Top Three Swedish Dividend Stocks To Watch In July 2024

As global markets navigate through fluctuating economic signals, Sweden's market remains a point of interest for investors seeking stable dividend stocks. With the broader European indices showing resilience amidst political and economic shifts, Swedish dividend stocks could offer appealing opportunities for those looking to enhance their investment portfolios in July 2024. In this context, understanding the attributes that define a robust dividend stock is crucial—particularly sustainability of payments, company stability, and alignment with current economic conditions.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.29% | ★★★★★★ |

Betsson (OM:BETS B) | 5.64% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.57% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.38% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.00% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.39% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.50% | ★★★★★☆ |

Duni (OM:DUNI) | 4.92% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.39% | ★★★★★☆ |

Bahnhof (OM:BAHN B) | 3.75% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Eolus Vind

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eolus Vind AB operates in the renewable energy sector, focusing on the development, construction, and management of assets across Sweden, Norway, Finland, the U.S., Poland, Spain, and the Baltic states with a market capitalization of SEK 1.74 billion.

Operations: Eolus Vind AB generates its revenue through the development, construction, and management of renewable energy projects across multiple countries including Sweden, Norway, Finland, the United States, Poland, Spain, and the Baltic states.

Dividend Yield: 3.2%

Eolus Vind, a Swedish wind power company, recently declared a dividend of SEK 2.25 per share for 2023, supported by a low payout ratio of 10.1%, indicating strong earnings coverage. Despite this, the dividend yield at 3.21% remains below the top quartile in Sweden's market. The firm's recent expansion into offshore projects like Skidbladner aims to significantly boost capacity and energy production by 2033 but faces an earnings forecast decline of roughly 24.9% annually over the next three years, reflecting potential volatility in its financial performance and dividends.

ITAB Shop Concept

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB specializes in designing solutions and providing customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores, with a market capitalization of approximately SEK 5.38 billion.

Operations: ITAB Shop Concept AB generates its revenue primarily from the sale of furniture and fixtures, totaling SEK 6.21 billion.

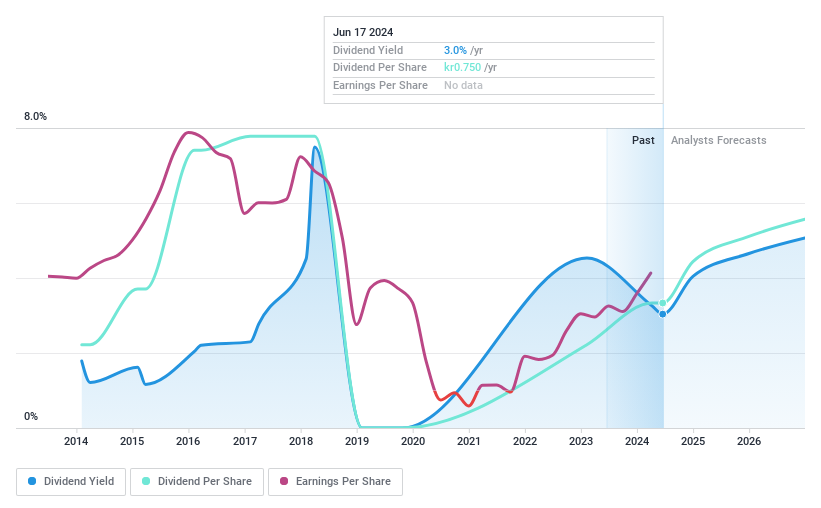

Dividend Yield: 3%

ITAB Shop Concept announced a dividend of SEK 0.75 per share for 2023, with a payment date set for May 22, 2024. Despite a volatile share price and unstable dividend history over the past decade, recent financials show promise: Q1 sales rose to SEK 1.58 billion from SEK 1.51 billion year-over-year, and net income increased significantly to SEK 100 million from SEk33 million. The dividends are well-supported by earnings with a payout ratio of 47.9% and cash flows with a cash payout ratio of only 22.2%. However, its dividend yield at 3% is below the top quartile in Sweden's market at over4%.

New Wave Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB operates in designing, acquiring, and developing brands and products across corporate, sports, gifts, and home furnishings sectors globally with a market capitalization of SEK 15.17 billion.

Operations: New Wave Group AB generates revenue through three primary segments: Corporate (SEK 4.68 billion), Sports & Leisure (SEK 3.82 billion), and Gifts & Home Furnishings (SEK 874.40 million).

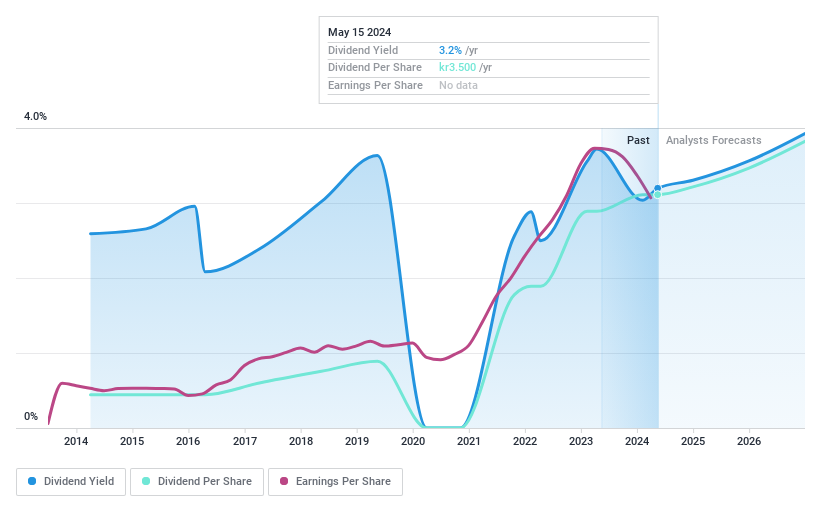

Dividend Yield: 3.1%

New Wave Group's dividend sustainability is moderately secure, with a payout ratio of 45.6% and cash flows covering dividends at 42.6%. However, its dividend track record over the past decade has been unstable and unreliable, showing volatility in payments despite recent growth. At a recent AGM, the company declared a SEK 3.50 per share dividend for 2024, split into two payments. Despite these payouts, New Wave's current yield of 3.06% remains below Sweden's top quartile average of 4.21%.

Turning Ideas Into Actions

Access the full spectrum of 23 Top Dividend Stocks by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:EOLU B OM:ITAB and OM:NEWA B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance