Tom Gayner's Firm Expands Holding in Hagerty Inc Shares

Overview of the Recent Transaction

On July 3, 2024, Tom Gayner (Trades, Portfolio), through Markel Corporation, made a significant addition to its investment portfolio by purchasing 108,000 shares of Hagerty Inc (NYSE:HGTY), a specialty automotive insurance provider. This transaction, executed at a price of $11.04 per share, reflects a strategic move by the firm, enhancing its stake in the company to 3.108 million shares, with a modest impact of 0.01%.

Profile of Tom Gayner (Trades, Portfolio)

Tom Gayner (Trades, Portfolio) is the Co-Chief Executive Officer at Markel Corporation, where the firm's investment activities are managed. With a background as a Certified Public Accountant and a former vice president at Davenport & Co of Virginia, Gayner brings a wealth of experience to his role. The investment philosophy at Markel Corporation emphasizes acquiring businesses with good returns, minimal leverage, reputable management, and significant reinvestment opportunities, all at fair prices. This approach has consistently guided the firm's strategic investment decisions.

Introduction to Hagerty Inc

Hagerty Inc, listed under the ticker HGTY, operates primarily in the United States, Canada, and Europe, focusing on classic and enthusiast vehicle insurance. Since its IPO on December 3, 2021, the company has expanded its revenue streams across various segments including commission and fees, and membership revenue. Despite a challenging market, Hagerty maintains a market capitalization of approximately $950.45 million and a PE ratio of 61.61, indicating profitability but also highlighting its premium pricing relative to earnings.

Significance of the Trade

The acquisition of Hagerty shares is a notable expansion within Tom Gayner (Trades, Portfolio)'s investment portfolio, which predominantly focuses on high-value, growth-oriented stocks. This move aligns with Markel's strategy of investing in niche markets with potential for substantial growth and stable returns. The addition of Hagerty Inc not only diversifies the portfolio but also taps into the lucrative specialty insurance sector.

Market Context and Stock Performance

Currently, Hagerty's stock price stands at $11.09, showing a modest increase of 0.45% since the transaction. The stock has experienced a significant year-to-date increase of 40.91%, outperforming many of its peers within the insurance industry. This performance is a testament to the company's robust business model and market positioning.

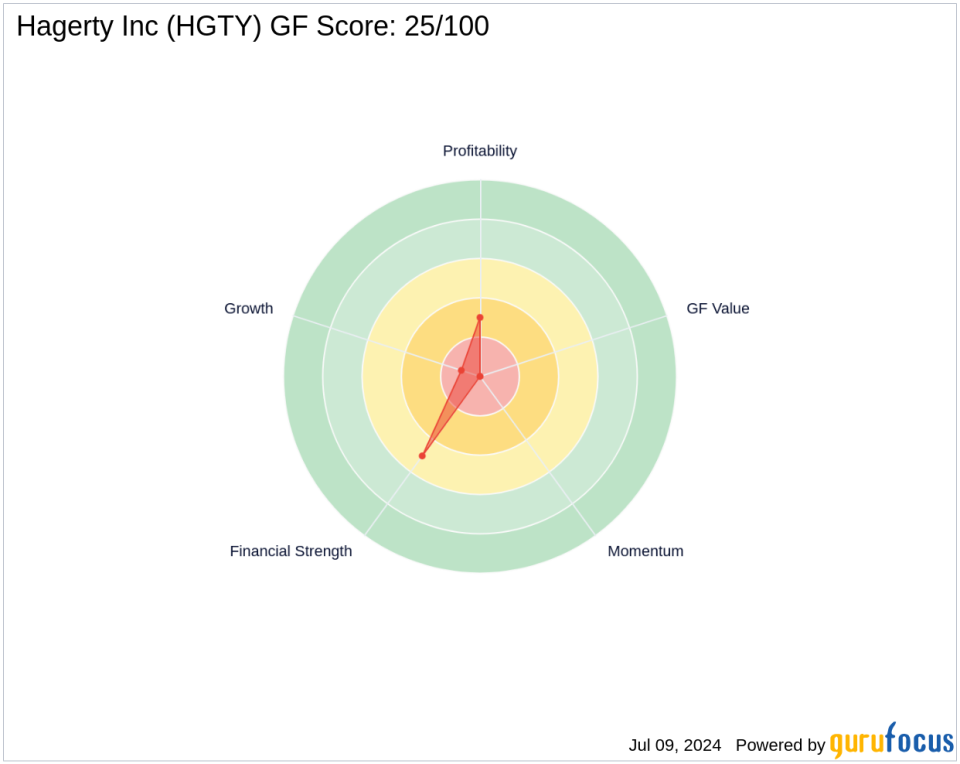

Investment Analysis

Despite its growth, Hagerty's financial health shows mixed signals. The company's GF Score of 25/100 suggests potential challenges ahead, with low rankings in Growth Rank and Profitability Rank. However, its strong Return on Equity (ROE) of 26.90% presents a silver lining, indicating effective management performance relative to shareholder equity.

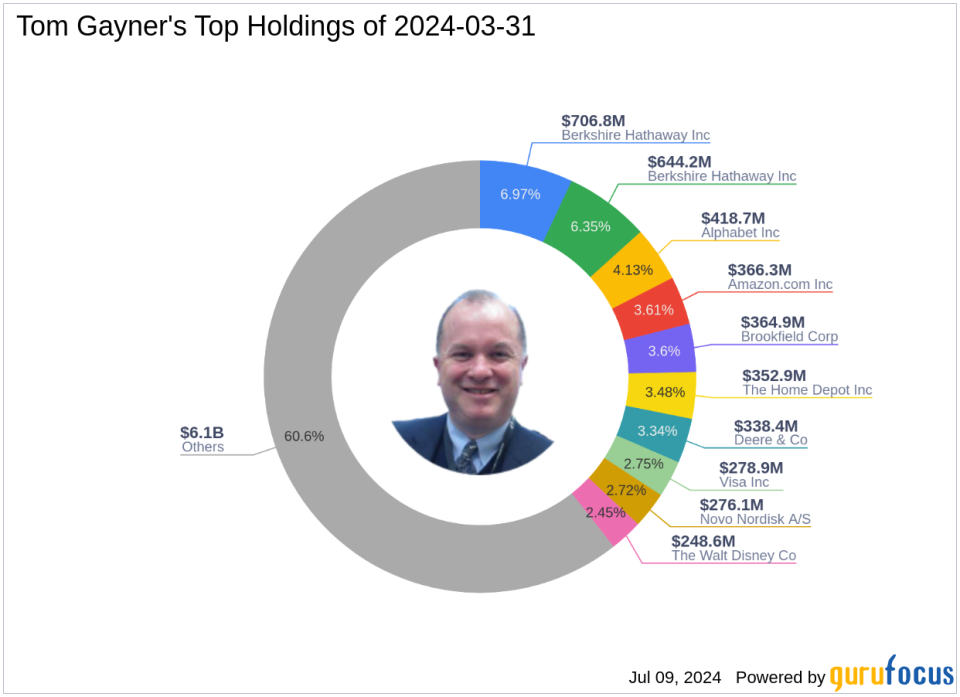

Comparative Insight

When compared to other top holdings in Gayner's portfolio such as Amazon.com Inc and Alphabet Inc, Hagerty represents a smaller, yet strategic bet on a specialized market segment. This investment reflects a calculated risk, diversifying away from the tech-heavy focus and into a stable revenue-generating insurance sector.

Conclusion

Tom Gayner (Trades, Portfolio)'s recent acquisition of Hagerty Inc shares underscores a strategic diversification within Markel's investment portfolio. While the stock presents certain financial risks, its market position and growth potential make it an intriguing asset for value investors. As the market dynamics evolve, this investment could yield significant returns, aligning with Gayner's long-term investment philosophy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance