Top Three German Dividend Stocks For May 2024

Amidst a backdrop of fluctuating global markets and cautious optimism in Europe, Germany's DAX index has shown remarkable resilience, remaining relatively stable. This steadiness makes it an opportune time to consider the potential stability offered by dividend-paying stocks, particularly for those looking to invest in the German market during these uncertain times.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.19% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.44% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.72% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.54% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.69% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.55% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.13% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.93% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.98% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.23% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

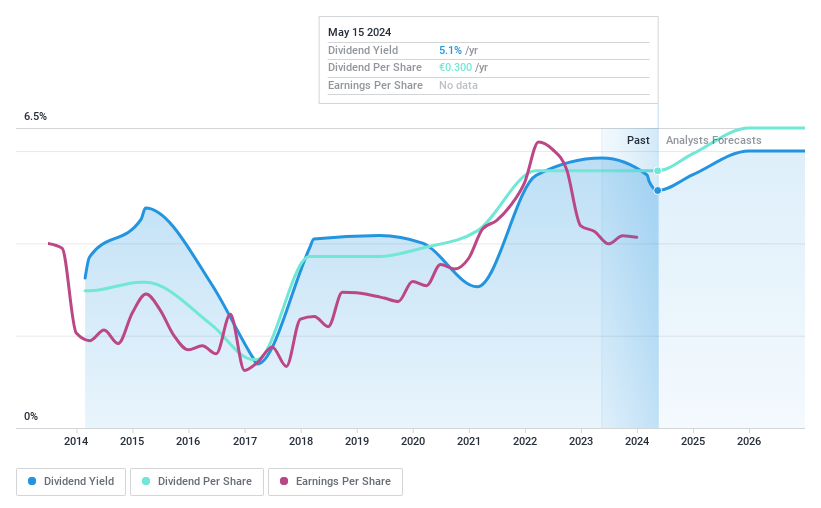

MLP

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE operates in Germany, offering financial services to private, corporate, and institutional clients with a market capitalization of approximately €0.70 billion.

Operations: MLP SE generates its revenue by providing financial services to a diverse range of clients including private individuals, corporations, and institutions.

Dividend Yield: 4.7%

MLP SE, a constituent of the Germany SDAX Total Return Index, reported a stable dividend of €0.30 per share as of March 2024, maintaining the previous year's level despite a slight dip in annual sales from €892.6 million in 2023 to €875.4 million. First-quarter results for 2024 showed improved earnings with net income rising to €27.76 million from €23.51 million year-over-year and revenues increasing to €284.11 million from €262.76 million. The firm's dividends are well-covered by earnings with a payout ratio of 62.6% and by cash flows with a low cash payout ratio of 10.9%, indicating sustainability despite past volatility in dividend payments over the last decade.

Click here to discover the nuances of MLP with our detailed analytical dividend report.

The valuation report we've compiled suggests that MLP's current price could be quite moderate.

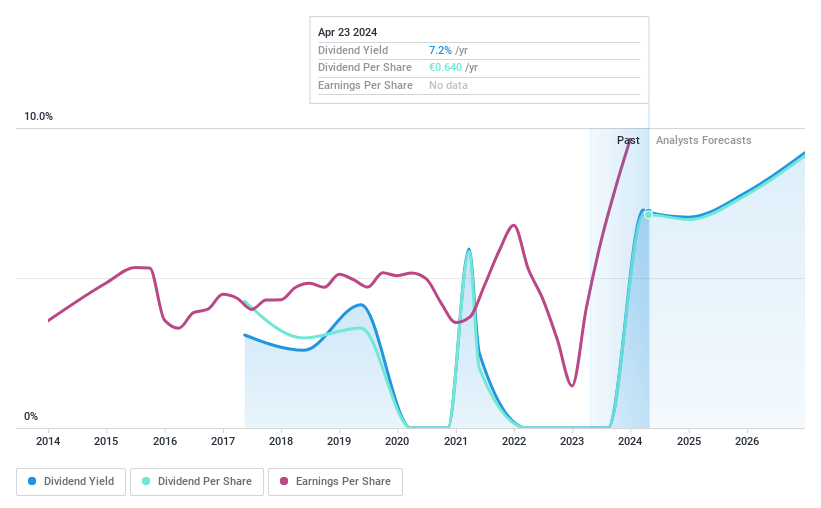

ProCredit Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG operates as a commercial bank offering services primarily to small and medium enterprises and private customers across Europe, South America, and Germany, with a market capitalization of approximately €583.10 million.

Operations: ProCredit Holding AG generates its revenue primarily through banking services, with total earnings amounting to €414.50 million.

Dividend Yield: 6.5%

ProCredit Holding AG's recent earnings show significant growth, with net income increasing to €33.5 million in Q1 2024 from €29.5 million a year prior, and annual net interest income rising from €264.63 million in 2023 to €337.22 million. Despite trading at 61.2% below its estimated fair value and expectations of a price rise by 76.1%, the company's dividend history is marked by volatility, having dropped over 20% annually at times within its short seven-year dividend-paying period. With a payout ratio of 33.2%, dividends are currently well-covered by earnings, though the company grapples with a high bad loans ratio of 2.7%.

Click to explore a detailed breakdown of our findings in ProCredit Holding's dividend report.

Our valuation report here indicates ProCredit Holding may be undervalued.

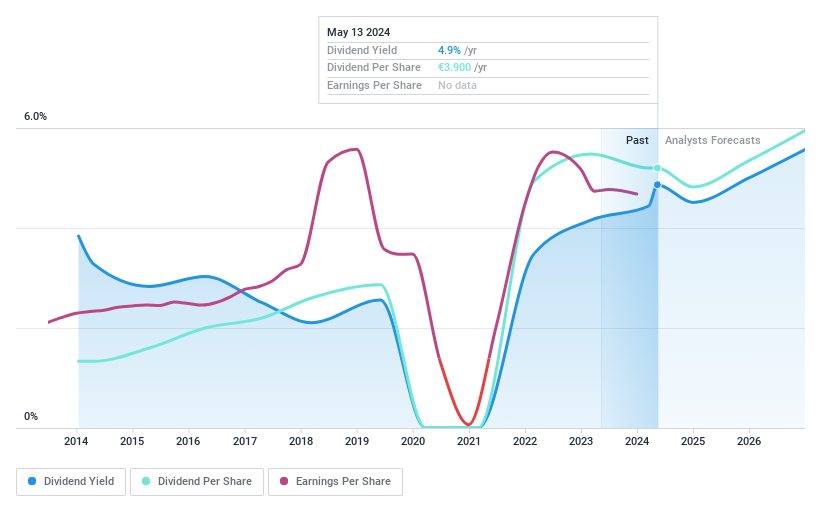

Sixt

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE operates globally, offering mobility services to both private and business customers through a network of corporate and franchise stations, with a market capitalization of approximately €3.30 billion.

Operations: Sixt SE generates its revenue primarily from operations in Germany (€1.21 billion), Europe excluding Germany (€1.49 billion), and North America (€1.14 billion).

Dividend Yield: 5.1%

Sixt SE's dividend yield of 5.13% ranks in the top quartile of German dividend payers, yet its sustainability is questionable as dividends are not well-covered by earnings or cash flows. Recent financials reveal a Q1 2024 net loss of €23.12 million, a downturn from the previous year's net income, despite an increase in sales to €780.24 million from €695.09 million. The firm continues to expand aggressively in the U.S., opening new branches and tapping into significant growth markets, indicating potential for future revenue streams but also highlighting current financial strains.

Taking Advantage

Unlock our comprehensive list of 29 Top Dividend Stocks by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MLP XTRA:PCZ and XTRA:SIX2.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance