Toast (TOST) to Report Q1 Earnings: What's in the Cards?

Toast TOST is set to release its first-quarter 2024 results on May 7.

The Zacks Consensus Estimate for the top line is currently pegged at $1.03 billion, suggesting a 25.8% year-over-year growth.

The consensus mark for loss is estimated to be 15 cents per share, unchanged over the past 30 days. TOST reported a loss of 16 cents per share in the year-ago quarter.

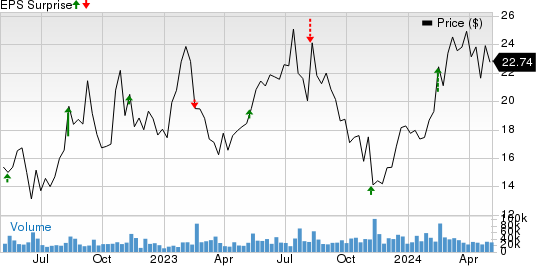

The company’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing once, delivering an earnings surprise of 7.49%, on average.

Toast, Inc. Price and EPS Surprise

Toast, Inc. price-eps-surprise | Toast, Inc. Quote

Let’s see how things have shaped up for this announcement:

Factors to Consider

Toast has been benefiting from expanding locations. At the end of 2023, there were more than 106,000 restaurants on the platforms, up 34% over 2022. It has been riding on improved rep productivity and growing market share among small and medium businesses.

However, the first quarter is seasonally weak, and Toast expects to add locations less than the year-ago quarter’s figure in the 5,500 range, down from the 6,500 net locations it added in the fourth quarter of 2023.

TOST’s focus on high-value, full-serve restaurants has been a key catalyst. Its strategy of serving different restaurants has been driving market share. These factors are expected to have driven average revenue per user growth and Gross Payment Volume per location above the industry average in the to-be-reported quarter.

Toast’s expansion into the mid-market segment is noteworthy, thanks to a strong partner base that includes Wetzel's Pretzels, The99, Dirty Dough and Romano’s Macaroni Grill. The first-quarter 2024 results are expected to have benefited from these strengths.

Moreover, expanding international locations is expected to have benefited top-line growth.

However, higher expenses due to the seasonal nature of the payments business, cash bonus payments, restructuring charges ($45-$55 million) and severance costs are likely to have hurt profitability in the to-be-reported quarter. Toast expects to report negative free cash flow in the first quarter of 2024.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Toast has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few companies worth considering, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Arista Networks ANET has an Earnings ESP of +3.76% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 11.6% year to date. ANET is set to report its first-quarter 2024 results on May 7.

NVIDIA NVDA has an Earnings ESP of +2.50% and a Zacks Rank #2.

NVIDIA’s shares have gained 74.5% year to date. NVDA is scheduled to release first-quarter fiscal 2025 results on May 22.

Docebo DCBO has an Earnings ESP of +8.00% and a Zacks Rank #3 at present.

Docebo’s shares have declined 5.7% year to date. DCBO is set to report first-quarter 2024 results on May 9.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Docebo Inc. (DCBO) : Free Stock Analysis Report

Toast, Inc. (TOST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance