Top 3 Value Stocks Estimated Below Market Worth On US Exchanges In June 2024

As of June 2024, the U.S. stock market exhibits a mixed landscape with tech stocks driving gains amid sector-specific challenges like those in semiconductors and financials. In this context, identifying undervalued stocks becomes crucial for investors seeking opportunities that may not fully reflect their market worth given the current economic indicators and market events.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Noble (NYSE:NE) | $45.12 | $88.11 | 48.8% |

Selective Insurance Group (NasdaqGS:SIGI) | $92.76 | $179.45 | 48.3% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.50 | $32.41 | 49.1% |

Marriott Vacations Worldwide (NYSE:VAC) | $83.32 | $162.76 | 48.8% |

Associated Banc-Corp (NYSE:ASB) | $20.30 | $39.29 | 48.3% |

HeartCore Enterprises (NasdaqCM:HTCR) | $0.70415 | $1.41 | 49.9% |

Hexcel (NYSE:HXL) | $63.62 | $122.82 | 48.2% |

Vasta Platform (NasdaqGS:VSTA) | $3.01 | $5.81 | 48.2% |

Hesai Group (NasdaqGS:HSAI) | $4.24 | $8.41 | 49.6% |

Hecla Mining (NYSE:HL) | $4.86 | $9.48 | 48.7% |

We'll examine a selection from our screener results

monday.com

Overview: Monday.com Ltd. is a global company that develops software applications, operating in regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market capitalization of approximately $11.42 billion.

Operations: The company generates its revenue primarily from the Internet Software & Services segment, totaling $784.35 million.

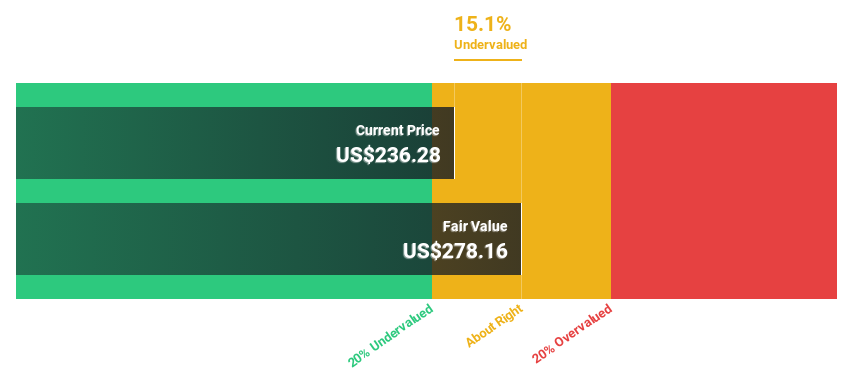

Estimated Discount To Fair Value: 15.1%

Monday.com is currently trading at US$236.28, below its estimated fair value of US$278.16, indicating a potential undervaluation by 15.1%. The company has recently transitioned to profitability with a reported net income of US$7.08 million for Q1 2024, reversing from a net loss the previous year. Forecasted revenue and earnings growth are robust, significantly outpacing the market with expectations of 20.4% and 34% per year respectively, suggesting strong future performance potential despite current equity returns forecasted to be modest at 15%.

AngloGold Ashanti

Overview: AngloGold Ashanti plc is a gold mining company with operations in Africa, Australia, and the Americas, boasting a market capitalization of approximately $10.26 billion.

Operations: The company generates its revenue primarily from the Metals & Mining - Gold & Other Precious Metals segment, totaling approximately $4.58 billion.

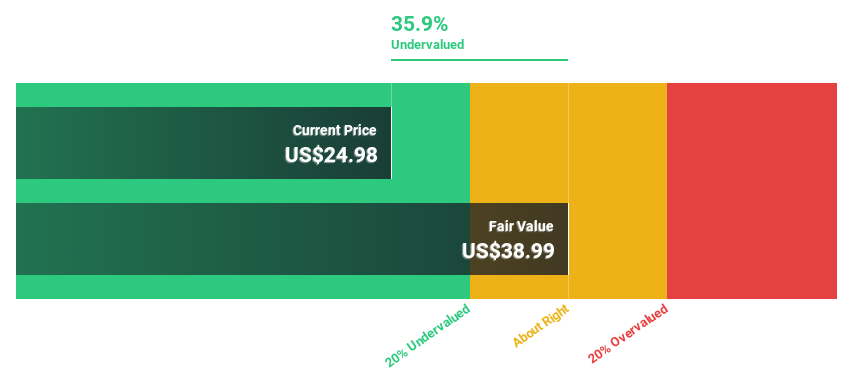

Estimated Discount To Fair Value: 35.9%

AngloGold Ashanti, valued at US$24.98, is significantly under its fair value of US$38.99, reflecting a 35.9% undervaluation based on discounted cash flows. The company is on track to become profitable within three years with earnings expected to grow by 40.34% annually, although its revenue growth at 8.1% per year lags behind the U.S market average of 8.7%. Recent operational improvements have led to increased gold production, highlighted by significant gains in recovered grades and efficiencies at key mines.

Carpenter Technology

Overview: Carpenter Technology Corporation specializes in manufacturing, fabricating, and distributing specialty metals across the United States, Europe, Asia Pacific, Mexico, Canada, and other international markets with a market capitalization of approximately $5.26 billion.

Operations: The company generates revenue primarily through its Specialty Alloys Operations and Performance Engineered Products segments, which collectively brought in approximately $2.39 billion and $418.50 million respectively.

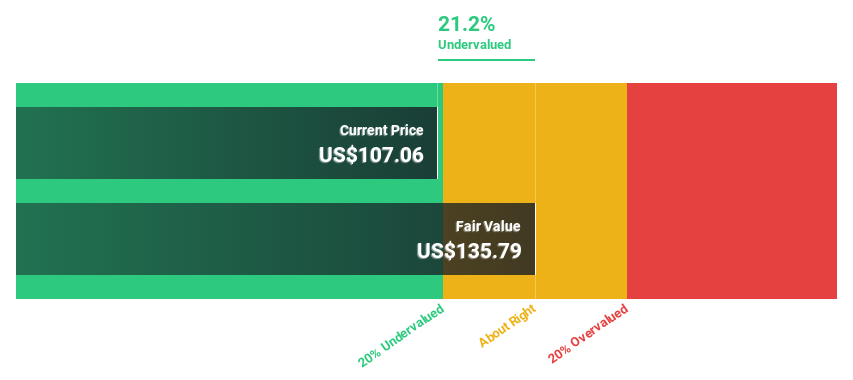

Estimated Discount To Fair Value: 21.2%

Carpenter Technology, priced at US$107.06, trades below its estimated fair value of US$135.79, indicating a substantial undervaluation. Despite a high debt level and shareholder dilution over the past year, the company's earnings are projected to grow by 27.4% annually. Recently, Carpenter raised its Q4 earnings guidance by about 8%, though it also reported a significant goodwill impairment of US$14.1 million for Q3 2024, reflecting some financial challenges alongside growth prospects.

Key Takeaways

Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 177 more companies for you to explore.Click here to unveil our expertly curated list of 180 Undervalued US Stocks Based On Cash Flows.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:MNDY NYSE:AU and NYSE:CRS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance