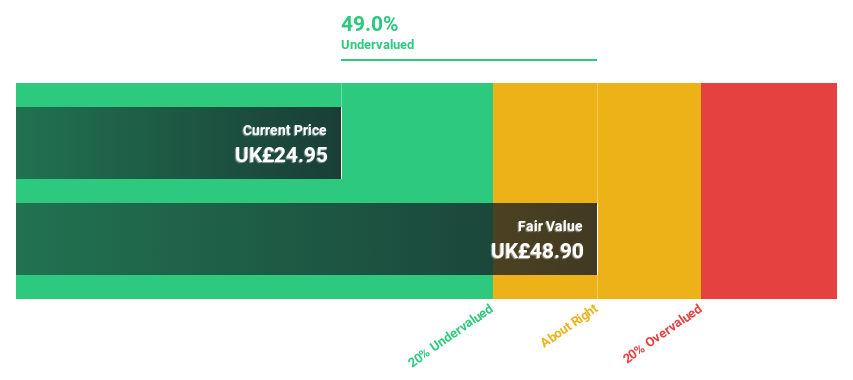

Estimated Discount To Fair Value: 49%

TBC Bank Group, with a recent share repurchase program of GEL 75 million and strong Q1 earnings showing net income rising to GEL 292.81 million from GEL 248.67 million year-over-year, demonstrates robust financial health. Despite concerns about its high bad loans ratio at 2.1% and unstable dividend track record, the bank is trading at £24.95, significantly below the estimated fair value of £48.9. This discrepancy suggests undervaluation based on cash flows, supported by a forecasted above-market revenue growth rate of 18.3% per year compared to the UK market's 3.5%.

Trainline

Overview: Trainline Plc operates as an independent platform in the UK and internationally, selling rail and coach tickets with a market capitalization of approximately £1.44 billion.

Operations: Trainline's revenue is generated from three primary segments: Trainline Solutions at £134.76 million, International Consumer at £53.16 million, and United Kingdom Consumer at £208.80 million.

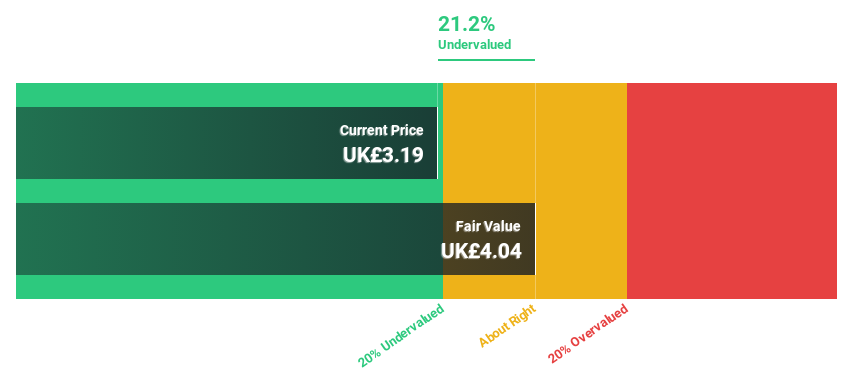

Estimated Discount To Fair Value: 21.2%

Trainline Plc, trading at £3.19, is observed below its fair value of £4.04, indicating a possible undervaluation based on cash flow analyses. Recent financials show a significant uptick in sales and net income, with reported earnings growth of 60.2% over the past year and an expected annual profit growth rate of 21.67%. Despite slower revenue growth forecasts (6.6% per year), it outpaces the UK market average (3.5%). The company's aggressive share buyback program further underscores its robust financial management and shareholder value focus.

WPP

Overview: WPP plc is a creative transformation company offering communications, experience, commerce, and technology services worldwide, with a market capitalization of approximately £8.13 billion.

Operations: WPP's revenue is segmented into Public Relations (£1.26 billion), Specialist Agencies (£0.99 billion), and Global Integrated Agencies (£12.59 billion).

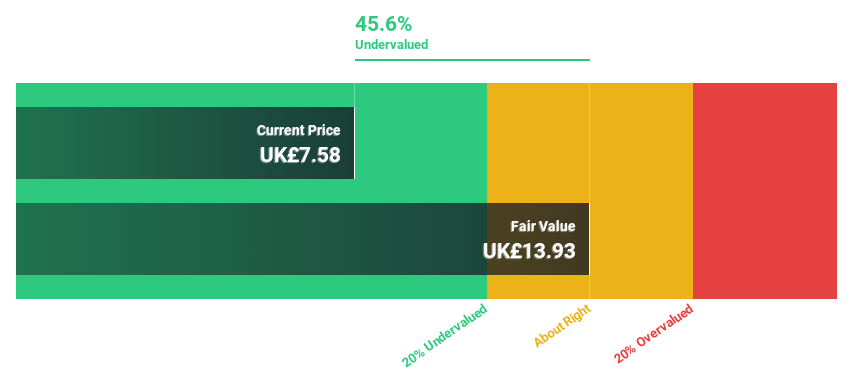

Estimated Discount To Fair Value: 45.6%

WPP, priced at £7.58, appears undervalued against a fair value estimate of £13.93 based on discounted cash flow analysis. Despite a forecasted revenue decline of 5.4% annually over the next three years, WPP's earnings are expected to surge by 28.3% per year in the same period, outpacing the UK market average growth of 12.6%. However, its dividend coverage is weak and profit margins have decreased from last year's 4.7% to just 0.7%.

Make It Happen

Click this link to deep-dive into the 69 companies within our Undervalued UK Stocks Based On Cash Flows screener.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:TBCGLSE:TRN and LSE:WPP

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance