Top 5 Trades of Donald Smith's Firm

- By Sydnee Gatewood

Donald Smith & Co. released its second-quarter portfolio earlier this month.

Founded by the late Donald Smith (Trades, Portfolio) in 1980, the New York-based investment firm uses a deep-value, bottom-up approach to invest in out-of-favor stocks that are trading at a discount to tangible book value. According to the firm's website, the portfolio managers look for opportunities among companies that are in the bottom decile of price-tangible book ratios and have a positive earnings outlook over the next two to four years.

Based on these criteria, the firm added three new positions to the portfolio, divested of six holdings and added to or reduced a slew of other investments during the quarter ended June 30. Among the most notable trades was a new holding in Fifth Third Bancorp (NASDAQ:FITB), an increase in the Jefferies Financial Group In. (NYSE:JEF) stake and reductions of the Gold Fields Ltd. (NYSE:GFI), Kinross Gold Corp. (NYSE:KGC) and Air France-KLM (AFLYY) positions.

Fifth Third Bancorp

The firm invested in 786,079 shares of Fifth Third Bancorp, allocating 0.75% of the equity portfolio to the holding. The stock traded for an average price of $18.45 per share during the quarter.

The Cincinnati-based bank has a $15.01 billion market cap; its shares were trading around $21.07 on Friday with a price-earnings ratio of 10.86, a price-book ratio of 0.74 and a price-sales ratio of 2.05.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued. The GuruFocus valuation rank of 6 out of 10 also supports this assessment.

GuruFocus rated Fifth Third's financial strength 3 out of 10 on the back of a low cash-debt ratio that is underperforming versus other industry players. The weighted average cost of capital also significantly outperforms the return on invested capital, indicating the company is destroying value for shareholders.

The company's profitability did not fare much better with a 5 out of 10 rating. While its margins and returns are underperforming over half of its competitors, the moderate Piotroski F-Score of 5 implies business conditions are stable. Fifth Third also has a predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically return an average of 1.1% annually over a 10-year period.

Of the gurus invested in the bank, the T Rowe Price Equity Income Fund (Trades, Portfolio) has the largest stake with 1.55% of outstanding shares. Other top guru shareholders include Richard Pzena (Trades, Portfolio), Hotchkis & Wiley, Pioneer Investments (Trades, Portfolio), Robert Olstein (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), John Hussman (Trades, Portfolio) and Lee Ainslie (Trades, Portfolio).

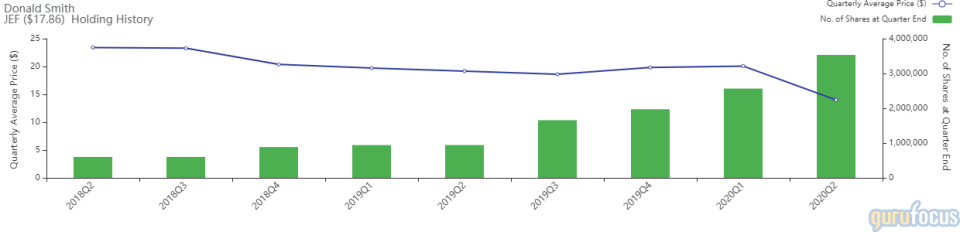

Jefferies Financial Group

With an impact of 0.74% on the equity portfolio, the firm boosted its Jefferies position by 37.67%, buying 966,558 shares. Shares traded for an average price of $14 each during the quarter.

It now holds 3.5 million shares total, which represent 2.71% of the total assets managed. GuruFocus estimates the firm has lost 4.40% on the investment since the second quarter of 2018.

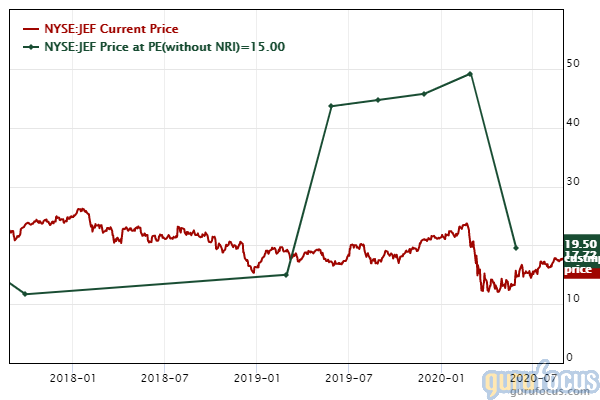

The investment bank and financial services company, which is headquartered in New York, has a market cap of $4.73 billion; its shares were trading around $17.75 on Friday with a price-earnings ratio of 13.65, a price-book ratio of 0.51 and a price-sales ratio of 1.21.

According to the Peter Lynch chart, the stock is undervalued. The GuruFocus valuation rank of 7 out of 10 supports this analysis.

Jefferies financial strength was rated 4 out of 10 by GuruFocus. Although the company has issued approximately $2.7 billion in new long-term debt over the past three years, it is at a manageable level as a result of adequate interest coverage. The low Altman Z-Score of 0.48, however, warns the company could be at risk of going bankrupt since it has recorded losses in operating income and declining revenue per share over the past several years. The WACC also surpasses the ROIC, indicating it is destroying value for shareholders.

The company's profitability scored a 5 out of 10 rating. In addition to strong margins, Jefferies' returns outperform a majority of industry peers. It also has a moderate Piotroski F-Score of 5 and a one-star predictability rank.

With a 6.77% stake, First Pacific Advisors (Trades, Portfolio) is the company's largest guru shareholder. Steven Romick (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, Private Capital (Trades, Portfolio), Michael Price (Trades, Portfolio), Jones, Pioneer, Ainslie and Greenblatt also own the stock.

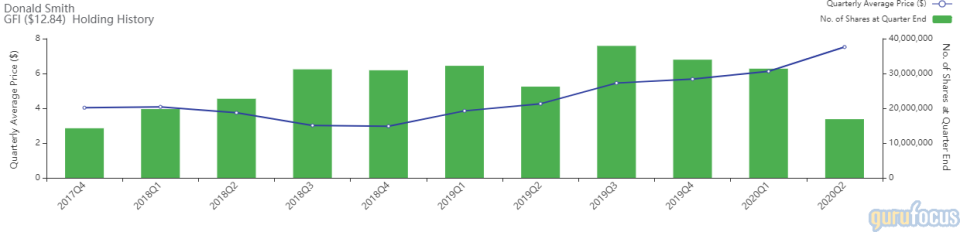

Gold Fields

Impacting the equity portfolio by -4.12%, the firm curbed its Gold Fields stake by 46.22%, selling 14.5 million shares. The stock traded for an average per-share price of $7.52 during the quarter.

The firm now holds a total of 16.8 million shares, which account for 7.81% of the total assets managed. GuruFocus data shows the firm has gained around 110.74% on the investment since the fourth quarter of 2017.

The South African mining company has an $11.6 billion market cap; its shares were trading around $13.15 on Friday with a price-earnings ratio of 46.85, a price-book ratio of 3.93 and a price-sales ratio of 3.53.

Based on the Peter Lynch chart and GuruFocus valuation rank of 1 out of 10, the stock appears to be overvalued.

GuruFocus rated Gold Fields' financial strength 5 out of 10. Despite the company issuing around $1.8 billion in new long-term debt over the past three years, it is at a manageable level due to sufficient interest coverage. The Altman Z-Score of 3.01 indicates it is in good standing even though the ROIC is lower than the WACC.

The miner's financial strength scored a 6 out of 10 rating, driven by an expanding operating margin, strong returns that outperform a majority of competitors and a high Piotroski F-Score of 7, which implies business conditions are healthy. Gold Fields also has a one-star predictability rank.

Jim Simons (Trades, Portfolio)' Renaissance Technologies is the largest guru shareholder of Gold Fields with a 2.24% stake. Pioneer, Ken Heebner (Trades, Portfolio) and Chuck Royce (Trades, Portfolio) also have positions in the stock.

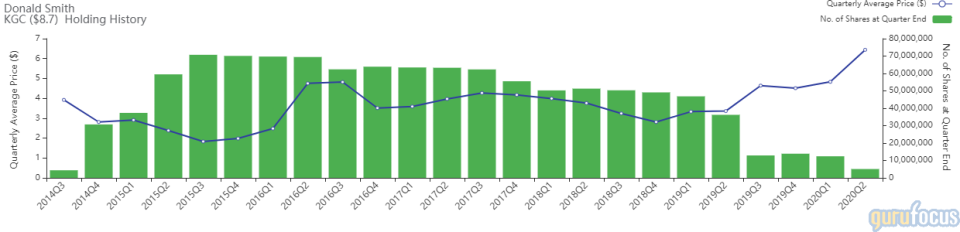

Kinross Gold

The firm sold 7.33 million shares of Kinross Gold, curbing the stake by 59.06%. The trade had an impact of -1.75% on the equity portfolio. During the quarter, the stock traded for an average price of $6.44 per share.

Representing1.81% of total assets managed, the firm now holds 5.08 million shares. According to GuruFocus, the firm has gained an estimated 77.19% on the investment since the third quarter of 2014.

The Canadian miner has a market cap of $11.16 billion; its shares were trading around $8.86 on Friday with a price-earnings ratio of 11.98, a price-book ratio of 1.88 and a price-sales ratio of 2.84.

The Peter Lynch chart suggests the stock is undervalued. The GuruFocus valuation rank of 3 out of 10, however, leans more toward overvaluation.

Kinross' financial strength was rated 6 out of 10 by GuruFocus. Although it has adequate interest coverage, the Altman Z-Score of 1.03 warns the company could be in danger of bankruptcy since its revenue per share has declined over the past five years. The ROIC, however, outperforms the WACC, suggesting value creation.

The company's profitability did not fare as well, scoring a 3 out of 10 rating even though margins and returns are outperforming a majority of industry peers. Kinross is also supported by a high Piotroski F-Score of 7 as well as a one-star predictability rank.

Of the gurus invested in Kinross, Simons' firm has the largest stake with 4.2% of outstanding shares. Pioneer, Heebner, First Eagle Investment (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), Hussman and Mario Gabelli (Trades, Portfolio) also hold the stock.

Air France-KLM

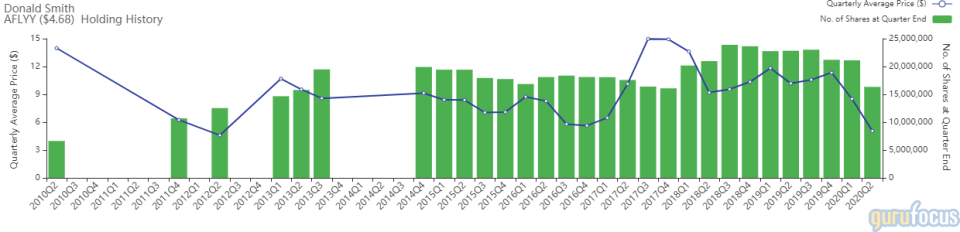

Reducing its stake in Air France-KLM by 22.61%, the firm sold 4.7 million shares. The transaction impacted the equity portfolio by -1.63%. During the quarter, shares traded for an average price of $5.05 each.

Accounting for 3.67% of the total assets managed, the firm now holds 16.34 million shares. GuruFocus estimates the investment has lost 37.62% since being established in the second quarter of 2010.

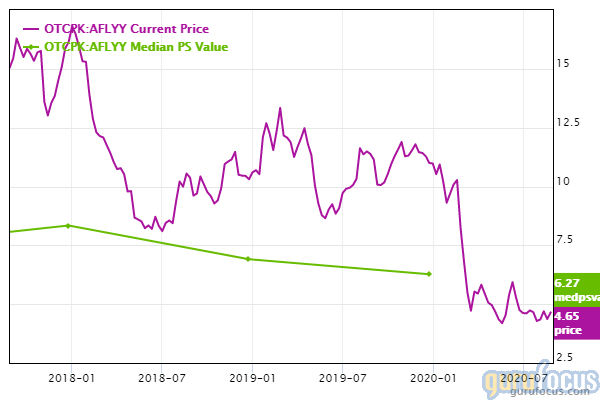

The French airline has a $1.99 billion market cap; its shares were trading around $4.65 on Friday with a price-sales ratio of 0.09.

According to the median price-sales chart, the stock is undervalued. The GuruFocus valuation rank of 6 out of 10 supports this assessment since the share price is near a five-year low.

Air France-KLM's financial strength was rated 3 out of 10 by GuruFocus. As a result of issuing approximately 2.2 billion euros ($2.6 billion) in new long-term debt over the past three years, the company has weak interest coverage. The low Altman Z-Score of -0.09 warns that the company could be in danger of going bankrupt.

The company's profitability scored a 4 out of 10 rating. Although the operating margin is expanding, the returns are negative and underperform a majority of competitors. It also has a low Piotroski F-Score of 3, which suggests business conditions are in poor shape. Due to a loss in operating income as well as declining revenue per share, the one-star predictability rank is on watch.

The firm is the only guru currently invested in the stock with a 3.82% stake.

Additional trades and portfolio composition

During the quarter, the firm also entered positions in Hawaiian Holdings Inc. (NASDAQ:HA) and Bristow Group Inc. (NYSE:VTOL) as well as increased its holdings of Equinox Gold Corp. (EQX) and Domtar Corp. (UFS). It also reduced its stakes in Iamgold Corp. (NYSE:IAG) and Micron Technology Inc. (NASDAQ:MU).

Over half of the firm's $2.03 billion equity portfolio is invested in the basic materials and industrials sectors, followed by a slightly smaller representation in the financial services space.

Disclosure: No positions.

Read more here:

The Top 5 Trades of George Soros' Firm

Larry Robbins Dives Into Laboratory Corp of America

John Paulson Buys TD Ameritrade, Trims Anglogold Ashanti and ViacomCBS

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance