Time to Buy Lowe's or Target Stock as They Round Out the Favorable Retail Earnings Season?

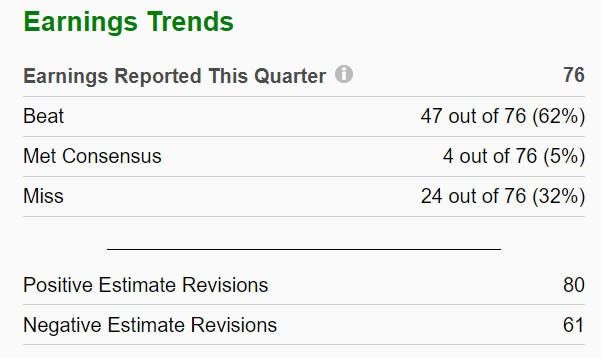

The retail earnings scorecard will be completed in the next few weeks with 62% of the companies in the Zacks Retail-Wholesale Sector beating earnings estimates so far.

Overall, operating conditions appear to be strengthening amid easing inflation. That said, reports from retail giants Lowe’s LOW and Target TGT are still to come with their results due on Tuesday, February 27, and Tuesday, March 5 respectively. With the retail earnings scorecard being favorable so far let’s see if now is a good time to buy Lowe's or Target stock.

Image Source: Zacks Investment Research

Lowe’s Q4 Preview

Wall Street will be closely monitoring Lowe’s guidance tomorrow with fellow home improvement retailer Home Depot HD expecting a moderation in its growth despite exceeding its Q4 top and bottom line expectations last Tuesday.

Lowe’s Q4 results are expected to reflect a slowdown on the horizon with earnings projected to drop -26% to $1.68 a share versus $2.28 per share in a very tough to-compete against prior-year quarter. Fourth quarter sales are expected at $18.34 billion compared to $22.45 billion last year. Still, Lowe’s has topped the Zacks EPS Consensus for 18 consecutive quarters dating back to August of 2019.

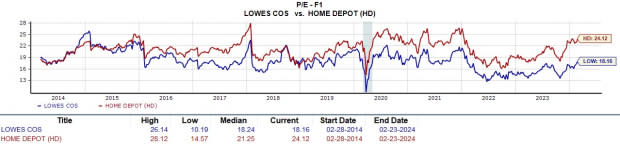

Image Source: Zacks Investment Research

Lowe’s valuation also stands out trading at 18.1X forward earnings which is a noticeable discount to Home Depot’s 24.1X and their Zacks Building Products-Retail Industry average of 21.4X. Notably, Lowe’s stock is up a respectable +13% over the last year although this has trailed Home Depot’s +25% and their Zacks Subindustry’s +24%.

Image Source: Zacks Investment Research

Target Q4 Preview

While high post-pandemic demand may be winding down for home improvement retailers, Target’s rebound may just be underway. The omnichannel retailer has slowly but surely gotten issues with shrink under control along with previous inflationary pressures. Demand for Target’s higher-end consumer products is expected to return with many shoppers sticking or shifting to Walmart’s WMT more affordable pricing over the last few years.

Target’s guidance will be closely watched as Walmart gave a modest outlook after joining Home Depot in topping its quarterly expectations last Tuesday as well. However, Target’s Q4 earnings are forecasted to jump 26% YoY to $2.38 per share with sales expected to rise over 1% to $31.88 billion. Furthemore, Target has topped earnings expectations in each of its last four quarterly reports posting an eye-catching average earnings surprise of 30.84%.

Image Source: Zacks Investment Research

In regards to valuation, Target's 16.5X forward earnings multiple is certainly intriguing. At the moment this is well below Walmart’s 25X and a 44% discount to its Zacks Retail-Discount Stores Industry average of 29.9X. This comes as Target’s stock is still down -10% over the last year but has risen +5% year to date.

Image Source: Zacks Investment Research

Bottom Line

Relative to their retail peers, Lowe’s and Home Depot’s valuations are very attractive ahead of their quarterly reports. Target’s stock makes a stronger case for more upside and a sharper rebound landing a Zacks Rank #2 (Buy) while Lowe’s lands a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance