Top Dividend Stocks On KRX In June 2024

Despite a recent hiccup in its two-day winning streak, the South Korean stock market remains a point of interest for investors, particularly as it hovers around the 2,780-point plateau. Amidst mixed global signals and domestic economic updates on industrial production and retail sales, investors continue to monitor the KRX for opportunities. In this context, understanding what constitutes a resilient dividend stock becomes crucial. Stocks that consistently offer dividends can be appealing, especially in a market characterized by such fluctuations and amidst broader economic indicators suggesting cautious optimism.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.33% | ★★★★★★ |

NH Investment & Securities (KOSE:A005940) | 6.30% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.02% | ★★★★★☆ |

KT (KOSE:A030200) | 5.35% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.49% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.36% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.90% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.01% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.65% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

NOROO Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOROO Holdings Co., Ltd. is a general fine chemical company based in South Korea, with a market capitalization of approximately ₩138.94 billion.

Operations: NOROO Holdings Co., Ltd.'s revenue is primarily generated from Architectural and Industrial Paints (₩800.42 billion), Automotive Paint (₩441.57 billion), PCM Paint (₩220.23 billion), and the Agricultural Life Sector (₩28.91 billion).

Dividend Yield: 3.9%

NOROO Holdings has shown robust earnings growth with a significant increase in net income and sales in Q1 2024. Despite this, the company's dividend history over the past five years has been marked by volatility and unreliability. Dividends are well-covered by both earnings, with a payout ratio of 15.8%, and cash flows, indicating sustainability from a financial perspective. However, NOROO's short dividend payment history and unstable track record might concern long-term dividend investors seeking consistency.

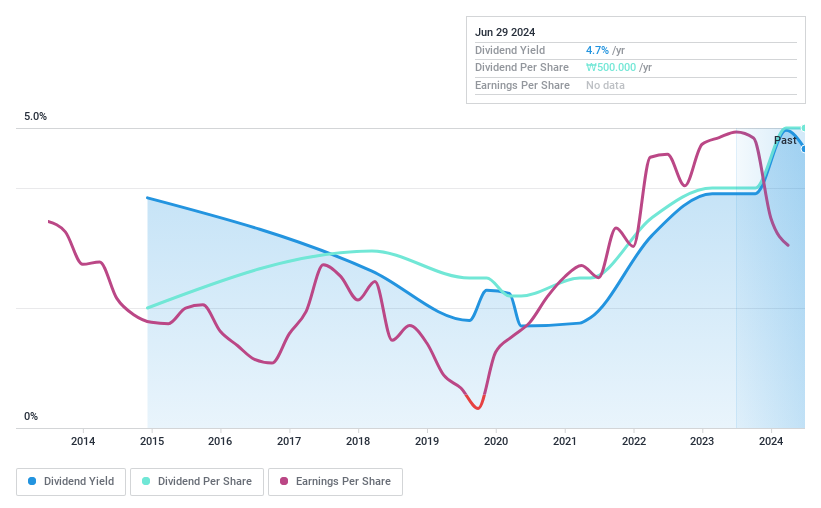

Kyung Nong

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyung Nong Corporation, based in South Korea, specializes in the production and sale of agricultural chemicals with a market capitalization of approximately ₩192.04 billion.

Operations: Kyung Nong Corporation generates its revenue primarily through the production and sale of agricultural chemicals.

Dividend Yield: 4.7%

Kyung Nong Corporation's Q1 2024 earnings showed a decrease in both sales and net income, with figures at KRW 136.72 billion and KRW 27.44 million respectively, compared to the previous year. The company has a history of unstable and volatile dividend payments over the past decade, despite having a reasonable payout ratio of 50.2% and cash payout ratio of 50.8%, which suggests dividends are supported by earnings and cash flows. Additionally, its price-to-earnings ratio stands below the South Korean market average, potentially indicating value at current prices.

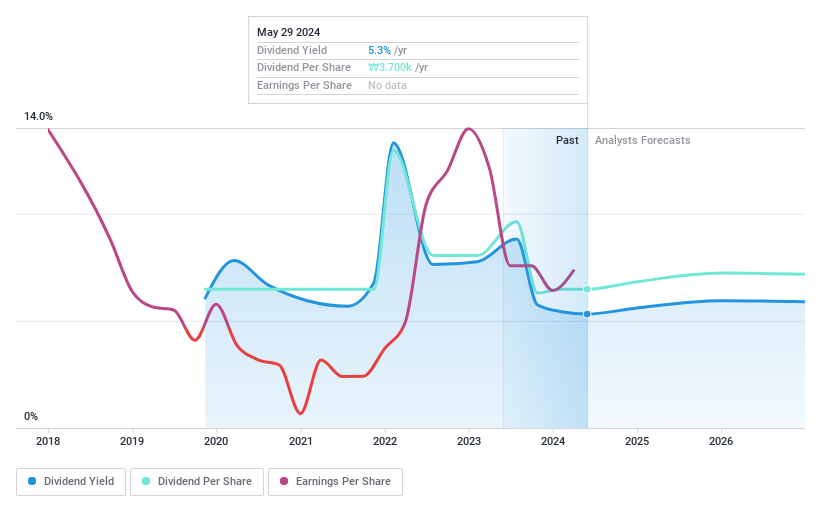

HD Hyundai

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HD Hyundai Co., Ltd. operates in the oil refining sector both in Korea and globally, with a market capitalization of approximately ₩5.26 trillion.

Operations: HD Hyundai Co., Ltd. primarily focuses on the oil refining industry, serving both domestic and international markets.

Dividend Yield: 5%

HD Hyundai's recent financial performance shows a significant increase in net income from KRW 62.13 billion to KRW 203.15 billion, boosting earnings per share similarly from KRW 879 to KRW 2,875. Despite this growth, the company's dividend history is marked by instability and no growth over the past five years, with a high payout ratio of 80.2% but a low cash payout ratio of 13.5%, suggesting dividends are well-covered by cash flows yet potentially at risk due to earnings volatility and high debt levels.

Click here to discover the nuances of HD Hyundai with our detailed analytical dividend report.

The valuation report we've compiled suggests that HD Hyundai's current price could be inflated.

Make It Happen

Click this link to deep-dive into the 71 companies within our Top KRX Dividend Stocks screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A000320 KOSE:A002100 and KOSE:A267250.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance