Top High Growth Tech Stocks To Watch In October 2024

As global markets reach record highs fueled by China's robust stimulus measures and optimism around artificial intelligence, the technology sector continues to outperform. In this environment, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on market momentum and innovation trends.

Top 10 High Growth Tech Companies

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

Medley | 24.98% | 30.36% | ★★★★★★ |

Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

KebNi | 34.75% | 86.11% | ★★★★★★ |

Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

REA Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited, with a market cap of A$26.53 billion, operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam and other international markets.

Operations: REA Group generates revenue primarily from property and online advertising in Australia (A$1.25 billion) and financial services (A$320.60 million), with additional contributions from its operations in India (A$103.10 million). The company focuses on leveraging its digital platforms to provide comprehensive real estate listings and related services across multiple international markets.

REA Group, amidst a challenging year with a 15% earnings contraction, still projects an optimistic future with expected annual profit growth of 16.7%, outpacing the Australian market's forecast of 12.1%. This resilience is underscored by their commitment to innovation and development, as evidenced by substantial R&D investments which align closely with revenue growth forecasts of 6.4% annually—exceeding the broader Australian market's expectation of 5.5%. Furthermore, the company recently increased its dividend payout by 23%, reflecting confidence in sustained cash flows and financial health despite recent one-off losses totaling A$153.6 million that impacted last year’s financials. These strategic decisions highlight REA Group’s robust operational framework geared towards long-term value creation in the competitive Interactive Media and Services industry.

Delve into the full analysis health report here for a deeper understanding of REA Group.

Gain insights into REA Group's historical performance by reviewing our past performance report.

Shanghai Baosight SoftwareLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Baosight Software Co., Ltd. provides industrial solutions in China and has a market cap of CN¥79.98 billion.

Operations: Baosight Software specializes in delivering industrial solutions within China. The company generates revenue from various segments, with a market cap of CN¥79.98 billion.

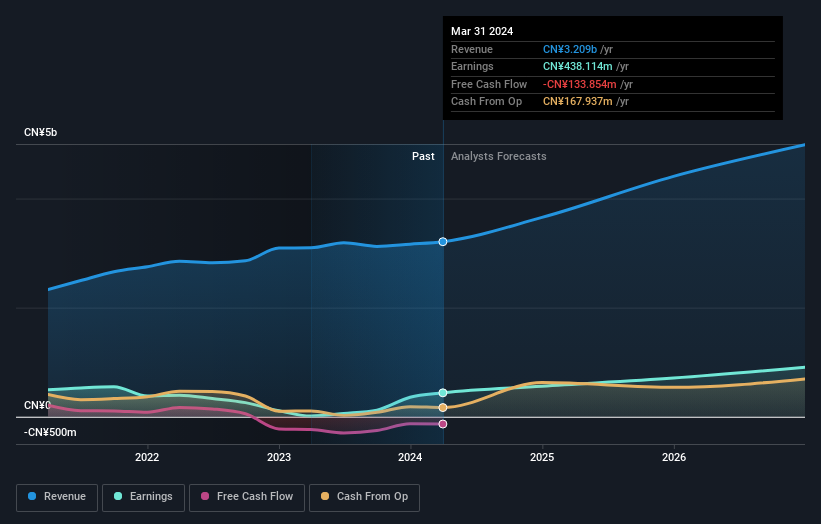

Shanghai Baosight Software Co., Ltd. has demonstrated robust financial performance with a notable 18.8% increase in annual revenue growth, surpassing the Chinese market average of 13.2%. This growth trajectory is complemented by an impressive forecast of earnings growth at 21.3% annually, although slightly trailing the broader market expectation of 23.2%. The company's strategic focus on R&D is evident from its substantial investment in this area, aligning closely with its revenue enhancements and positioning it well for sustained innovation and market competitiveness in software solutions. Recent events such as their successful Q2 earnings call and a special shareholders meeting underscore proactive management actions aimed at maintaining momentum amidst dynamic market conditions.

Winning Health Technology Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. (ticker: SZSE:300253) specializes in providing healthcare information technology solutions and has a market cap of CN¥15.86 billion.

Operations: Winning Health Technology Group generates revenue primarily from healthcare information technology solutions. The company has a market cap of CN¥15.86 billion.

Winning Health Technology Group Co., Ltd. has demonstrated significant financial momentum, with earnings forecasted to surge by 30.9% annually, outpacing the broader Chinese market's expectation of 23.2%. This growth is underpinned by a robust commitment to research and development, evidenced by a substantial increase in R&D expenses which align closely with revenue growth trends. The company recently announced plans for share repurchases and adjustments to performance appraisal goals during their special shareholders meeting, signaling proactive governance aligned with their aggressive growth strategy. These strategic moves are set against a backdrop of increasing revenue, up from CNY 1,191.84 million to CNY 1,223.74 million year-over-year as reported in their latest earnings announcement.

Taking Advantage

Explore the 1291 names from our High Growth Tech and AI Stocks screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:REA SHSE:600845 and SZSE:300253.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com