Top 3 Stocks Estimated To Be Undervalued On Euronext Amsterdam In June 2024

As European markets show signs of recovery with easing political uncertainties and a brighter monetary policy outlook, investors are turning their attention to potentially undervalued opportunities. In this context, identifying stocks on the Euronext Amsterdam that appear undervalued could be particularly timely for those looking to diversify or enhance their portfolios in June 2024.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

Name | Current Price | Fair Value (Est) | Discount (Est) |

Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

PostNL (ENXTAM:PNL) | €1.326 | €2.61 | 49.3% |

Arcadis (ENXTAM:ARCAD) | €59.85 | €114.52 | 47.7% |

InPost (ENXTAM:INPST) | €16.39 | €31.09 | 47.3% |

Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

Alfen (ENXTAM:ALFEN) | €31.93 | €40.21 | 20.6% |

Ctac (ENXTAM:CTAC) | €3.10 | €3.84 | 19.2% |

Let's uncover some gems from our specialized screener

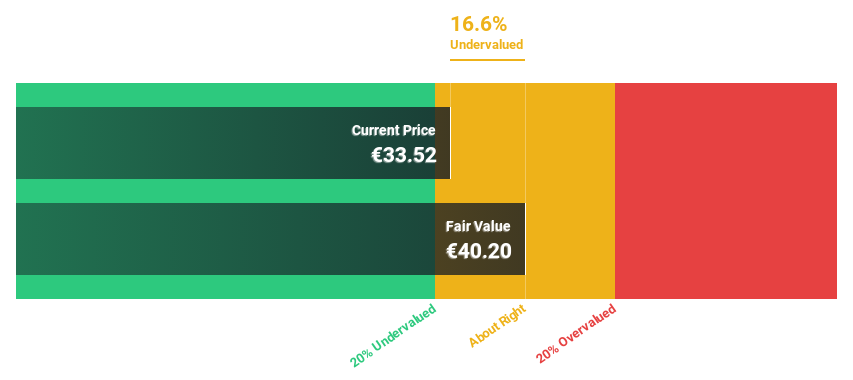

Alfen

Overview: Alfen N.V. specializes in the design, engineering, development, production, and servicing of smart grids, energy storage systems, and electric vehicle charging equipment with a market capitalization of approximately €0.69 billion.

Operations: The company generates revenue through three primary segments: Smart Grid Solutions (€188.38 million), Electric Vehicle Charging Equipment (€153.12 million), and Energy Storage Systems (€162.98 million).

Estimated Discount To Fair Value: 20.6%

Alfen, priced at €31.93, is valued below its estimated fair value of €40.21, indicating a potential undervaluation based on discounted cash flows. Despite a highly volatile share price recently, Alfen's earnings are expected to grow significantly over the next three years with an anticipated annual growth rate of 20.1%, outpacing the Dutch market's 16.2%. However, its current profit margin of 5.9% has decreased from the previous year's 12.1%. Forecasted revenue growth at 15.5% annually also exceeds market expectations.

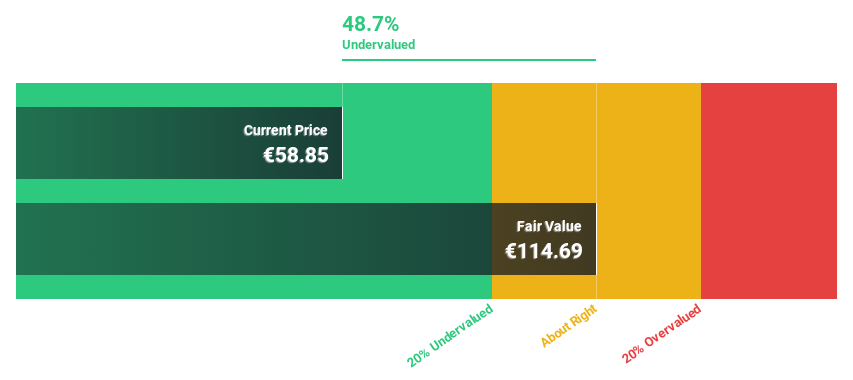

Arcadis

Overview: Arcadis NV, with a market cap of €5.38 billion, provides design, engineering, and consultancy services for natural and built assets across The Americas, Europe, the Middle East, and Asia Pacific.

Operations: The company's revenue is generated through four main segments: Places (€1.94 billion), Mobility (€0.98 billion), Resilience (€1.96 billion), and Intelligence (€0.12 billion).

Estimated Discount To Fair Value: 47.7%

Arcadis, currently trading at €59.85, is significantly undervalued with a fair value estimate of €114.52 based on discounted cash flow analysis. While its revenue growth forecast of 1.6% per year lags behind the market average, Arcadis' earnings are expected to increase by 20.72% annually over the next three years, outperforming the Dutch market's growth rate. Additionally, recent contracts like managing digital asset systems for Henderson highlight operational expansion despite a high debt level and modest insider selling in recent months.

The growth report we've compiled suggests that Arcadis' future prospects could be on the up.

Click to explore a detailed breakdown of our findings in Arcadis' balance sheet health report.

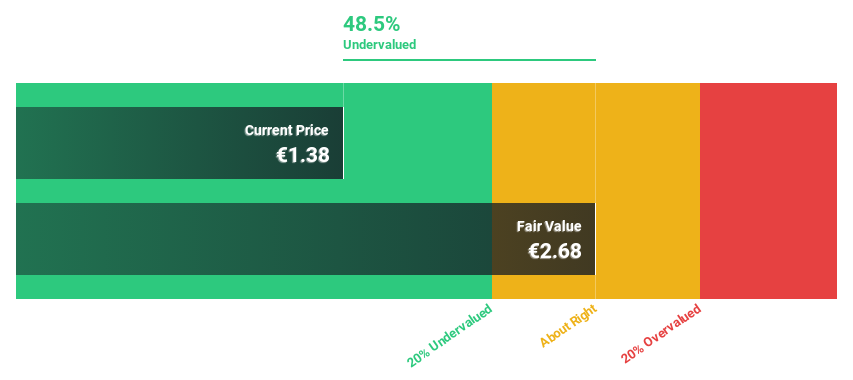

PostNL

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.66 billion.

Operations: The company's revenue is primarily derived from its Packages and Mail in the Netherlands segments, generating €2.25 billion and €1.35 billion respectively.

Estimated Discount To Fair Value: 49.3%

PostNL, priced at €1.33, is significantly undervalued with a fair value estimate of €2.61, reflecting more than a 20% discount based on discounted cash flow analysis. Despite recent financial struggles including a net loss in Q1 2024 and highly volatile share prices, PostNL's earnings are expected to grow by 24.23% annually. The company also recently raised €298.67 million through sustainability-linked bonds, indicating steps towards bolstering its financial position amidst high debt levels.

Taking Advantage

Explore the 7 names from our Undervalued Euronext Amsterdam Stocks Based On Cash Flows screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ALFEN ENXTAM:ARCAD and ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance