As Tide Goes Out on Private Credit, Smaller Firms Look Exposed

(Bloomberg) -- The clubby world of private credit seems to be running out of space for the little guy.

Most Read from Bloomberg

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

As the rush of money into Wall Street’s hottest market slows, life is getting especially hard for firms that already oversee a smaller amount of capital.

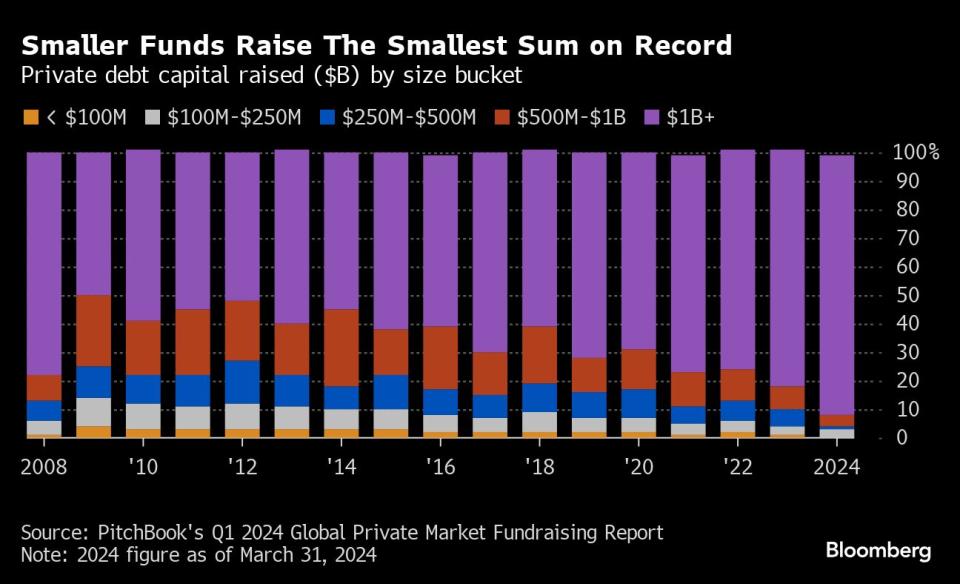

Funds with less than $1 billion of assets received the least amount of cash on record last year. They’re finding it hard to compete on rock-bottom fees and the larger allocations being offered by larger rivals.

So-called limited partners such as pension plans and insurance companies that are the main funding source behind private credit are instead choosing well-known giants who deploy over half of the market’s capital. In 2023, large firms got more than four fifths of the $200 billion raised by private credit globally, dwarfing allocations to smaller rivals, according to PitchBook.

“An LP looking to put $400 million to work has already cut out all of the smaller managers,” said Oliver Fadly, head of private debt at NEPC, a consultant to limited partners. “Big check investors that have already allocated to larger firms are now looking at the second wave of mega-cap lenders, not newer, smaller ones.”

Now, a growing number of newcomers are being forced out of the once-frothy $1.7 trillion private credit market. Long-held firms are putting themselves up for sale.

The fact that so much lending is concentrated in a clutch of funds has come to the notice of the US Securities and Exchange Commission, with its top enforcement official recently saying it posed a wider economic risk.

In a sign of how ambitions have become undone by market reality, Fidelity International and Polen Capital Management had to rethink plans to expand into Europe this year.

Those with less access to cash are in danger of being swallowed up by better-capitalized rivals, participants say. Listed German private equity firm Deutsche Beteiligungs AG acquired ELF Capital Group in 2023, while BlackRock Inc. acquired Kreos Capital and Sienna IM bought an Italian-focused firm earlier this year.

Cristobal Cuart, a former KKR & Co. executive who helped found private capital manager All Seas Capital five years ago, acknowledges larger rivals have a wealth of resources and longer track records. But smaller funds can outperform on returns, he said.

Smaller firms lend to smaller companies, whose loans typically pay higher interest margins, have tighter covenants and lower leverage multiples.

That can translate into a 1.4% yield premium on loans to companies with cash flow of less than $10 million, compared to those that generate more than $100 million, according to Cliffwater research.

Compared with larger managers, smaller firms typically have broader portfolios of “lower mid market companies that deliver alpha returns and management fees need to be set accordingly,” said Paul Shea, managing partner at Beechbrook Capital.

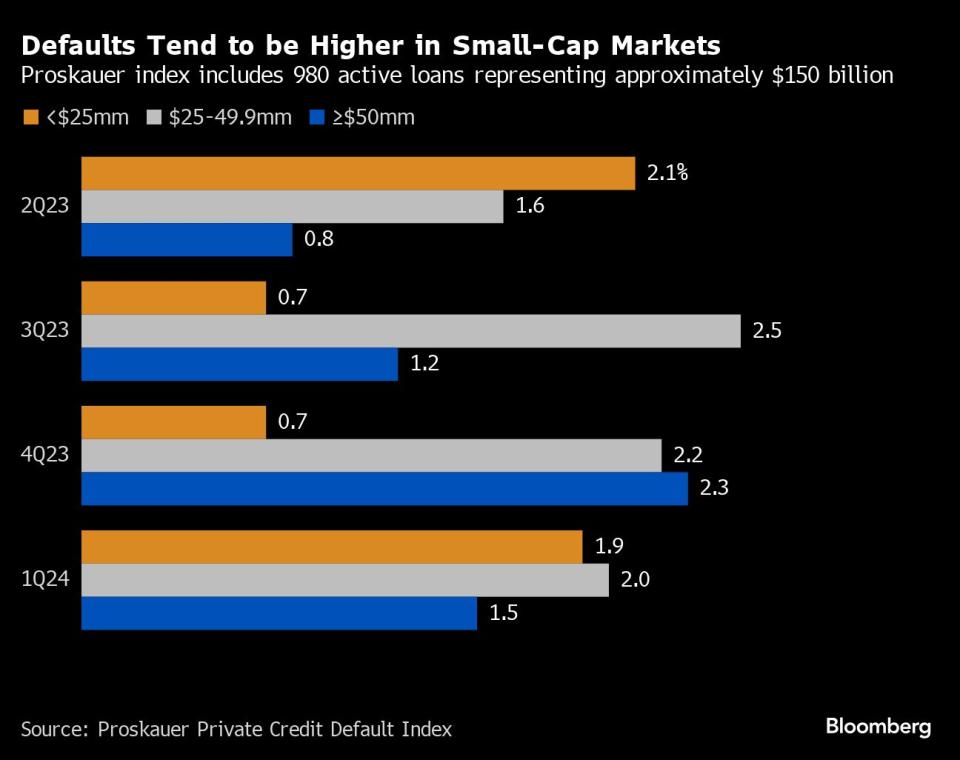

Nevertheless, PitchBook data shows investors are less interested in putting their money with the smallest managers. In part, that may be explained by fears that elevated interest rates may tip more of the smallest companies into default.

Larger firms often employ teams of restructuring experts to deal with debt restructurings and fight for better recoveries in defaults.

“The larger managers attract more capital as they have more infrastructure to protect their investments if things go sideways,” said Fadly at NEPC. “Smaller managers might only have one restructuring person that doesn’t have the scar tissue from prior cycles.”

Yet higher default rates in the portfolios of small managers are also the result of triggers on covenants often lacking on larger loans, participants say.

Lately, margins on the largest and most fiercely contested deals have compressed by about 100 basis.

That’s made it even harder for smaller firms, who are getting outbid on trophy deals.

But by squeezing out the smallest managers, larger managers may imperil their own futures, Cuart argues.

“These managers fill the gap left by larger funds that scale up and vacate the smaller mid-market segment,” he said. “By supporting new and smaller businesses, they play a pivotal role in nurturing the next generation of larger companies.”

Deals

Blue Owl Capital is leading a $2.15 billion private debt facility for a refinancing at Inspira Financial Inc.

RxBenefits Inc., a pharmacy benefits manager, is looking to tap private credit to refinance existing debt. The company is seeking around $1 billion from direct lenders

Credit Agricole SA plans to tap investors to offload risk tied to a pool of up to about $10 billion of loans

Chinese data center service provider Vnet’s founder and co-chairperson Josh Chen Sheng has finally paid off a short-term private loan from Ares Management Corp that a unit of his defaulted on more than 2.5 years ago

Deutsche Bank AG has approached several existing lenders to buy a stake in a HK$10.2 billion ($1.3 billion) project loan backing a luxury-property development in Hong Kong

Fundraising

Rest, one of Australia’s largest pension funds, has increased its investment in a property private credit fund, diversifying private markets exposure

Insignia Financial Ltd.’s pensions business is in the final stages of appointing external managers to deploy billions of dollars into global private credit markets

Job Moves

UBS Group AG’s head of banks and diversified financials, Samuel Reinhart, has left the firm for a role at BC Partners

Pacific Investment Management Co. is ramping up its expansion into private markets by adding Prashant Dwivedi as the firm seeks to capitalize on volatility across the corporate, private-lending and real estate markets

Blackstone Inc. has hired Tyler Dickson, former global head of investment banking at Citigroup Inc., to lead client relations for its credit and insurance unit as the private equity giant continues to expand its lending business

Societe Generale SA has hired Joseph Falcone to lead its private credit partnership with Brookfield Asset Management

Apollo Global Management Inc. has hired Kazuo Yamataka to focus on Apollo’s private credit strategy in Japan, as the firm looks to grow its footprint in the country

Cahill Gordon & Reindel is building out its private credit practice with the addition of KKR managing director Peter Williams

Did You Miss?

Pimco Warns Credit Market Returns Fail to Compensate for Risks

Ailing Hedge Funds Turn to Brazil’s Hot Private-Credit Market

Private Credit Funds Take On Wall Street’s Least Loved Label

Oaktree’s Dahl on Risk-Managing Credit’s Now Equity-Like Returns

Private Credit Funds With No Skin in Game a Worry

--With assistance from Natasha Doff.

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

He’s Starting an Olympics Rival Where the Athletes Are on Steroids

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance