Tokyo Inflation Quickens, Output Gains Keeping BOJ on Hike Path

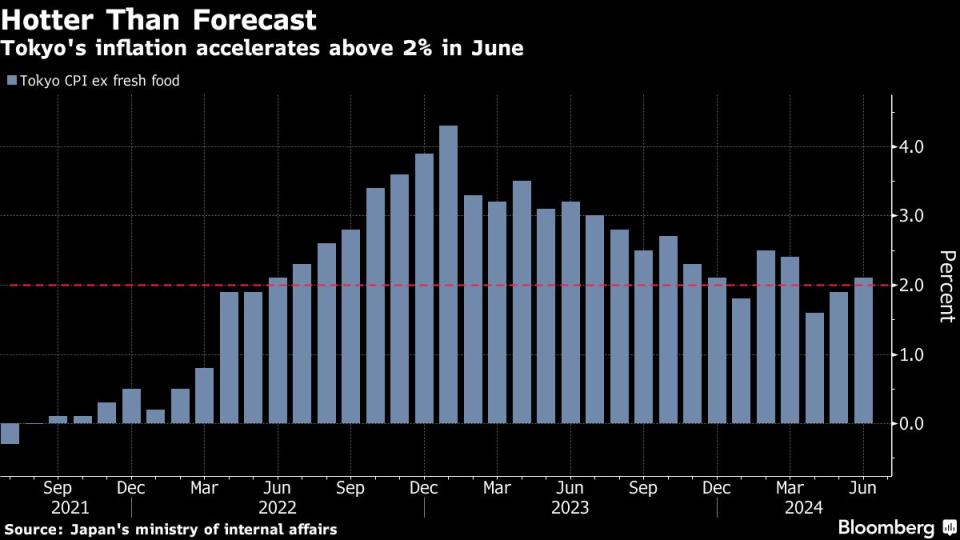

(Bloomberg) -- Inflation in Tokyo picked up in June on the back of higher energy prices and industrial output rose more than expected in May, likely keeping the Bank of Japan on track to consider an interest rate hike as early as July.

Most Read from Bloomberg

Democrats Question Replacing Biden: Here’s How It Could Work

Biden Struggles as He Spars With Trump on Economy: Debate Takeaways

SpaceX Tender Offer Said to Value Company at Record $210 Billion

Consumer prices excluding fresh food rose 2.1% in the capital, accelerating from 1.9% in May, the ministry of internal affairs reported Friday. The reading exceeded the consensus estimate of 2%.

Tokyo’s figures are leading indicators of the national data to be released in July.

In a separate set of data, Japan’s factory output rose 2.8% in May from April, beating the consensus call for 2% growth, as automakers including Daihatsu Motor Co. fully resumed production in the wake of a safety certification scandal that prompted suspensions of some factory lines.

The weak yen helped underpin price growth in June, and it’s stayed under pressire, trading around 160.60 to the dollar Friday morning in Tokyo.

“If the currency level stays around where it is now, there is a very good chance that the BOJ will move to raise interest rates in July,” said Yuichi Kodama, chief economist at Meiji Yasuda Research Institute.

The inflation figures were influenced in both directions by policy initiatives. The government’s move to phase out utility subsidies and introduce a renewable energy levy put a floor under prices, while an education support program available in the capital weighed. A gauge that excludes energy in addition to fresh food accelerated to 1.8%, reversing course after nine consecutive months of deceleration.

On balance, with the key gauge back above the BOJ’s 2% target and fresh signs of health in the manufacturing sector, Friday’s data will likely keep the BOJ on track toward normalizing monetary policy.

What Bloomberg Economics Says...

“Tokyo’s hot June CPI report isn’t the last data release before the Bank of Japan’s July meeting but it provides compelling evidence that the BOJ can proceed with a rate hike — our base case.”

— by Taro Kimura

Click here to read the full report

At this month’s policy meeting, the BOJ left interest rates unchanged while flagging its intention to reduce its bond buying. Some in the market have questioned whether the bank could unveil two significant policy initiatives at the same meeting. Governor Kazuo Ueda has kept his options open, saying last week in the parliament that there’s a good chance the policy rate could be raised next month if data warrant such action.

One in three BOJ watchers foresees a rate hike in July, according to a Bloomberg survey earlier this week.

Natural gas prices flipped to a gain of 3.8% from a decline of 3.9% in the previous month, making the largest contribution to overall price growth.

Electricity prices rose 10.8% from a year earlier, a slower pace than in May even after the government began phasing-out a utility subsidy. The subsidies will be terminated completely at the end of the month.

The government also raised its renewable energy surcharges by about 2.5 times to ¥3.49 per kilowatt-hour starting in May.

Energy prices will continue to inject uncertainty into price development, with Prime Minister Fumio Kishida having recently announced the reinstatement of the utility subsidy from August through October in an apparent bid to revive his cabinet’s slumping popularity.

Saisuke Sakai, senior economist at Mizuho Research & Technologies, said the CPI report might not have been strong enough to convince the BOJ to raise interest rates in July.

“It’s true that prices are rising due to the weak yen and consumers are feeling it,” he said. “However, the BOJ is focusing on service prices and demand-driven inflation. In that sense, I felt that there were not yet enough strong evidence to support the BOJ’s interest rate hike next month.”

Several factors could put upward pressure on prices in coming months. The weak yen may continue to spur cost-push inflation through costlier imports. Japan’s currency slid to a fresh 38-year low earlier this week, prompting a volley of verbal intervention remarks by authorities and raising the prospects for actual action. Top currency official Masato Kanda reiterated that he’ll take appropriate steps if there are excessive currency moves.

Meanwhile, demand-driven inflation may also materialize as government income tax rebates in June are expected to increase disposable incomes for some families. Private consumption has recently shown signs of recovery, with households boosting spending in April for the first time in 14 months. The BOJ is looking for rising incomes to support spending that feeds into demand-led price gains.

Also, wage gains are expected to further support consumption. Annual wage talks between the country’s main umbrella group for unions and large companies resulted in an agreement to raise wages by more than 5%, marking the highest jump in over three decades.

Whether those gains ripple more widely remains to be seen. Still, upward pressure on wages is likely to continue as a tight labor market forces companies to compete to retain and attract talent. The jobless rate held steady at 2.6% in May. The jobs-to-applicants ratio slipped to 1.24, meaning there were 124 jobs available to every 100 applicants, still a relatively high number.

--With assistance from Keiko Ujikane.

(Updates with economist’s comment)

Most Read from Bloomberg Businessweek

The FBI’s Star Cooperator May Have Been Running New Scams All Along

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance