Top Dividend Stocks To Watch In June 2024

Over the past year, the United States stock market has shown robust growth with a 23% increase, despite a recent flat performance over the last week. In this climate of anticipated 15% annual earnings growth, dividend stocks continue to attract attention for their potential to offer both stability and steady income.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.65% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.10% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.34% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.09% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.08% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.89% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.83% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.88% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.96% | ★★★★★★ |

Citizens & Northern (NasdaqCM:CZNC) | 6.58% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

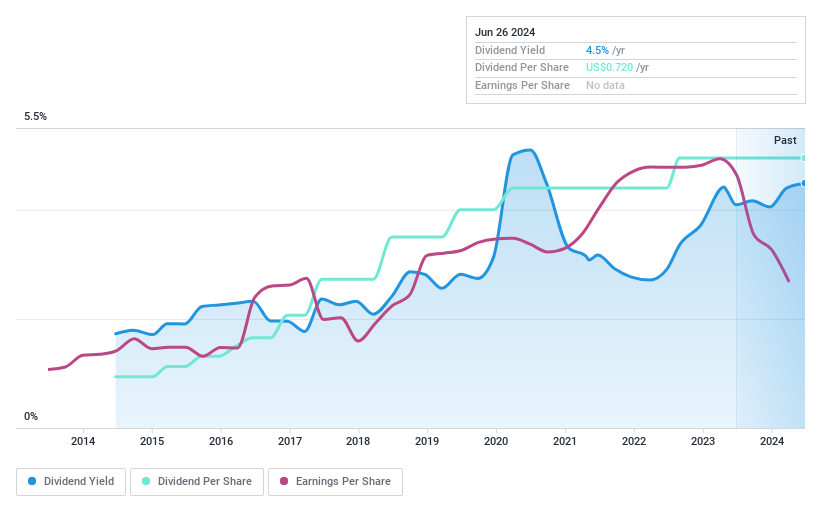

Parke Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parke Bancorp, Inc., serving as the bank holding company for Parke Bank, offers personal and business financial services to individuals and small to mid-sized businesses with a market capitalization of approximately $185.30 million.

Operations: Parke Bancorp, Inc. generates its revenue primarily through its community banking segment, which amounted to $66.54 million.

Dividend Yield: 4.5%

Parke Bancorp recently affirmed a dividend of US$0.18 per share, maintaining its history of reliable payouts, characterized by a steady increase over the past decade. Despite this consistency, its current yield of 4.49% is slightly below the top quartile in the U.S market. Financially, Parke reported a decrease in both net interest income and net profit from last year, with earnings also declining. The company's dividends are supported by a reasonable payout ratio of 36.7%, suggesting sustainability despite recent financial setbacks.

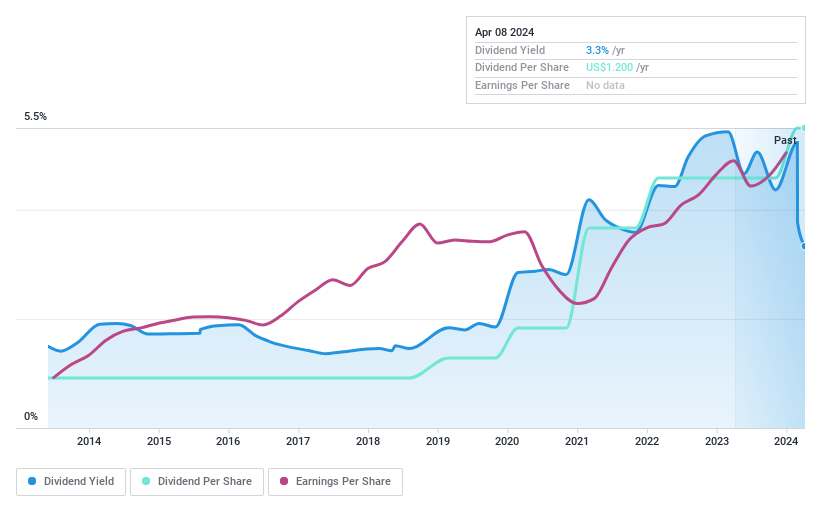

CompX International

Simply Wall St Dividend Rating: ★★★★★★

Overview: CompX International Inc., primarily operating in North America, focuses on manufacturing and selling security products and recreational marine components, with a market capitalization of approximately $298 million.

Operations: CompX International Inc. generates its revenue from two main segments: marine components, which brought in $34.38 million, and security products, contributing $123.73 million.

Dividend Yield: 5%

CompX International recently confirmed a quarterly dividend of US$0.30 per share, maintaining its pattern of stable dividends. Despite a decrease in sales and net income in the first quarter of 2024, with sales dropping from US$41.15 million to US$37.97 million and net income falling from US$6.07 million to US$3.75 million, the company's dividend remains well-covered by earnings with a payout ratio of 63.8%. Additionally, its dividend yield stands at 4.96%, placing it among the higher echelons in the U.S market, supported further by a cash payout ratio of 63.5%.

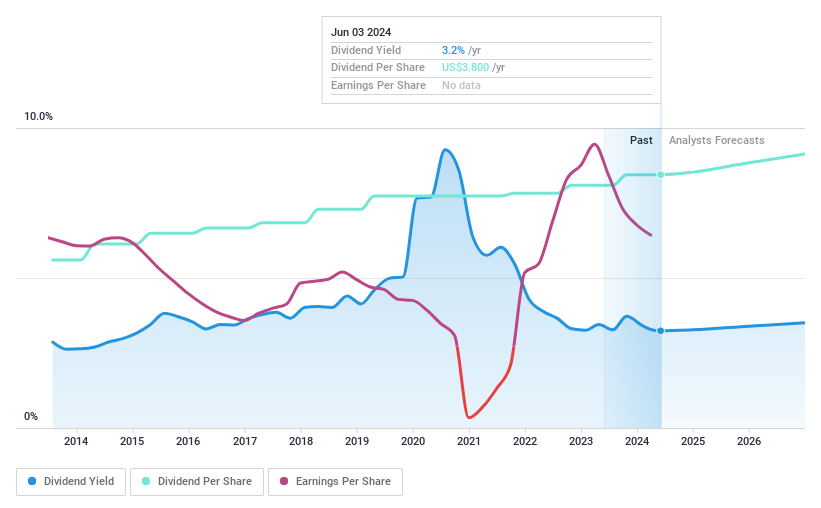

Exxon Mobil

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation, a global leader in the exploration and production of crude oil and natural gas, operates both in the United States and internationally with a market capitalization of approximately $450.89 billion.

Operations: Exxon Mobil Corporation's revenue is generated through various segments including Chemicals ($16.18 billion in the U.S. and $18.16 billion internationally), Upstream operations ($30.92 billion in the U.S. and $53.78 billion internationally), Energy Products ($128.34 billion in the U.S. and $191.99 billion internationally), and Specialty Products ($8.49 billion in the U.S. and $12.84 billion internationally).

Dividend Yield: 3.3%

Exxon Mobil's dividends are well-supported by both earnings and cash flows with payout ratios of 45.7% and 46.7% respectively, ensuring sustainability despite a dividend yield of 3.32%, which is below the top quartile in the U.S market at 4.79%. The company has maintained stable dividends over the past decade, reflecting reliability. Recently, Exxon Mobil signed an MOU with SK On to supply lithium for EV batteries, aligning with its strategic diversification into essential materials for clean energy technologies.

Turning Ideas Into Actions

Investigate our full lineup of 205 Top Dividend Stocks right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:PKBK NYSEAM:CIX and NYSE:XOM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance