Top Ranked Value Stocks to Buy for May 7th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, May 7th:

Customers Bancorp, Inc. (CUBI): This bank holding company has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 45.9% over the last 60 days.

Customers Bancorp, Inc Price and Consensus

Customers Bancorp, Inc price-consensus-chart | Customers Bancorp, Inc Quote

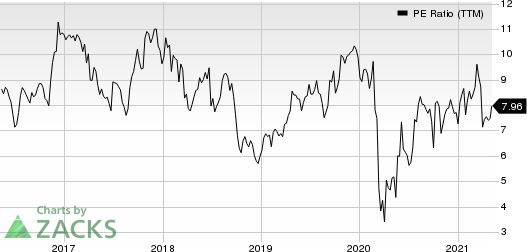

Customers Bancorp has a price-to-earnings ratio (P/E) of 4.81, compared with 12.70 for the industry. The company possesses a Value Score of A.

Customers Bancorp, Inc PE Ratio (TTM)

Customers Bancorp, Inc pe-ratio-ttm | Customers Bancorp, Inc Quote

Group 1 Automotive, Inc. (GPI): This seller of new and used cars, light trucks, and vehicle parts has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 5.4% over the last 60 days.

Group 1 Automotive, Inc. Price and Consensus

Group 1 Automotive, Inc. price-consensus-chart | Group 1 Automotive, Inc. Quote

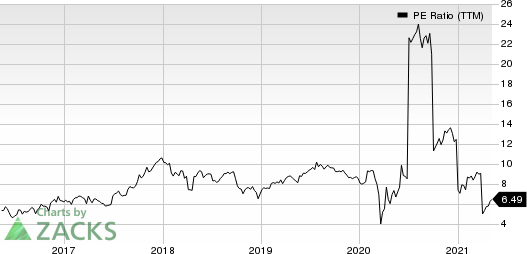

Group 1 Automotive has a price-to-earnings ratio (P/E) of 9.22, compared with 13.60 for the industry. The company possesses a Value Score of A.

Group 1 Automotive, Inc. PE Ratio (TTM)

Group 1 Automotive, Inc. pe-ratio-ttm | Group 1 Automotive, Inc. Quote

M/I Homes, Inc. (MHO): This single-family home builder has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 42.4% over the last 60 days.

M/I Homes, Inc. Price and Consensus

M/I Homes, Inc. price-consensus-chart | M/I Homes, Inc. Quote

M/I Homes has a price-to-earnings ratio (P/E) of 6.87, compared with 9.90 for the industry. The company possesses a Value Score of A.

M/I Homes, Inc. PE Ratio (TTM)

M/I Homes, Inc. pe-ratio-ttm | M/I Homes, Inc. Quote

Santander Consumer USA Holdings Inc. (SC): This specialized consumer finance company has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 86.1% over the last 60 days.

Santander Consumer USA Holdings Inc. Price and Consensus

Santander Consumer USA Holdings Inc. price-consensus-chart | Santander Consumer USA Holdings Inc. Quote

Santander Consumer USA has a price-to-earnings ratio (P/E) of 5.81, compared with 8.70 for the industry. The company possesses a Value Score of A.

Santander Consumer USA Holdings Inc. PE Ratio (TTM)

Santander Consumer USA Holdings Inc. pe-ratio-ttm | Santander Consumer USA Holdings Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Santander Consumer USA Holdings Inc. (SC) : Free Stock Analysis Report

MI Homes, Inc. (MHO) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Customers Bancorp, Inc (CUBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance