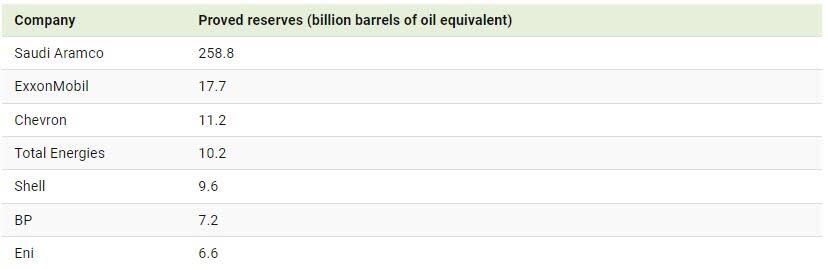

The Top 7 Oil Companies by Proved Reserves

Saudi Aramco controls 259 billion barrels worth of oil and gas reserves, which is unmatched by any other company globally. This is a key factor in the company’s massive $1.8 trillion valuation.

To illustrate that, Visual Capitalist's Marcus Lu created this chart to compare the proved reserves of major oil companies as of 2022.

Data was compiled by Statista from various company reports.

Crown Jewel

Saudi Aramco is the national oil company of Saudi Arabia. As of 2024, it is the sixth-largest company in the world by market capitalization.

Its oil reserves are over four times bigger than the reserves of all the other six companies on our list combined.

Behind Saudi Aramco, American company ExxonMobil comes in second with 17.7 billion barrels of oil equivalent, followed by another American company, Chevron, with 11.2 billion barrels of oil equivalent.

Saudi Aramco produces 9 million barrels of oil a day, more than any other firm and nearly a tenth of the world’s total.

In addition, the state-run oil giant is the world’s most profitable company, generating $722 billion in profits between 2016 and 2023.

Saudi Aramco is also expected to play a big part in Saudi Arabia’s plans to diversify its economy and reduce oil dependence. Recently, Saudi Arabia’s Crown Prince Mohammed Bin Salman confirmed that the kingdom is in talks to sell a 1% stake in the state oil giant, which could help fund the country’s projects in clean energy and technology.

If you enjoyed this post, be sure to check out this graphic, which ranks oil production by country.

By Zerohedge.com

More Top Reads From Oilprice.com:

Yahoo Finance

Yahoo Finance