Top Three Dividend Stocks For July 2024

As global markets navigate through a mix of quiet trading periods and anticipatory adjustments ahead of key economic events, investors continue to seek reliable income streams. In this context, dividend stocks remain a compelling option for those looking to balance potential market volatility with steady returns.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.11% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.51% | ★★★★★★ |

Globeride (TSE:7990) | 3.75% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.70% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.91% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.04% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

James Latham (AIM:LTHM) | 6.35% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

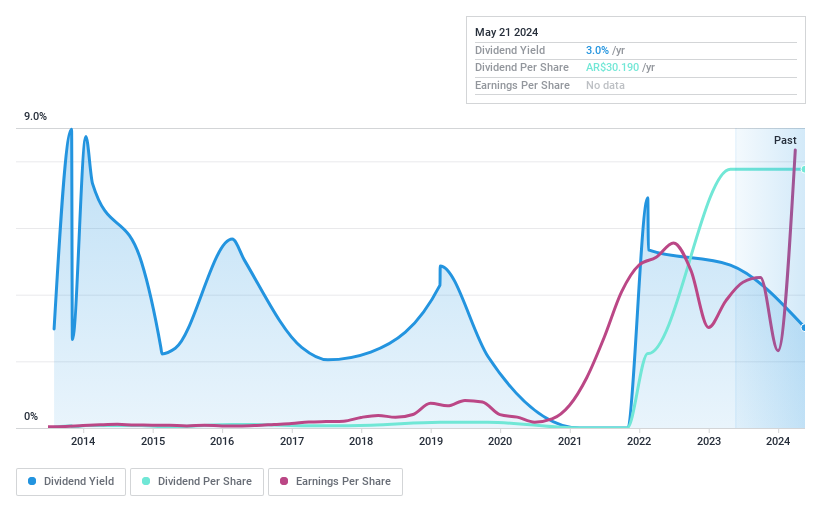

Ternium Argentina

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ternium Argentina S.A. is a company that manufactures, produces, and processes various steel products in Argentina, with a market capitalization of approximately ARS 4.40 trillion.

Operations: Ternium Argentina S.A. generates revenue primarily from two segments: Coated steel products, which brought in ARS 0.55 billion, and Uncoated steel products, contributing ARS 0.65 billion.

Dividend Yield: 3.1%

Ternium Argentina reported a significant increase in sales and net income for Q1 2024, with sales rising to ARS 436.39 billion from ARS 165.53 billion, and net income climbing to ARS 216.61 billion from ARS 50.35 billion year-over-year. However, the company faces challenges with its dividend sustainability; despite a yield of 3.1%, the dividend coverage is weak due to a high payout ratio of 109.5%. Additionally, Ternium Argentina's recent legal setback could further strain finances, as potential indemnifications might reach approximately US$0.8 billion following an adverse court decision regarding past acquisitions.

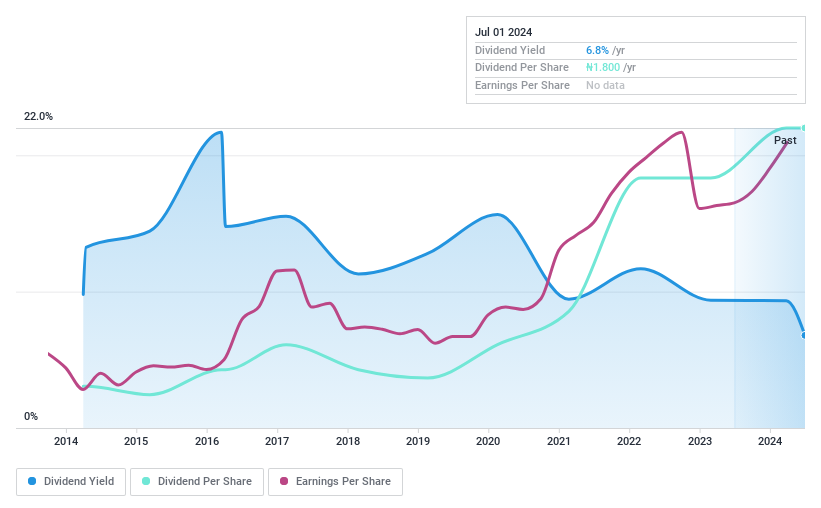

United Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Capital Plc operates in Nigeria, offering services such as investment banking, portfolio management, securities trading, and trusteeship with a market capitalization of approximately NGN 159 billion.

Operations: United Capital Plc generates revenue primarily through its brokerage services, totaling approximately ₦20.62 billion.

Dividend Yield: 6.8%

United Capital Plc demonstrated robust growth in Q1 2024, with revenue climbing to NGN 6.14 billion from NGN 5.34 billion year-over-year and net income increasing to NGN 3.59 billion from NGN 2.44 billion. Despite a decade of increasing dividend payments, the company's dividends have shown volatility and unreliability over the same period. Currently, its dividends are supported by earnings with an 86% payout ratio and strong cash flows, evidenced by a low cash payout ratio of 21.4%. However, its dividend yield of 6.79% barely trails the top quartile of Nigerian market payers at 6.82%.

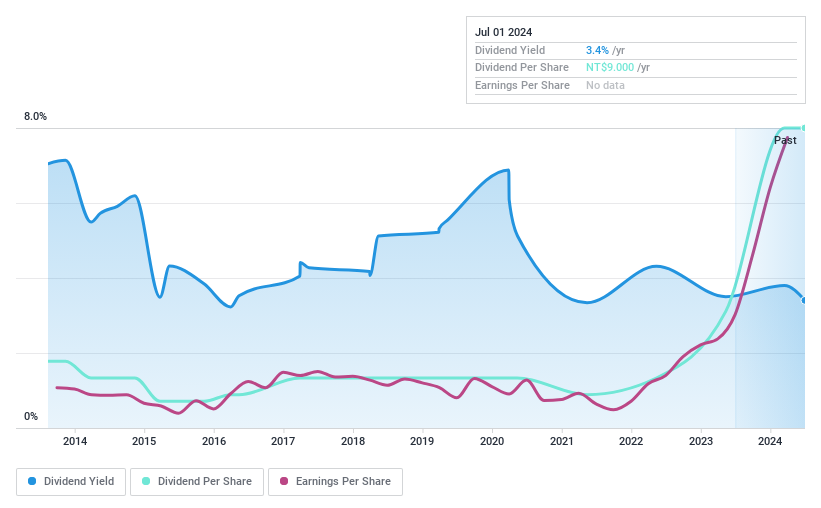

L&K Engineering

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering Co., Ltd. specializes in providing turnkey engineering services across Taiwan, Hong Kong, and internationally, with a market capitalization of NT$55.93 billion.

Operations: L&K Engineering Co., Ltd.'s revenue is primarily derived from three segments: L1 Company generating NT$17.34 billion, L2 Company contributing NT$15.15 billion, and The Company itself accounting for NT$37.08 billion.

Dividend Yield: 3.4%

L&K Engineering has experienced significant earnings growth, with a 226.4% increase this past year, enhancing its ability to sustain dividends. Despite a decade of dividend increases, payments have been inconsistent, showing over 20% annual fluctuations. The dividends are well-covered by both earnings and cash flows, with payout ratios of 58.1% and 24.9%, respectively. However, the current dividend yield of 3.4% is below the top quartile in its market at 4.25%. Recent corporate governance changes may impact future operations and dividend policies.

Click to explore a detailed breakdown of our findings in L&K Engineering's dividend report.

Our valuation report unveils the possibility L&K Engineering's shares may be trading at a discount.

Make It Happen

Delve into our full catalog of 1959 Top Dividend Stocks here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BASE:TXAR NGSE:UCAP and TWSE:6139.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance