Top Hong Kong Dividend Stocks To Watch In June 2024

As of June 2024, the Hong Kong market has shown resilience with the Hang Seng Index posting modest gains amidst a mixed economic backdrop, characterized by robust retail sales growth and ongoing challenges in the real estate sector. In this context, dividend stocks continue to attract attention for their potential to offer investors steady income streams in a fluctuating market environment.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.18% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.81% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.51% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.40% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.68% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.37% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.28% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.89% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 7.96% | ★★★★★☆ |

Click here to see the full list of 88 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Xingda International Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Xingda International Holdings Limited operates as an investment holding company, specializing in the manufacture and trade of radial tire cords, bead wires, and other related products across various countries including the People's Republic of China, India, the United States, Thailand, Korea, Slovakia, and Brazil; it has a market capitalization of approximately HK$2.57 billion.

Operations: Xingda International Holdings Limited generates revenue primarily from the sale of radial tire cords, bead wires, and other wires, totaling CN¥11.49 billion.

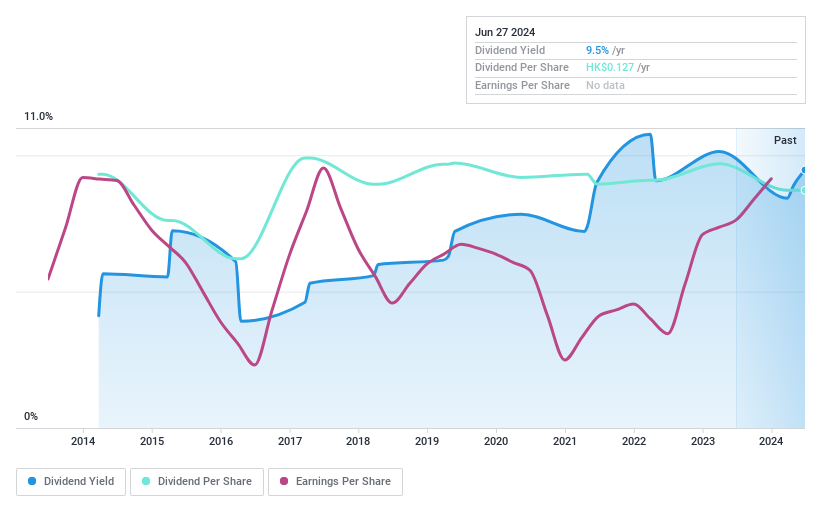

Dividend Yield: 9.5%

Xingda International Holdings offers a high dividend yield of 9.46%, ranking in the top 25% of Hong Kong dividend payers, supported by a reasonable cash payout ratio of 55.3% and an earnings payout ratio of 43.6%. Despite its attractive dividend yield, the company faces challenges with declining dividends over the past decade and high debt levels. Recent leadership changes, including new appointments within its executive ranks, may impact strategic directions affecting financial stability and dividend policies.

Bosideng International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited specializes in the research, design, development, manufacturing, marketing, and distribution of branded down apparel and non-down products as well as OEM services primarily in China, with a market capitalization of approximately HK$49.74 billion.

Operations: Bosideng International Holdings Limited generates revenue from branded down apparel, OEM products, and non-down apparel.

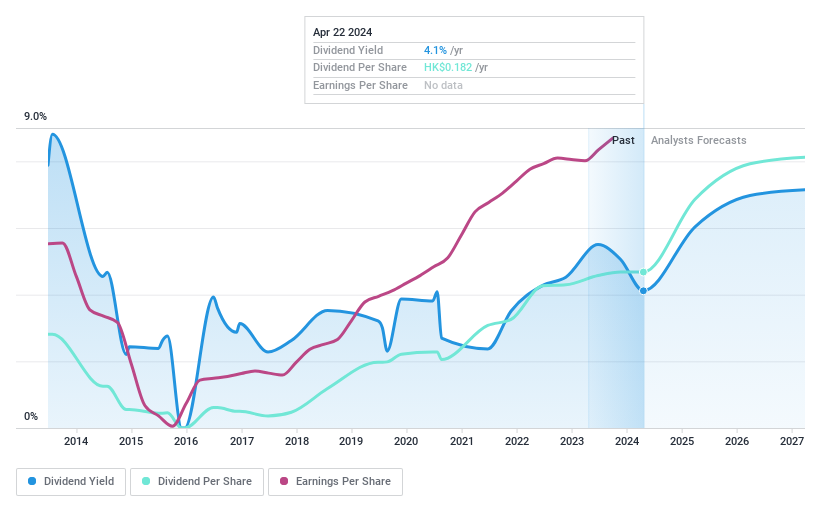

Dividend Yield: 4%

Bosideng International Holdings reported a significant revenue increase to CNY 23.21 billion and net income growth to CNY 3.07 billion for FY2024, reflecting a strong operational year. However, its dividend yield at 3.96% remains below the Hong Kong market's top quartile of 7.9%. Dividend payments have shown volatility over the past decade but are currently supported by a sustainable payout ratio of 42% from earnings and 50.1% from cash flows, indicating improved stability in shareholder returns despite historical inconsistencies.

China Mobile

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Mobile Limited operates as a telecommunications and information service provider in Mainland China and Hong Kong, with a market capitalization of approximately HK$1.64 trillion.

Operations: China Mobile Limited generates revenue primarily through its telecommunications and information related businesses, totaling CN¥1.02 billion.

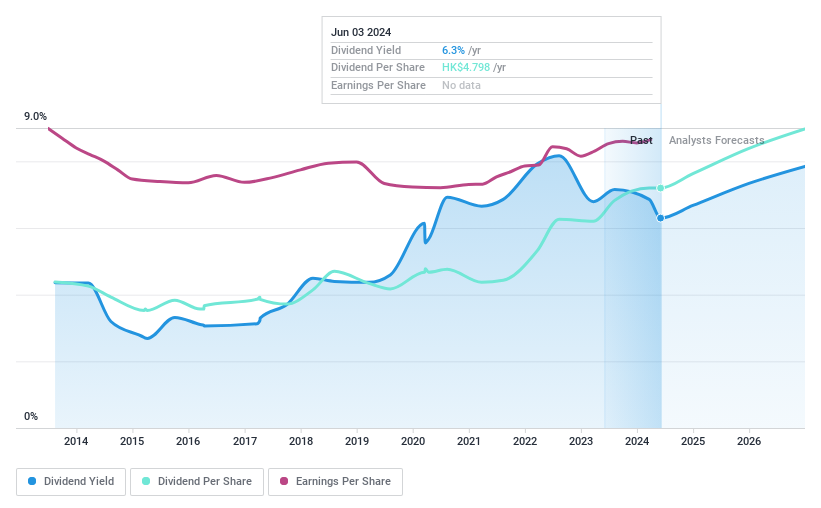

Dividend Yield: 6.4%

China Mobile has demonstrated a consistent capability in dividend distribution, with an increase in dividends over the past decade. As of Q1 2024, the company reported revenues of CNY 263.71 billion and net income of CNY 29.61 billion, indicating a stable financial position. The dividend payout is sustainable with a payout ratio at 70.3% from earnings and covered by cash flows at 89%. However, its current dividend yield stands at 6.37%, which is below the top quartile for Hong Kong market dividend payers at 7.9%. Recent technological advancements through partnerships, such as the development of an 800G hollow-core fibre transmission network, underscore its commitment to innovation in telecommunications.

Key Takeaways

Gain an insight into the universe of 88 Top Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1899 SEHK:3998 and SEHK:941.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance