Three UK Growth Companies With Insider Ownership As High As 38%

Amidst a backdrop of mixed global market signals and cautious optimism in European indices, the United Kingdom’s financial landscape presents a complex yet intriguing scenario for investors. High insider ownership in growth companies often indicates confidence from those who know the business best, making such stocks potentially appealing during uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Petrofac (LSE:PFC) | 16.6% | 102.2% |

Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 30.9% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 99.2% |

Here we highlight a subset of our preferred stocks from the screener.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

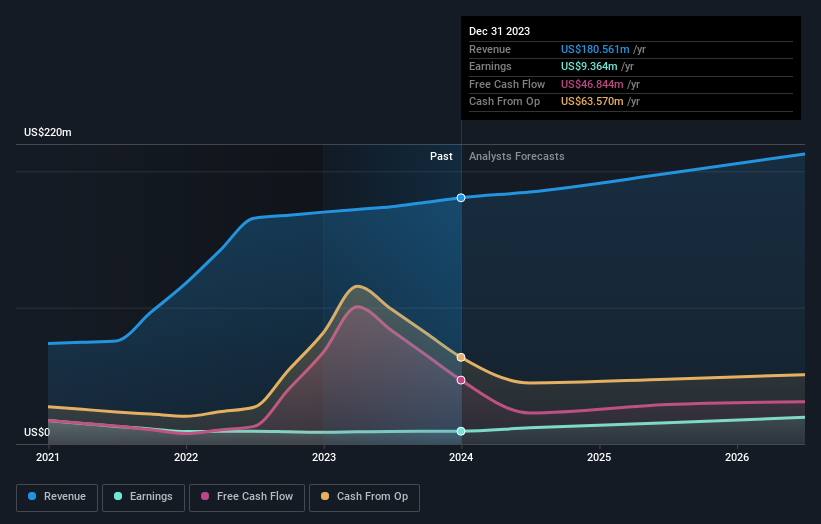

Overview: Craneware plc, a company specializing in the development, licensing, and support of computer software for the healthcare industry primarily in the United States, has a market capitalization of approximately £863.35 million.

Operations: The company generates its revenue primarily from the healthcare software segment, totaling $180.56 million.

Insider Ownership: 17%

Craneware, a UK-based firm, exhibits moderate revenue growth at 7.3% annually, outpacing the UK market's 3.7%. However, its Return on Equity is expected to remain low at 11.2% in three years. On a positive note, earnings are projected to increase significantly by 28.52% per year over the same period, surpassing the UK market average of 13.2%. Recent activities include extending a buyback plan and presenting at various conferences, indicating active engagement and strategic initiatives to bolster market presence.

Click here and access our complete growth analysis report to understand the dynamics of Craneware.

Our valuation report here indicates Craneware may be overvalued.

Foresight Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

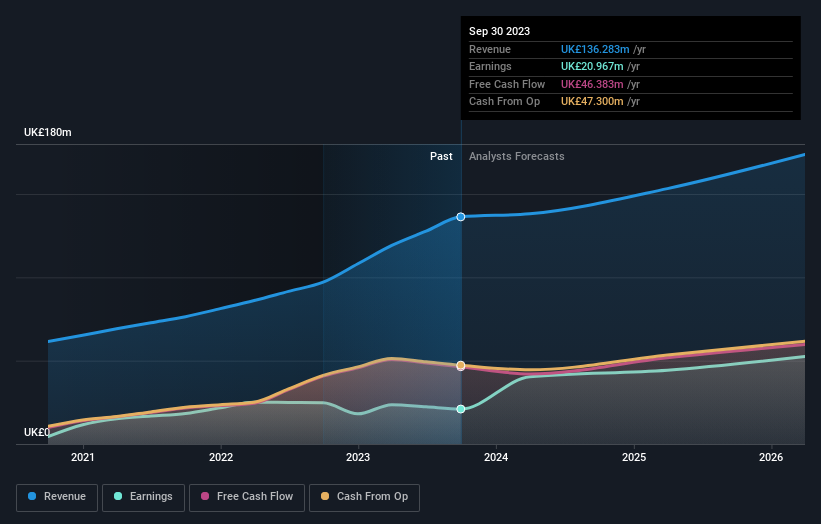

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £556.15 million.

Operations: The company generates revenue primarily through its Infrastructure, Private Equity, and Foresight Capital Management segments, with earnings of £85.68 million, £39.28 million, and £11.33 million respectively.

Insider Ownership: 31.7%

Foresight Group Holdings is poised for substantial growth with earnings expected to increase by 30.9% annually, significantly outstripping the UK market's average of 13.2%. Despite slower revenue growth at 10% per year compared to the industry benchmark of 20%, it still exceeds the UK market's average of 3.7%. However, its profit margins have declined from last year's 25.5% to 15.4%. Analysts predict a potential stock price rise of 23.9%, and it trades at a considerable discount, valued at 35.6% below its estimated fair value.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

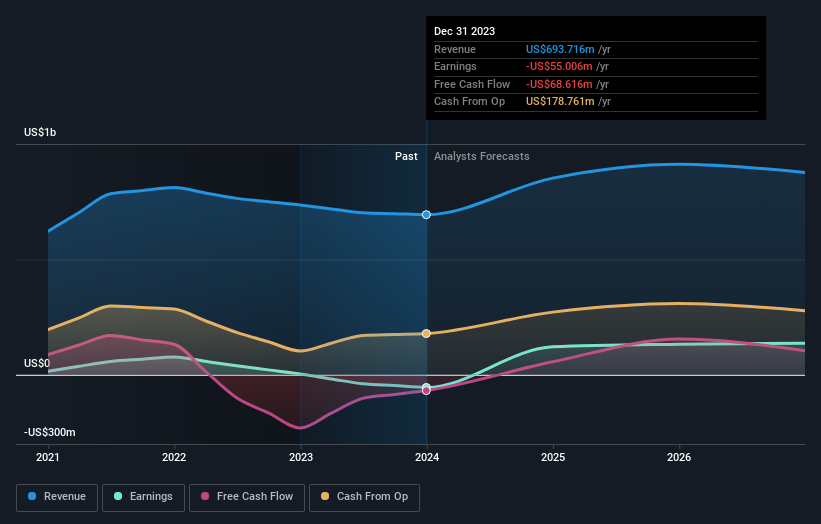

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £0.97 billion.

Operations: The company generates revenue primarily from three segments: San Jose at $242.46 million, Inmaculada at $396.64 million, and Pallancata at $54.05 million.

Insider Ownership: 38.4%

Hochschild Mining is expected to see a notable uptick in profitability over the next three years, with earnings forecasted to grow significantly. Insider activity has been predominantly bullish, with more shares bought than sold recently, indicating confidence from within. However, its return on equity is projected to remain modest at 14.2%. Recent operational results show a slight dip in silver production but an increase in gold output, supporting a positive outlook for 2024 production targets amidst active pursuit of value-accretive mergers and acquisitions.

Where To Now?

Investigate our full lineup of 67 Fast Growing UK Companies With High Insider Ownership right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRW LSE:FSG and LSE:HOC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance