TikTok Ban Coming? 3 Stocks Would Benefit

The Social Media Landscape is Evolving

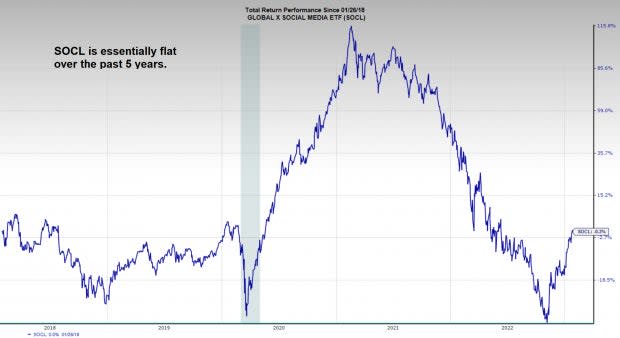

The social media landscape has changed dramatically over the past few years with the rapid ascent of the personalized video platform app TikTok. Despite TikTok’s rapid rise, Meta Platforms META and Alphabet GOOGL are still the dominant players. In terms of monthly active users, three Meta platforms make up the top four rankings globally: Facebook (#1), Whatsapp (#3), and Instagram (#4). Alphabet holds the second spot with its video platform Youtube and TikTok is ranked #6. Even with the continued dominance of existing players like META and GOOGL, stock performance has been lackluster in recent years. The Global Social Media ETF SOCL is the most followed social media ETF (note that it does not include TikTok).

Image Source: Zacks Investment Research

What has Led to the Underperformance of Existing Players?

For one, Meta CEO Mark Zuckerberg is paying less attention to his lucrative social media business and instead investing valuable resources in what he sees as the future – the metaverse. Approximately 20% of Meta’s current investments are aimed at this project. While the bold bet has not panned out for Zuckerberg and Meta yet, he plans to stay the course.

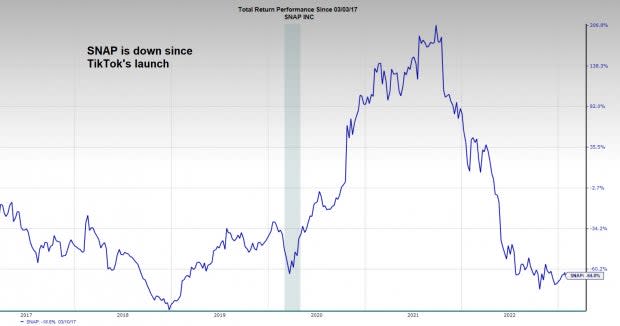

The other major factor leading to the underperformance in domestic social media platforms such as Instagram, Youtube, and Snap Inc’s SNAP Snap Chat platform is TikTok’s success.

Image Source: Zacks Investment Research

Chinese-based ByteDance launched TikTok in the United States in 2016, and since then, the platform form has dominated. The app, which allows users to create and modify short-form videos, has caught on, especially with the younger generation. TikTok’s competitors have noticed. To win eyes back, Instagram has launched “Reels” and Youtube has created “Shorts” –aimed at users who prefer short, customizable videos like Tik Tok.

Snap Chat, already in the short video space, has suffered the most from TikTok’s rise.

National Security Concerns

Though TikTok is one of the dominant global social media players and shows little signs of slowing growth – other factors may play a significant role in the social media space moving forward. Concerns are growing that ByteDance is collecting unnecessary personal data on its users and possibly supplying it to the Chinese government (the biggest rival of the U.S.). Former President Donald Trump attempted to ban TikTok in 2020, but ultimately the app was able to remain active. The Biden administration struck down the potential Trump ban on TikTok but ordered a national security investigation.

A Potential Catalyst for Domestic Social Media Platforms

Even with the failed TikTok bans of the past, momentum is growing for a new possible attempted ban. In the past year, FBI director Christopher Wray, FCC Commissioner Brendan Carr, and Senator Josh Hawley have called for a domestic TikTok ban. Meanwhile, several U.S. colleges have implemented their own bans (via WiFi) amid security concerns.

Tuesday, Josh Hawley announced he would introduce a bill to ban the app. Investors who follow the social media space should keep a close eye on how the efforts to ban the app play out. If the app is ultimately banned, SNAP will benefit the most, along with META and GOOGL. Software giant Oracle ORCL, which supports TikTok via its cloud platform, would stand to lose.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Global X Social Media ETF (SOCL): ETF Research Reports

Snap Inc. (SNAP) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance