Top Ranked Growth Stocks to Buy for April 24th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, April 24th:

The Sherwin-Williams Company (SHW): This developer of specialty chemicals, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 0.7% over the last 60 days.

The Sherwin-Williams Company Price and Consensus

The Sherwin-Williams Company price-consensus-chart | The Sherwin-Williams Company Quote

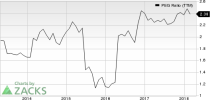

Sherwin-Williams has a PEG ratio 1.73, compared with 2.41 for the industry. The company possesses a Growth Score of A.

The Sherwin-Williams Company PEG Ratio (TTM)

The Sherwin-Williams Company peg-ratio-ttm | The Sherwin-Williams Company Quote

Mellanox Technologies, Ltd. (MLNX): This fabless semiconductor company, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 11.2% over the last 60 days.

Mellanox Technologies, Ltd. Price and Consensus

Mellanox Technologies, Ltd. price-consensus-chart | Mellanox Technologies, Ltd. Quote

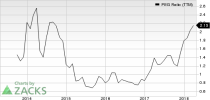

Mellanox Technologies has a PEG ratio 1.23, compared with 1.47 for the industry. The company possesses a Growth Score of A.

Mellanox Technologies, Ltd. PEG Ratio (TTM)

Mellanox Technologies, Ltd. peg-ratio-ttm | Mellanox Technologies, Ltd. Quote

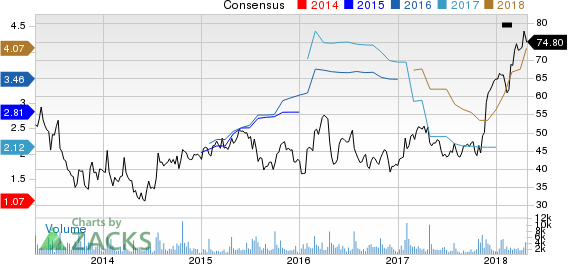

Patrick Industries, Inc. (PATK): This distributor of building products, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 3.9% over the last 60 days.

Patrick Industries, Inc. Price and Consensus

Patrick Industries, Inc. price-consensus-chart | Patrick Industries, Inc. Quote

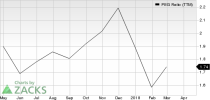

Patrick Industries has a PEG ratio 1.09, compared with 1.13 for the industry. The company possesses a Growth Score of A.

Patrick Industries, Inc. PEG Ratio (TTM)

Patrick Industries, Inc. peg-ratio-ttm | Patrick Industries, Inc. Quote

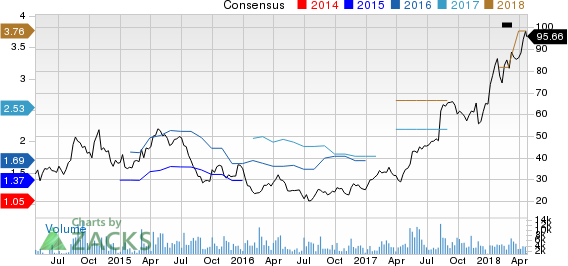

Autohome Inc. (ATHM): This online destination for automobile consumers, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 18.2% over the last 60 days.

Autohome Inc. Price and Consensus

Autohome Inc. price-consensus-chart | Autohome Inc. Quote

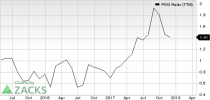

Autohome has a PEG ratio 0.76, compared with 1.68 for the industry. The company possesses a Growth Score of A.

Autohome Inc. PEG Ratio (TTM)

Autohome Inc. peg-ratio-ttm | Autohome Inc. Quote

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Sherwin-Williams Company (SHW) : Free Stock Analysis Report

Patrick Industries, Inc. (PATK) : Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

Autohome Inc. (ATHM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance