Top Three Dividend Stocks For July 2024

As global markets experience fluctuations with indices like the S&P 500 reaching new highs amidst a cooling labor market and falling interest rates, investors may find refuge in dividend stocks, known for providing steady income streams. In such an environment, selecting robust dividend-yielding stocks could be a prudent strategy for those seeking to balance growth with financial stability.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Guaranty Trust Holding (NGSE:GTCO) | 7.10% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.97% | ★★★★★★ |

Allianz (XTRA:ALV) | 5.26% | ★★★★★★ |

Globeride (TSE:7990) | 3.80% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.74% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.42% | ★★★★★★ |

James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 4.37% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Dubai Refreshment (P.J.S.C.)

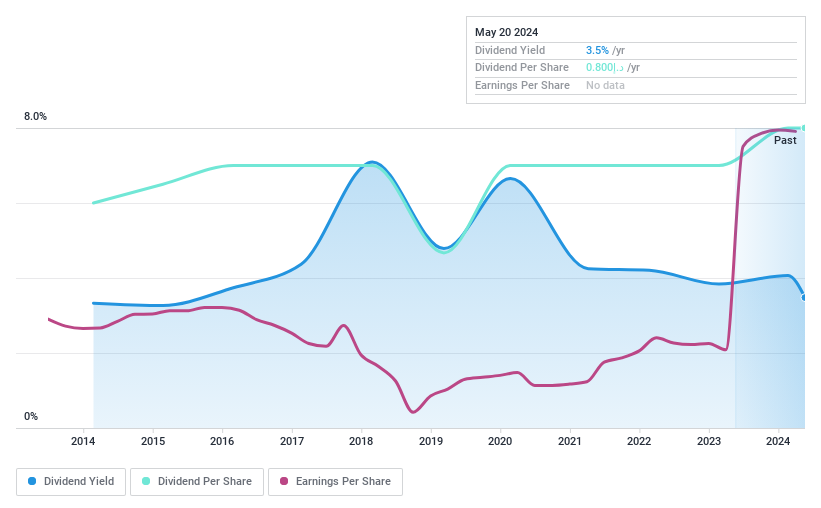

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) is a company that bottles and distributes Pepsi Cola International products across Dubai, Sharjah, and the Northern Emirates of the UAE, with a market capitalization of AED 1.86 billion.

Operations: Dubai Refreshment (P.J.S.C.) generates revenue primarily through its wholesale groceries segment, which amounted to AED 802.16 million.

Dividend Yield: 3.9%

Dubai Refreshment (P.J.S.C.) offers a modest dividend yield of 3.86%, which is lower than the top quartile in the AE market at 7.22%. Although dividends have increased over the past decade, their payments have shown volatility with significant annual drops exceeding 20%. The company maintains a low payout ratio of 20.2%, ensuring earnings comfortably cover dividends, complemented by a cash payout ratio of 56.6%. Recent financials indicate slight declines in sales and net income, with Q1 sales at AED 167.45 million and net income at AED 25.66 million, down from the previous year's figures.

Arwana Citramulia

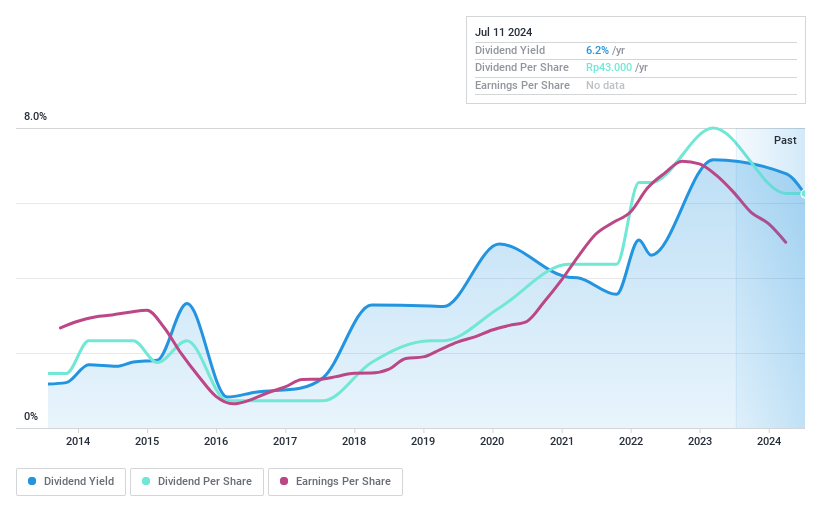

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PT Arwana Citramulia Tbk and its subsidiaries are engaged in the manufacturing and distribution of ceramic tiles across Indonesia, with a market capitalization of approximately IDR 4.97 billion.

Operations: PT Arwana Citramulia Tbk generates revenue primarily through two segments: IDR 2.33 billion from distribution and IDR 2.36 billion from manufacturing of ceramic tiles.

Dividend Yield: 6.2%

PT Arwana Citramulia Tbk's dividend yield of 6.23% ranks in the top 25% of Indonesian market payers, reflecting a robust rate despite challenges. However, its dividends are not fully supported by free cash flow or earnings, with a high cash payout ratio of 160.5% and earnings coverage at 77.2%. Recent financials show a decrease in Q1 sales to IDR 632.23 billion and net income to IDR 104.80 billion, alongside a drop in basic EPS from IDR 19.79 to IDR 14.27 year-over-year, signaling potential pressure on future dividend sustainability and stability.

Take a closer look at Arwana Citramulia's potential here in our dividend report.

Upon reviewing our latest valuation report, Arwana Citramulia's share price might be too optimistic.

Jiangsu chunlan refrigerating equipment stockltd

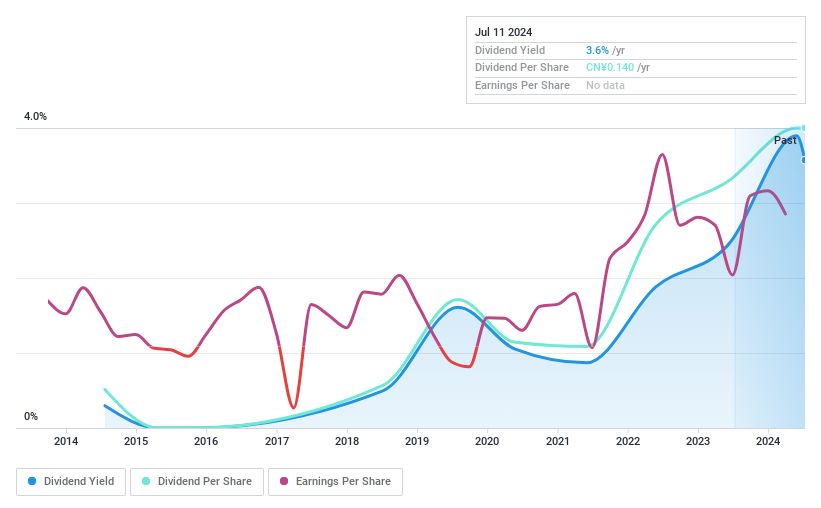

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Chunlan Refrigerating Equipment Stock Co., Ltd. is a company engaged in the manufacture and sale of refrigeration equipment, with a market capitalization of approximately CN¥1.85 billion.

Operations: The revenue segments for Jiangsu Chunlan Refrigerating Equipment Stock Co., Ltd. are not specified in the provided text.

Dividend Yield: 3.6%

Jiangsu Chunlan Refrigerating Equipment Stock Ltd. offers a dividend yield of 3.57%, placing it in the top quartile of Chinese market payers. Despite this, its dividend sustainability is questionable with a cash payout ratio at 396.7% and earnings coverage at only 57.7%. Recent financials indicate significant volatility; Q1 sales dropped to CNY 18.93 million from CNY 90.78 million year-over-year, and net income decreased to CNY 0.71 million from CNY 23.54 million, highlighting potential challenges in maintaining current dividend levels.

Where To Now?

Click this link to deep-dive into the 1974 companies within our Top Dividend Stocks screener.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DFM:DRC IDX:ARNA and SHSE:600854.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance